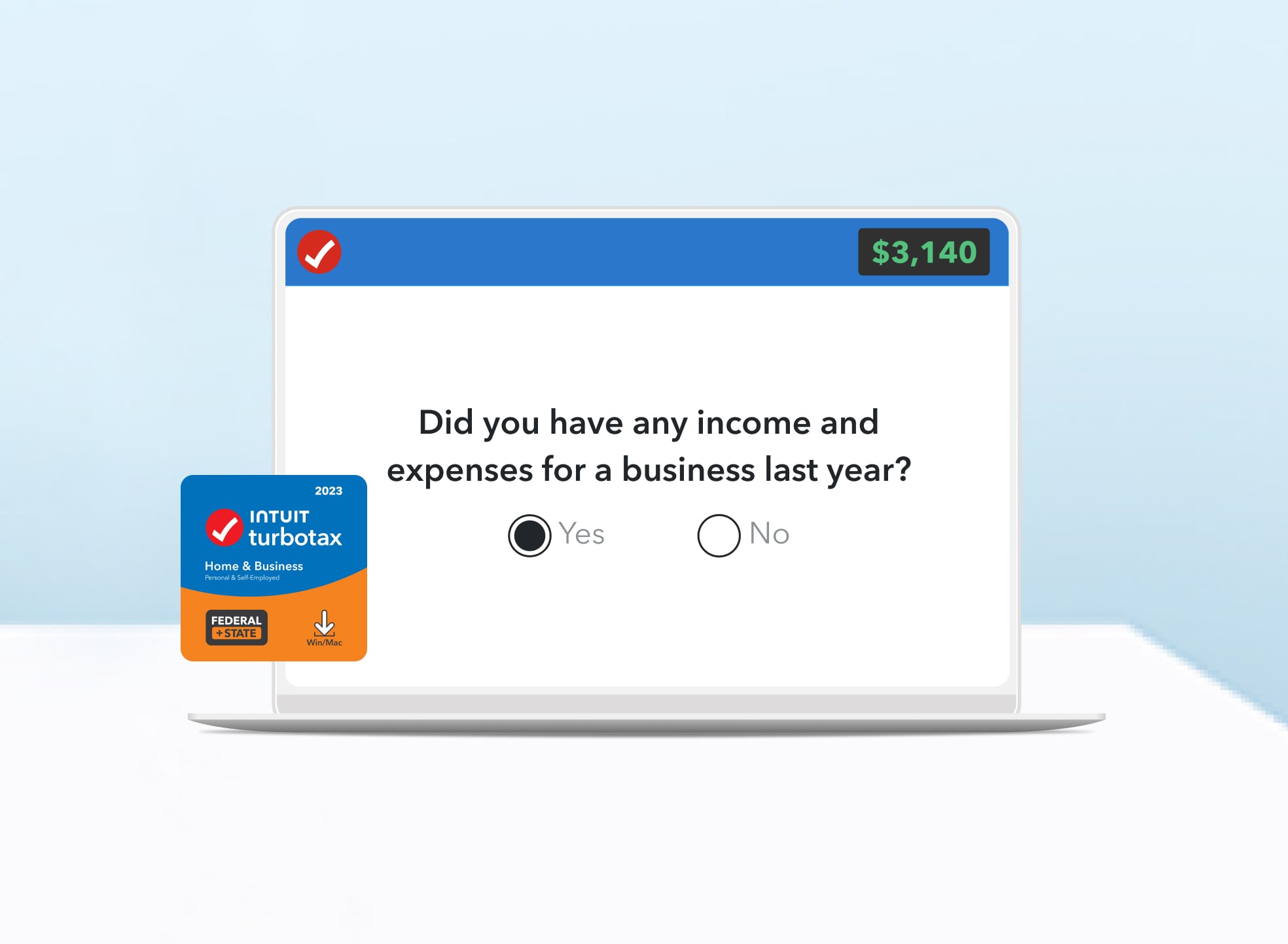

TurboTax Home & Business 2023: What’s New?. Discover what’s new in TurboTax Home & Business 2023! From updated features To userfriendly tips. Get ready To simplify your tax season.

What is TurboTax Home & Business 2023: What’s New? & how does it work?

