Are Small Business Loans Installment or Revolving? Key Differences Explained. Discover The key differences between installment & revolving small business loans. Learn which option suits your needs best in our easyTounderstand guide!

What are Small Business Loans: Installment or Revolving?

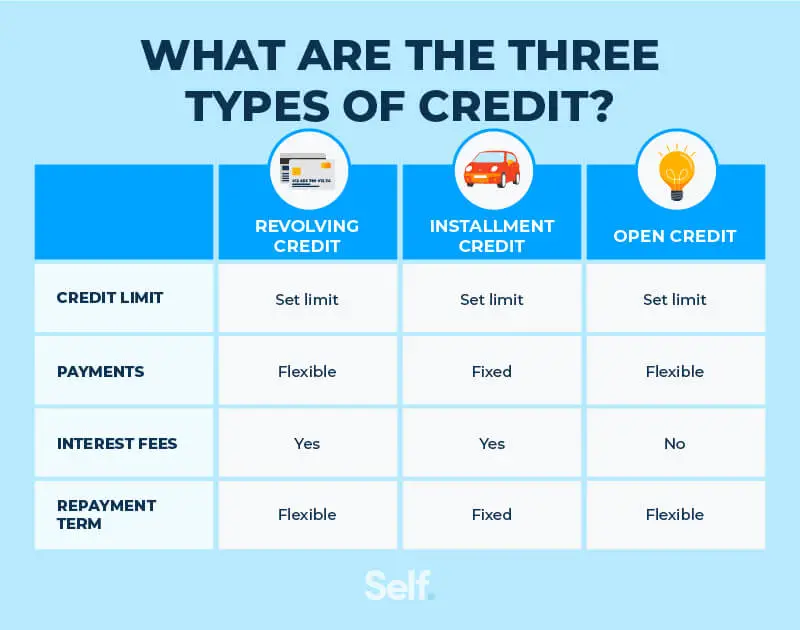

Small business loans offer essential financing options. Key differences exist between installment & revolving loans. Installment loans require fixed payments over time. Borrowers receive a lump sum at approval. These loans help with specific purchases or projects.

Revolving loans work differently. Borrowers can draw funds repeatedly. Credit limits apply. Similar To credit cards. Payments vary based on usage. Revolving loans offer flexibility in funding needs.

Brief History of Small Business Loans

Small business funding options evolved over decades. In earlier times. Banks dominated lending. Most funds required collateral. Limiting access. Alternative financing options emerged in recent years. Online lenders now offer more choices for borrowers.

Technology disrupted traditional lending approaches. Many innovative platforms provide quick access. This diversification increased flexibility for small businesses. Developing a robust financial ecosystem benefits many entrepreneurs.

How To Implement Small Business Loans Effectively

Implementing these loans requires careful planning. Assess specific business needs first. Determine whether installment or revolving suits better. Collect necessary financial documents before applications. Accurate records help lenders evaluate financial health.

Research various lenders. Comparing terms & rates. Understanding eligibility criteria ensures fewer surprises. Seek professional advice if complications arise. A well-structured loan strategy contributes significantly.

Key Benefits of Small Business Loans

Numerous advantages come with small business loans. Financing options improve cash flow for businesses. Installment loans allow predictable budgeting with fixed payments. Revolving loans provide quick access during emergencies.

Funding can support growth initiatives & expansions. Business owners gain flexibility when choosing repayment terms. Diverse loan products cater To different needs. Serving various industries.

Challenges & Solutions in Small Business Loans

Challenges exist. Making small business loans difficult. Limited credit history hampers approval chances for new companies. High-interest rates can burden cash-strapped businesses. Understanding fine print is essential; hidden fees may arise.

Potential solutions include improving credit scores before applying. Developing a solid business plan attracts lenders’ interest. Seeking alternative funding sources may also prove beneficial. Staying informed about loans minimizes pitfalls.

Future Trends in Small Business Loans

Future trends indicate growth in alternative loans. Peer-To-peer lending grows in popularity. Digital innovations simplify applications & approvals for lenders & borrowers. Automation streamlines processes & enhances efficiency.

Many lenders will increasingly rely on data analytics. Understanding borrower behavior aids risk assessment. Loans will become more tailored. Fitting unique business needs over time.