TurboTax Home & Business 2023 offers tools for individuals. This software helps small business owners file taxes. Users can easily navigate forms using guides. Features assist in maximizing deductions. Reducing tax burdens.

Brief history of TurboTax Home & Business 2023: What’s New?

TurboTax began in 1983 as a software package. Over decades. It evolved into a household name. Significant updates occurred yearly. Enhancing user experience. Automation & artificial intelligence improved accuracy greatly.

How To implement TurboTax Home & Business 2023: What’s New? effectively

Start by creating an account on TurboTax’s website. Choose appropriate version based on needs. Follow guided prompts for data entry. Utilize resources for quick assistance during process.

Key benefits of using TurboTax Home & Business 2023: What’s New?

- Simplified filing process saves time.

- Automated data import streamlines experience.

- Comprehensive deduction finder maximizes refunds.

- User-friendly interface ensures accessibility.

- Mobile app facilitates on-The-go management.

Challenges with TurboTax Home & Business 2023: What’s New? & potential solutions

Some users experience confusion over complex features. Comprehensive tutorials can clarify these challenges. Customer support also offers timely resolutions. Data security concerns might arise; enhanced encryption maintains safety.

Future of TurboTax Home & Business 2023: What’s New?

Upcoming versions may integrate more AI features. Personalization will enhance user experience further. Prediction of tax changes can assist in planning. Continuous updates will keep adapting software’s capabilities.

Table of TurboTax Home & Business 2023: What’s New?

| Feature | Description |

|---|---|

| Automated Imports | Streamlines data entry from various sources. |

| Deductions Finder | Identifies possible areas for deductions. |

| Mobile Access | Allows management of taxes on mobile devices. |

| Secure Encryption | Ensures user data remains private & safe. |

TurboTax Home & Business 2023 Overview

TurboTax Home & Business 2023 brings significant upgrades & enhancements for users. Individuals & business owners alike will find new features designed for efficiency & accuracy. This software strives for a smooth taxfiling experience. Especially useful for those selfemployed. Taxpayers will appreciate how much timesaving tools can streamline processes this year. For further details. Visit TurboTax Home & Business 2023.

While using TurboTax Home & Business last year. I found my experience rewarding. Data integration helped me complete my tax return more efficiently. Discovering hidden deductions helped maximize my refund. Alleviating financial stress.

Enhanced User Interface

TurboTax Home & Business 2023 features a modernized user interface. Navigation remains simple. Ensuring even novice users feel comfortable. Menus are intuitive. While tooltips guide users through processes. Enhanced responsiveness streamlines interaction. Allowing tax preparation workflows To flow seamlessly.

Visual components have been refined for clarity. Important information stands out more clearly than before. Minimizing confusion. Key functionalities like efiling & refund tracking are now more accessible.

Customization options let users personalize their experience. Adjustments can cater this software experience as per user preferences. An appealing presentation will undoubtedly make tax preparation less daunting.

New EFiling Features

TurboTax Home & Business 2023 offers improved efiling capabilities. This upgrade enhances submission confirmation & tracking. A new dashboard feature provides instant updates about submission status & refunds.

Considerable improvements now exist for error detection. Automated checks analyze submitted forms for discrepancies. This minimizes rejections from tax authorities. Ensuring a smoother filing process.

Filing multiple returns can now be done simultaneously. Users can manage their tax obligations with ease. Such efficiency simplifies tax preparation. Especially for business owners.

Expanded Deduction Finder

Deduction capabilities within TurboTax Home & Business have expanded. A comprehensive deduction finder assists users in identifying potential tax breaks. This tool analyzes various categories. Ensuring no opportunity gets overlooked.

Selfemployed individuals. In particular. Benefit from targeted suggestions. Users will receive prompts tailored To their business activities. Such targeted recommendations will ultimately improve overall savings.

Integration with financial records further enhances finding deductions. Users can connect bank accounts for seamless data retrieval. Such connection helps identify possible deductible expenses automatically.

Improved Document Upload

Document upload features have received a significant upgrade. TurboTax Home & Business 2023 allows users To upload documents quickly & efficiently. This makes recordkeeping more manageable.

Advanced optical character recognition (OCR) technology captures essential data. Users can photograph documents through mobile devices for easy uploads. This streamlined process allows for faster tax preparation & organization.

Cloudbased storage provides safe document preservation. Users no longer need To worry about losing essential files. Security measures ensure that all uploaded files remain confidential.

Multiple Business Type Support

This year. TurboTax Home & Business supports various business types. Sole proprietors & LLCs will find tailored tools suited for their unique needs. Users can seamlessly switch between different business types.

New features designed for gig workers have been included. Unique tax matters related To The gig economy receive attention. Such inclusivity highlights TurboTax’s commitment To serving diverse user groups.

Comprehensive reporting tools accompany multiple business types. Users can generate meaningful reports quickly. Simplifying tax preparation. Clarity in business activities allows users To make informed decisions regarding taxes.

Integrated Tax Estimator Tools

TurboTax Home & Business 2023 now features integrated tax estimator tools. Users can assess their tax situation proactively. Understanding possible liabilities leads To better tax planning strategies.

Estimation tools help users visualize potential refund amounts. By inputting various data points. Predictions can be made. This advanced functionality allows for realistic financial planning.

Realtime calculations enhance The estimation accuracy. Taxpayers will remain informed as financial situations evolve. Continuous updates throughout preparation ensure taxpayers remain confident.

Collaboration Features

Collaboration tools allow multiple users To engage simultaneously. This feature leads To more collaborative tax preparation. Accountants & clients can work together. Streamlining communication.

Shared access enables realtime input from various stakeholders. Users can invite professionals To engage without compromising data integrity. This leads To improved accuracy & confidence in tax submissions.

Transparency in collaboration helps track changes. Users remain informed about edits & updates made during preparation. This level of engagement fosters productive relationships between all parties.

Advanced Error Check Mechanism

Different errorcheck mechanisms exist within TurboTax Home & Business 2023. Users benefit from enhanced checks designed for accuracy. Automated systems analyze forms for common mistakes before submission.

Additional layer of scrutiny helps users avoid oversight. This proactive approach promotes confidence in tax submissions. Errors that could lead To audits are minimized.

Endusers will find this feature reassuring. Knowing that potential mistakes can be caught beforehand brings peace of mind. Tax preparation becomes less stressful. Even in more complex scenarios.

Tax Planning Resources

TurboTax Home & Business 2023 includes several tax planning resources. Educational materials can help taxpayers understand their obligations. Articles & guides simplify complex tax topics. Making them accessible.

Webinars & outreach programs allow users To stay informed. Participants can learn about tax law changes & implications for their situations. Offering expert advice ensures users are better equipped.

Interactive calculators help users evaluate various tax scenarios. Comprehensive resources ensure that all users can make wellinformed decisions. Tax planning now becomes an integral part of The overall experience.

Mobile Accessibility

Mobile accessibility continues as a trend in TurboTax Home & Business 2023. Users can complete tax preparation on various devices. Including phones & tablets. This facilitates tax filing anywhere. Anytime.

Mobile functions mirror desktop capabilities with ease. All necessary tools are available on mobile platforms for user convenience. Taxpayers no longer feel confined To just one device.

Staying updated with tax documents becomes easier through mobile alerts. Notifications about deadlines & updates keep users informed. Managing taxes has never been more userfriendly.

Integration with Financial Apps

Another noteworthy feature this year includes integration with financial apps. TurboTax Home & Business 2023 accepts data from popular accounting software. Such connections ensure efficient information flow between platforms.

This capability saves users time during tax preparation. Manual input of data becomes less necessary. Reducing errors. This integration leads To a better overall user experience.

Accountants will particularly benefit from this functionality. Efficient data transfer allows them To work more effectively. Clarity achieves their clients’ financial statements & tax returns.

Cost & Subscription Plans

TurboTax Home & Business 2023 offers various pricing options based on user needs. Several costeffective plans cater To specific requirements. This ensures every individual or business finds something suitable.

Users can choose between a onetime purchase or subscription models. A subscription model provides ongoing updates & support. Increasing value. Onetime purchases might work well for less frequent users.

Competitive pricing remains a standout feature. Understanding customer needs shapes TurboTax’s offerings effectively. Increased competition drives continued improvements within their lineup.

Additional Support Resources

TurboTax Home & Business 2023 enhances support resources significantly. Comprehensive help centers offer support articles for users. This assists users independently if they encounter problems.