Table of Small Business Loans Key Differences

| Type | Payment Structure | Access To Funds | Usage |

|---|---|---|---|

| Installment Loans | Fixed Payments | Lump Sum | Specific Purchases |

| Revolving Loans | Variable Payments | Credit Line | General Business Expenses |

Understanding Small Business Loans

Small business loans play a vital role in securing funds for various business needs. Entrepreneurs often seek these loans during different phases of their ventures. A common question arises: Are these loans classified as installment or revolving loans? Recognizing this difference affects loan repayment strategies & financial planning. More detailed information about these classifications can be found here.

Definition of Installment Loans

Installment loans represent a fixed sum borrowed. Repaid with regular payments over a specific duration. These loans require a predetermined schedule outlining payment amounts & intervals. The borrower receives a lump sum at initiation. Which they utilize as necessary for business operations.

Each installment consists of both principal & interest. Ensuring gradual reduction of total debt. By The end of term. Borrowers fully repay their obligations. Leading To zero outstanding balance. Various lenders offer this type of financing. Catering To distinct business needs & credit profiles.

Installment loans serve various purposes including equipment purchases. Renovations. Or even inventory acquisition. Understanding this classification aids business owners in determining appropriate financing options for their endeavors.

Definition of Revolving Loans

Revolving loans function differently compared To installment loans. These loans provide borrowers with a credit limit. Allowing them access To funds as necessary. Unlike traditional loans. Revolving loans do not require fixed repayment schedules. Instead. Borrowers repay only what they utilize.

This type of financing offers flexibility. Enabling businesses To tackle ongoing expenses or unexpected costs. Staying within The credit limit. Borrowers can cycle through available funds. Borrowing & repaying repeatedly. Common examples include credit cards & lines of credit.

Revolving loans cater well To businesses with fluctuating cash flow needs. Access To ready funds allows for swift responses To market changes. Understanding how revolving loans operate helps businesses manage working capital effectively.

Key Differences Between Installment & Revolving Loans

Main differences between these two loan types impact financial decisions. Installment loans entail structured repayments. While revolving loans emphasize flexibility. Understanding The distinctions assists business owners in making informed choices.

Installment loans require payments of fixed amounts. Leading To predictable finances. Borrowers can budget accordingly. Ensuring their operations remain smooth. Conversely. Revolving loans introduce uncertainty; repayments depend on usage & borrower behavior.

Furthermore. Installment loans often possess lower interest rates compared To revolving options. While this may vary based on creditworthiness. Understanding these trends helps in budgeting for total loan costs.

Repayment Terms Comparison

Repayment terms represent another critical difference between these loans. Installment loans demand regular payments throughout a specific time frame. Each payment reduces principal & interest. Ultimately resulting in a complete payoff.

On The other hand. Revolving loans allow for varied repayment amounts. Borrowers can choose minimum payments or pay off balances entirely. Flexibility remains key. But it can lead To prolonged debt if minimum amounts are only remitted.

The predictability of repayment schedules in installment loans facilitates longterm planning. Businesses can allocate resources effectively. Ensuring timely payments without unexpected financial strain.

Interest Rates: A Comparative Analysis

Examining interest rates yields crucial insights when evaluating loan options. Installment loans generally feature lower rates. Given their structured nature. Lenders can more easily assess risk levels based on borrower profiles & repayment history.

Conversely. Revolving loans often carry higher interest rates. While this allows access To credit ondemand. Costs accumulate quickly if balances remain unpaid. Business owners should evaluate potential interest rates. Ensuring alignment with their financial strategies.

Comparing rates across both loan types supports decisionmaking. A deeper understanding of financial implications allows for smarter borrowing strategies. Minimizing longterm costs.

Loan Purpose & Usage

Appropriate loan usage highlights further distinctions between these types. Installment loans provide funds for significant. Onetime projects or purchases. Such as equipment or real estate. Businesses benefit from fixed repayment schedules. Ensuring budget stability.

In contrast. Revolving loans excel in funding ongoing costs like inventory. Marketing expenses. Or emergency situations. This versatility enables companies To tackle unforeseen challenges without disrupting cash flow.

Understanding intended use for each option allows businesses To align their financing needs with appropriate loan types. Facilitating successful operations.