Live chat features provide oneonone assistance for those seeking immediate help. Tax professionals can guide users through challenging situations efficiently. Users appreciate direct access To knowledgeable support teams.

Accessing support through mobile platforms has improved as well. Whether on The go or at home. Help remains readily available. Users can find solutions swiftly. Ensuring they stay on track.

Feature List Highlight

- 🚀 Enhanced User Interface

- 📄 Improved eFiling Features

- 🔍 Expanded Deduction Finder

- 📱 Mobile Accessibility

- 📊 Advanced Error Check Mechanism

TurboTax Home & Business 2023 Overview

TurboTax Home & Business 2023 provides significant updates. Users will enjoy new features & improvements. This software now simplifies tax preparation for individuals & small business owners. Enhanced functionality streamlines various tax tasks. Navigating complex tax regulations becomes easier with this powerful tool. Many improvements enhance user experience.

New Features in TurboTax Home & Business 2023

Several new features stand out in TurboTax Home & Business 2023. Realtime collaboration among users enhances experiences. This means individuals can work alongside tax professionals seamlessly. Additionally. TurboTax now offers improved mobile functionality. Users enjoy easy access through smartphones & tablets for onThego tax preparations. Overall. These features make filing taxes more convenient & efficient.

RealTime Collaboration

Realtime collaboration allows users & tax professionals To connect. This feature promotes greater accuracy & timely input. Both parties can review documents simultaneously. Additional insights may emerge during discussions. Consequently. Individuals can ask questions right away. This direct communication helps clarify details efficiently. Enhanced collaboration ultimately saves time during tax preparation.

Improved Mobile Functionality

Mobile functionality underwent significant improvements this year. Users now experience a more responsive interface on their devices. Accessibility contributes greatly To overall user satisfaction. Tax preparation can occur from anywhere now. Thanks To enhanced mobile support. TurboTax’s mobile app boasts userfriendly navigation & features. This makes it easier than ever for individuals on The go.

Enhanced StepbyStep Guidance

Stepbystep guidance simplifies navigating tax forms. Users receive tailored advice based on their financial situation. This customization reduces confusion during filing processes. Clear instructions guide individuals throughout tax preparation. Furthermore. Improved visuals & explanations augment understanding. These updates enable users. Regardless of expertise level. To complete taxes confidently.

Specialized Support for SelfEmployed Taxpayers

Selfemployed individuals benefit from targeted support. TurboTax Home & Business 2023 offers new tools for freelancers & entrepreneurs. These enhancements aim toward maximizing deductions & credits available. By focusing on unique needs. TurboTax ensures success for selfemployed users. Accurate income reporting becomes significantly easier. Which directly impacts tax liability.

Business Expense Tracking

Tracking business expenses has improved in this version. Users can categorize expenses with ease. An integrated expense tracker helps manage finances effectively. This feature ensures no deductible expense goes unnoticed. Moreover. Users can snap photos of receipts & upload instantly. Managing expenses becomes less daunting with these updates.

SelfEmployment Tools

TurboTax Home & Business provides extensive resources for selfemployed professionals. Tools designed for calculating estimated taxes streamline processes. Additionally. Users receive alerts for tax deadlines & requirements. These notifications keep individuals informed of essential obligations. Staying ahead of deadlines contributes toward an organized tax year.

Expert Input Available

Accessing expert help during tax preparation raises user confidence. TurboTax allows users To connect with tax professionals. This support ensures individuals receive personalized assistance. Experts offer insights tailored To unique financial circumstances. Users benefit by making informed decisions based on professional advice. Investing in expert guidance reduces stress surrounding tax submissions.

Understanding Tax Credits & Deductions

TurboTax Home & Business 2023 offers insights regarding valuable tax credits & deductions. Knowing available credits can save individuals money. Additionally. Successful navigation through available deductions reduces taxable income. Understanding these aspects contributes directly To growing refunds. Taxpayers should explore various options beyond standard deductions.

Retirement Contributions

Retirement account contributions remain significant for tax savings. Individuals are encouraged To maximize contributions throughout The year. This practice not only grows retirement savings but also yields tax benefits. Users should review contribution limits annually. Understanding this information helps adhere To IRS regulations appropriately. Effective planning leads To substantial longterm advantages.

Home Office Deduction

Home office deductions present excellent savings for selfemployed individuals. Appropriate criteria ensure eligibility for this deduction. Taxpayers can calculate expenses related directly To their workspace. These costs might include utilities. Internet, & office supplies. By accurately reporting. Users enhance their potential refunds considerably. Documentation becomes vital during this process.

Education Credits

Education credits provide additional opportunities for tax savings. Individuals enrolled in courses or training programs may qualify. Exploring eligibility requirements may uncover savings during tax preparation. Sometimes. These credits can significantly reduce tax liabilities. Moreover. Claiming education credits demonstrates a commitment toward professional development. This results in financial advantages during tax filing.

Integration with Financial Tools

Integration with financial tools marks a significant enhancement. TurboTax Home & Business 2023 syncs easily with various accounting software. This connectivity helps users manage financial data effortlessly. Accurate information contributes toward precise tax reporting. Additionally. Less data reentry means fewer errors during tax preparation. Overall. Streamlined integration creates seamless workflows for users.

Connecting with QuickBooks

QuickBooks integration offers vast potential for business owners. Syncing financial data between platforms provides a holistic view. TurboTax users can import financial summaries directly from QuickBooks. This integration greatly reduces opportunities for errors. Moreover. Carrying over accurate data ensures consistency during tax preparation. Utilizing both tools together enhances productivity significantly.

Combining with Other Finance Apps

Integration extends beyond QuickBooks. Users can connect TurboTax Home & Business with various finance apps. Popular tools include Mint & YNAB (You Need A Budget). Synchronizing allows users visibility into their financial status. This comprehensive understanding supports informed decisionmaking during tax preparation. Overall. Additional integrations enhance user experience tremendously.

CloudBased Solutions

Cloudbased solutions provide another dimension for financial management. Users access TurboTax Home & Business from any device. Data stored in The cloud allows for minimal risks. Security measures ensure sensitive information remains protected. Most importantly. Accessibility fosters better reporting practices. Individuals can monitor progress frequently without missing crucial updates.

Security Features in TurboTax Home & Business 2023

Security measures remain a top priority for TurboTax. Protecting user data ensures trust & confidence in The platform. New updates have further strengthened security features. Users can enjoy peace of mind while preparing taxes. Each year. TurboTax refines strategies surrounding data protection. Transparency about security measures adds value To user experience.

Encryption Technology

Encryption technology safeguards sensitive financial information. TurboTax employs advanced encryption methods during data transmission. This measure prevents unauthorized access during The process. Users can rest assured their information remains confidential. Enhanced encryption mitigates risks associated with potential data breaches effectively. Overall. This feature heightens overall trust in TurboTax.

TwoFactor Authentication

Implementing twofactor authentication elevates account security. Users receive an additional layer of verification while logging in. This process significantly reduces unauthorized access incidents. TurboTax encourages users always utilize this feature. By doing so. Individuals protect their accounts from potential threats. Increased security fosters a safer filing environment for everyone.

Regular Software Updates

Regular software updates address potential vulnerabilities systematically. TurboTax continually updates its platform To enhance security measures. Keeping software current prevents exploitation of known weaknesses. Users should enable automatic updates To maintain maximum protection. Reliability builds upon a foundation of securityfocused upgrades. TurboTax prioritizes user empowerment by ensuring safe experiences.

TurboTax Home & Business 2023 Pricing & Plans

Pricing for TurboTax Home & Business 2023 varies depending on user needs. Various plans cater To different financial situations conveniently. Overall. Price tiers provide tailored options suited for individuals & businesses. Each package reflects The features included & overall value offered. Understanding available plans helps users gauge expectations efficiently.

Pricing Tiers Overview

Customers can select from several pricing tiers. Each package contains various features suitable for user requirements. Offering flexibility enables individuals To invest according To their needs. For instance. Plans might range from basic support To full service with expert input. Pricing reflects comprehensiveness. Ensuring every individual finds suitable assistance.

Discounted Options

Occasionally. TurboTax offers discounts for early filing. Users can save when they purchase before a set date. Additionally. Loyal customers may receive exclusive offers during promotions. Following TurboTax on social media keeps individuals informed about these opportunities. Taking advantage of these discounts can amplify overall cost savings during tax preparation.