Application Process Variations

Applying for each loan type presents distinct processes. Influencing borrower experiences. Installment loans may require extensive documentation. Including detailed business plans & financial statements. Lenders assess risk meticulously. Demanding proofs of income & business stability.

Conversely. Revolving loans often prioritize speed & usability. Borrowers can frequently apply online. Simplifying coordination. Credit limits may initially appear lower but can increase as businesses demonstrate responsible repayment patterns.

Simplified application processes remove barriers. Allowing access To necessary funds promptly. Business owners should assess which type aligns with their current needs & timelines.

Impact on Credit Scores

The implications of these loans on credit scores merit consideration. Installment loans typically impact a score based on fixed repayment schedules. Timely payments reflect positively. Enhancing eligibility for future loans.

Revolving accounts. However. Affect credit utilization ratios. High balances can detrimentally impact credit scores. Particularly if utilization exceeds recommended limits. Business owners must be vigilant about maintaining a healthy credit profile.

Understanding these effects enables entrepreneurs To navigate credit relationships effectively. Strategic borrowing practices result in healthier credit outcomes over time.

Flexibility vs. Predictability

Flexibility remains a core component of revolving loans. Enabling businesses To rapidly access capital as needed. Borrowers appreciate this capacity. Particularly during unpredictable economic climates. Accessing funds without delays can foster growth & stability.

In contrast. Installment loans emphasize predictability. Businesses can count on fixed repayments. Aligning financial strategies accordingly. For some. This reliability equips them better for longterm planning.

Balancing flexibility with predictability promotes successful financial management. Each business must evaluate its unique circumstances when determining which aspect holds greater importance.

Loan Terms & Conditions

Each loan type features unique terms & conditions warranting scrutiny. Installment loans often have set maturity dates. Concluding repayment periods that vary from a few months To several years. Understanding these timeframes can aid managerial planning.

Revolving loans typically renew indefinitely. Provided borrowers maintain good standing. This ongoing access can support businesses through various operational phases. Adapting To their changing requirements.

Carefully analyzing loan terms enables borrowers To select options that align with their financial capabilities & longterm goals. Grasping key conditions also offers insights into potential risks.

Examples of Each Loan Type

Concrete examples further elucidate differences between these loan types. Installment loans may include equipment financing. Real estate loans. Or capital improvements. By securing large amounts upfront. Businesses can invest in crucial assets.

Revolving loans find expression in business credit cards or lines of credit. These options allow businesses access To funds even as they engage in separate financial endeavors. Quick access To revolving accounts supports diverse operational needs.

Exploring practical applications of these loans aids in understanding which type suits specific business situations best. External factors may also influence these preferences.

Borrowing Capacity & Limits

Loan types also affect overall borrowing capacity. Installment loans usually offer larger principal amounts due To their predictable nature. Lenders feel comfortable extending larger sums. Given The repayment schedules involved.

Meanwhile. Revolving loans may impose lower limits initially. Especially for new borrowers. As businesses utilize credit responsibly. They may see limits increase. Granting broader access To funds.

Awareness of borrowing capacities aids businesses in planning financial strategies effectively. Businesses can avoid pitfalls of overextending or underutilizing available credit.

LongTerm Financial Planning

Integrating loans into longterm financial plans facilitates sustainable growth. Installment loans lend themselves To clear forecasting due To fixed repayment structures. Businesses can plan future investments more strategically.

Revolving loans complicate longterm planning due To fluctuating balances. Businesses unsure of cash flow may find it challenging. Balancing these two strategies allows for a comprehensive approach To financial health.

An inclusive understanding of both loan types cultivates a strategic outlook. This perspective supports growth while mitigating financial risks over time.

RealLife Experience with Small Business Loans

In my experience. I utilized an installment loan for purchasing new equipment last year. This strategic decision helped streamline my operations. With predictable payments. I managed my budget effectively. The loan provided me with The stability needed during a crucial time in my business journey.

Consideration for Future Financial Decisions

When evaluating small business loans. Consider future impacts on your financial situation. Decisions today can shape your business’s direction significantly. Maintaining awareness of costs. Payments, & overall credit health aids in strategic planning.

Thinking longterm allows for smarter financial moves. Benefiting overall operations. Business owners should continually assess options. Adapting as necessary based on their evolving needs.