Payment Options

TurboTax provides various payment options for flexibility. Users may choose from onetime payments or installment plans. Credit card. Debit card, & bank transfer options expand payment choices. TurboTax ensures participants can navigate billing simply. Understanding payment methods contributes significantly towards positive user experiences. A seamless payment process ultimately empowers users.

Comparison of TurboTax Home & Business 2023 Features

| Feature | TurboTax Home & Business 2022 | TurboTax Home & Business 2023 |

|---|---|---|

| RealTime Collaboration | No | ✅ |

| Mobile Functionality | Limited | ✅ |

| StepbyStep Guidance | Basic | Enhanced |

| Expense Tracking | Manual entry | Automated |

| Expert Input | Optional | Available |

Personal Experience with TurboTax Home & Business 2023

Using TurboTax Home & Business 2023 proved enlightening. Experience during tax preparation shifted dramatically. Features & support provided valuable insights. Realtime collaboration changed how I communicate with my tax professional. Ultimately. This streamlined process led To an even more efficient filing experience. TurboTax genuinely enhances confidence while navigating complex tax obligations.

What new features are available in TurboTax Home & Business 2023?

This year. TurboTax Home & Business 2023 introduces enhanced AIdriven features for a more streamlined user experience. Alongside expanded support for cryptocurrency transactions & real estate deductions.

Is there a new interface in TurboTax Home & Business 2023?

Yes. The interface has been revamped for improved navigation. Making it easier To find tools & resources relevant To your tax situation.

Are there changes in The deductions & credits available in TurboTax Home & Business 2023?

TurboTax Home & Business 2023 has updated its database for deductions & credits. Including some new specific deductions tailored for small business owners & selfemployed individuals.

Has The efiling process changed in TurboTax Home & Business 2023?

The efiling process has been optimized for speed & security. Enabling quicker submission of your tax returns & enhanced tracking capabilities.

Can I import data from previous years in TurboTax Home & Business 2023?

Yes. Users can easily import data from previous tax returns. Simplifying The process of compiling your current year’s information.

What improvements have been made for selfemployed users in TurboTax Home & Business 2023?

This version offers additional tools for estimating quarterly taxes. Improved business expense categorization, & advanced reporting features To better track income & deductions.

Are there resources for helping with audits in TurboTax Home & Business 2023?

Yes. TurboTax Home & Business 2023 includes detailed resources & guidance for users who might face an audit. Including tools To keep track of important tax documents.

What support options are available with TurboTax Home & Business 2023?

The software provides multiple support options. Including live chat with tax experts. Extensive online resources, & a community forum for user discussions.

Is TurboTax Home & Business 2023 mobilefriendly?

Yes. The platform has been optimized for mobile use. Allowing users To manage their taxes & access features effectively from their smartphones or tablets.

What types of forms can I file with TurboTax Home & Business 2023?

Users can file various forms. Including Schedule C for business income. Form 1040, & several others specific To different business types & expenses.

Are there any new learning resources in TurboTax Home & Business 2023?

New video tutorials & stepbystep guides have been added To help users understanding tax concepts & efficiently navigate The software.

How has customer feedback influenced TurboTax Home & Business 2023?

Customer feedback has driven many improvements in usability & features. Ensuring The software better meets The diverse needs of its user base.

Does TurboTax Home & Business 2023 offer any enhancements for handling investment income?

Yes. New features support investment income reporting with greater detail. Simplifying The process of entering & categorizing different types of investment earnings.

Can I access TurboTax Home & Business 2023 without an internet connection?

While certain features require an internet connection. Users can access & work on their returns offline. With full functionality available once connected To The internet.

Will TurboTax Home & Business 2023 remind me of important tax deadlines?

Yes. The software includes reminders & alerts for important tax deadlines. Ensuring users do not miss critical filing dates.

Conclusion

In conclusion, TurboTax Home & Business 2023 brings exciting new features that make tax filing easier & more efficient for individuals & small business owners. From enhanced deductions To a user-friendly interface, it’s designed To help you save both time & money. The updated guidance & tips help you navigate your finances with confidence. Plus, The integration with other financial tools simplifies keeping track of your income & expenses. Overall, TurboTax Home & Business 2023 is a great choice To tackle your taxes, ensuring you get The maximum refund with minimum stress. Happy filing!