Features of Small Business Loans

- Flexible repayment terms 🎯

- Access To capital when needed 💰

- Structured payment schedules 📈

- Variety of funding options 🛠️

- Impact on credit scores ⚖️

Understanding Small Business Loans

Small business loans serve as vital resources for entrepreneurs. They provide necessary financing for various purposes. Funding may cover operational costs. Inventory purchases. Or equipment acquisition.

Understanding different types of loans helps in making informed decisions. Loans often fall into two categories: installment & revolving. Each type presents unique characteristics that suit varying needs.

Being familiar with loan dynamics enhances financial literacy. This knowledge plays a significant role in selecting appropriate financing options. Clients benefit greatly when they understand what each type entails.

What Are Installment Loans?

Installment loans represent a standard financing method. Borrowers receive a lump sum upfront. Then. They repay this amount over time in fixed installments.

These payments. Often monthly. Include both principal & interest. Borrowers appreciate predictable payment schedules. Which aid in budgeting. Businesses can anticipate when payments will occur. Minimizing financial strain.

Many entrepreneurs opt for installment loans for major purchases. Equipment upgrades or significant expansions often require this type of financing. Loan terms typically range from a few months To several years.

What Are Revolving Loans?

Revolving loans. In contrast. Offer flexibility. Borrowers receive access To a specified credit limit. They can draw funds as needed. Up To that limit.

This type of loan allows flexibility in repayments. As borrowers repay borrowed funds. Available credit replenishes. This ondemand access helps manage cash flow effectively.

Businesses frequently utilize revolving loans for variable expenses. Operational costs. Such as payroll or inventory. Benefit from this adaptable approach. Their dynamic nature attracts many small business owners.

Key Differences Between Installment & Revolving Loans

Small business loans vary significantly in structure & repayment. Understanding these differences is crucial for making informed choices. A thorough comparison sheds light on which option best suits individual needs.

| Feature | Installment Loans 💼 | Revolving Loans 🔄 |

|---|---|---|

| Payment Structure | Fixed monthly payments | Variable payments based on usage |

| Loan Duration | Set term (months To years) | Ongoing. As long as account remains open |

| Access To Funds | Onetime disbursement | Reaccessible credit |

| Use of Funds | Specific purchases | Variable operational expenses |

| Loan Amount | Specified amount | Up To approved limit |

Pros & Cons of Installment Loans

Installment loans offer distinct advantages. Predictable monthly payments foster easier budgeting. Borrowers can plan finances effectively. Avoiding unexpected expenses.

However. Installment loans might lack flexibility. Once borrowers commit. They must adhere To a fixed schedule. This structure doesn’t accommodate changing cash flow needs.

Business owners should assess their financial situation before choosing. Unexpected expenses might arise. Hindering smooth repayments. A careful evaluation ensures alignment with overall business goals.

Pros & Cons of Revolving Loans

Revolving loans come with significant benefits. Flexibility stands out as a primary advantage. Borrowers can tap into funds as required. Facilitating immediate access.

This approach meets variable expenses efficiently. However. Overspending could become a concern for some entrepreneurs. Managing credit responsibly remains essential To avoid unnecessary debt.

Additionally. Interest rates on revolving credit can vary. This variability may lead To higher costs if not monitored. Borrowers should stay informed about interest rates & stay disciplined.

Choosing Between Installment & Revolving Loans

Selecting between these two loan types requires careful consideration. Businesses should evaluate specific needs. Repayment capacities, & purposes of borrowing. Understanding these factors will guide appropriate decisions.

Future projects play a vital role in deciding loan type. If planning for a significant purchase. Installment loans may prove beneficial. Alternatively. Revolving loans present a solid option for fluctuating expenses.

Consulting with financial advisors often aids decisionmaking. Their expertise helps clarify complex loan structures. Ultimately. Selecting The right loan supports business growth & sustainability.

My personal experience with small business loans began when I needed new equipment. I opted for an installment loan. The fixed payments aligned perfectly with my budget.

Resources for Small Business Financing

Numerous resources exist for entrepreneurs seeking financing. Various organizations provide information on available loans. Official websites. Such as SBA 7(a) loans. Offer valuable insights into loan options.

Other platforms also provide education on business financing. Accessing articles. Guides, & case studies can enhance understanding. This knowledge ultimately assists in making informed financial decisions.

Furthermore. Sites like Clarify Capital provide actionable advice. Entrepreneurs can gain insights through shared experiences To navigate their financial journeys. Engaging with these resources fosters financial literacy.

Final Thoughts on Choosing Loan Types

Understanding small business loans remains crucial when seeking financing. By recognizing key differences between installment & revolving loans. Entrepreneurs can make informed decisions. Carefully weighing each option ensures alignment with business goals.

As entrepreneurs embark on their financial journeys. Seeking guidance becomes essential. Advisors assist in clarifying which loan type suits their needs best. Ultimately. Holding knowledge empowers individuals towards success.

For more insights on financing. Exploring various resources remains beneficial. Engaging with online articles aids in enhancing understanding. Continuous learning supports longterm business success.

What are installment loans?

Installment loans are a type of loan that is repaid over time with a set number of scheduled payments. These loans typically have fixed interest rates. Which means The borrower’s payment amount remains The same for The entire loan term.

What are revolving loans?

Revolving loans allow borrowers To access a credit line up To a certain limit. They can borrow. Repay, & borrow again as needed. Similar To a credit card. Interest is charged only on The amount borrowed. Making it a flexible option.

What are The key differences between installment & revolving loans?

The key differences lie in The repayment structure & flexibility. Installment loans have set payments for a defined period. While revolving loans provide more flexibility To borrow as needed & only require minimum payments on The outstanding balance.

Can small businesses benefit from installment loans?

Yes. Small businesses can benefit from installment loans as they provide a structured repayment plan. Making it easier To manage cash flow & predict future expenses.

Are revolving loans suitable for small businesses?

Revolving loans are suitable for small businesses that need flexibility in their financing. They can cover unexpected expenses or smooth out cash flow variations without being tied To fixed monthly payments.

How do small business installment loans affect credit scores?

Timely payments on installment loans can improve a small business’s credit score. As it demonstrates responsible borrowing & repayment behavior. However. Missed payments can negatively impact credit scores.

Is The interest rate on installment loans higher than on revolving loans?

Interest rates can vary by lender & The borrower’s creditworthiness. But installment loans often have fixed rates. While revolving loans might have variable rates. It’s essential To compare terms To find The best option.

Can you convert a revolving loan To an installment loan?

Generally. It is not possible To convert a revolving loan To an installment loan directly. However. Borrowers can pay off a revolving balance & then apply for an installment loan if they need a structured repayment plan.

What types of expenses are best suited for installment loans?

Installment loans are ideal for significant. Onetime expenses. Such as equipment purchases. Renovations. Or longterm investments that require predictable monthly payments.

What types of expenses are best suited for revolving loans?

Revolving loans are best for shortterm expenses. Like managing cash flow fluctuations. Buying inventory. Or covering operational costs that may arise unexpectedly.

Are there fees associated with revolving loans?

Yes. Revolving loans can come with fees such as annual fees. Late payment fees, & cash advance fees. It’s crucial To understand all potential costs before taking on this type of loan.

Which type of loan is easier To obtain for small businesses?

The ease of obtaining a loan can depend on The business’s financial health. Creditworthiness, & The lender’s requirements. Generally. Revolving loans may be easier To access due To their flexible underwriting standards.

How does repayment differ between The two loan types?

Installment loans require fixed payments at regular intervals. While revolving loans allow for variable payments based on The outstanding balance. Providing more flexibility in The repayment process.

Can small businesses use both types of loans simultaneously?

Yes. Small businesses can use both types of loans simultaneously To balance their financial needs. Leveraging The fixed structure of installment loans alongside The flexibility of revolving loans for various expenses.

What factors should small businesses consider when choosing between installment & revolving loans?

Small businesses should consider their cash flow needs. The types of expenses they plan To finance. Interest rates. Repayment terms, & their overall financial strategy when choosing between installment & revolving loans.

Conclusion

In summary, understanding whether small business loans are installment or revolving is crucial for making The right financial choices. Installment loans provide a fixed amount with set payments, helping you manage budgets easily. On The other hand, revolving loans offer flexibility, allowing you To borrow as needed up To a limit. Each type has its benefits depending on your business needs. By knowing these differences, you can choose The loan that best fits your goals, helping your small business thrive. Whether you need stability or flexibility, The right loan type is out there for you!