How to Fill Out a Business Credit Application. Learn how To easily fill out a business credit application with our stepbystep guide. Get The tips you need To improve your chances of approval!

What is How To Fill Out a Business Credit Application & how does it work?

A business credit application helps assess creditworthiness. Companies provide financial details. Such as revenue & debts. Lenders evaluate risk based on these facts. Approval allows access To credit lines or loans.

Brief history of How To Fill Out a Business Credit Application

Business credit applications have evolved significantly. Early forms required minimal information. Modern applications assess potential risks comprehensively. Technology now plays a crucial role. Simplifying processes & enhancing accuracy.

How To implement How To Fill Out a Business Credit Application effectively

Prepare financial documents before starting The application. Documents include tax returns. Balance sheets, & profit statements. Fill out every section accurately & truthfully. Double-check details for correctness before submission. Submit online applications for faster processing.

Key benefits of using How To Fill Out a Business Credit Application

Accessing credit lines enhances business flexibility. Better financial options improve cash flow management. A strong credit profile increases negotiation power. Quick decisions allow businesses To seize opportunities rapidly. Building credit history opens future financing doors.

Challenges with How To Fill Out a Business Credit Application & potential solutions

Inaccurate information can lead To application denial. Verifying all details before submission helps mitigate this issue. Complex jargon might confuse applicants. Using straightforward language or seeking help proves beneficial. Time constraints often plague applicants. Setting aside dedicated time can ease this process.

Future of How To Fill Out a Business Credit Application

More automated solutions will arise in coming years. Artificial intelligence may streamline evaluations significantly. Enhanced data analytics could provide deeper insights into creditworthiness. Mobile applications will become more prevalent. Facilitating easy submissions.

Table of How To Fill Out a Business Credit Application

| Section | Description |

|---|---|

| Business Information | Name. Address, & contact details. |

| Financial Statements | Recent income statements. Cash flow reports, & balance sheets. |

| Ownership Structure | Ownership details. Including partners or stakeholders. |

| Credit History | Details about current credit lines & previous loans. |

| Purpose of Credit | Clear explanation of intended use for funds. |

Understanding A Business Credit Application

Filling out a business credit application can seem daunting. Many entrepreneurs overlook crucial details during this process. Knowing key components ensures a higher likelihood of approval. Watch this informative video for guidance: How To Fill Out a Business Credit Application.

Business credit applications serve a significant purpose. They provide lenders with necessary insights. Information shared directly affects potential credit limits & terms. Accurate applications help build trust between businesses & lenders.

Preparing Necessary Documentation

Before diving into filling out an application. Preparing necessary documentation proves essential. Various documents will showcase your business’s financial health. Be ready To present tax returns. Bank statements, & business licenses.

Businesses should also include their financial projections. These projections assist lenders in understanding future performance. Potential growth factors can increase confidence in granting credit. For further understanding. Refer To this ultimate guide.

Lastly. Don’t forget personal financial details. Lenders often request this information. Having a wellorganized collection of documents saves time during The application process.

Choosing Right Type of Credit

Understanding different types of credit available helps in making wellinformed decisions. Businesses can apply for lines of credit. Loans. Or credit cards. Each option has distinct features & benefits.

Lines of credit offer flexibility. These allow businesses To borrow as needed. Loans may provide larger amounts for specific projects or expansions. Credit cards provide shortterm financing with easy access.

Researching these options before applying can yield crucial insights. Each type plays a different role within a business. Consider longterm versus shortterm needs before making a choice.

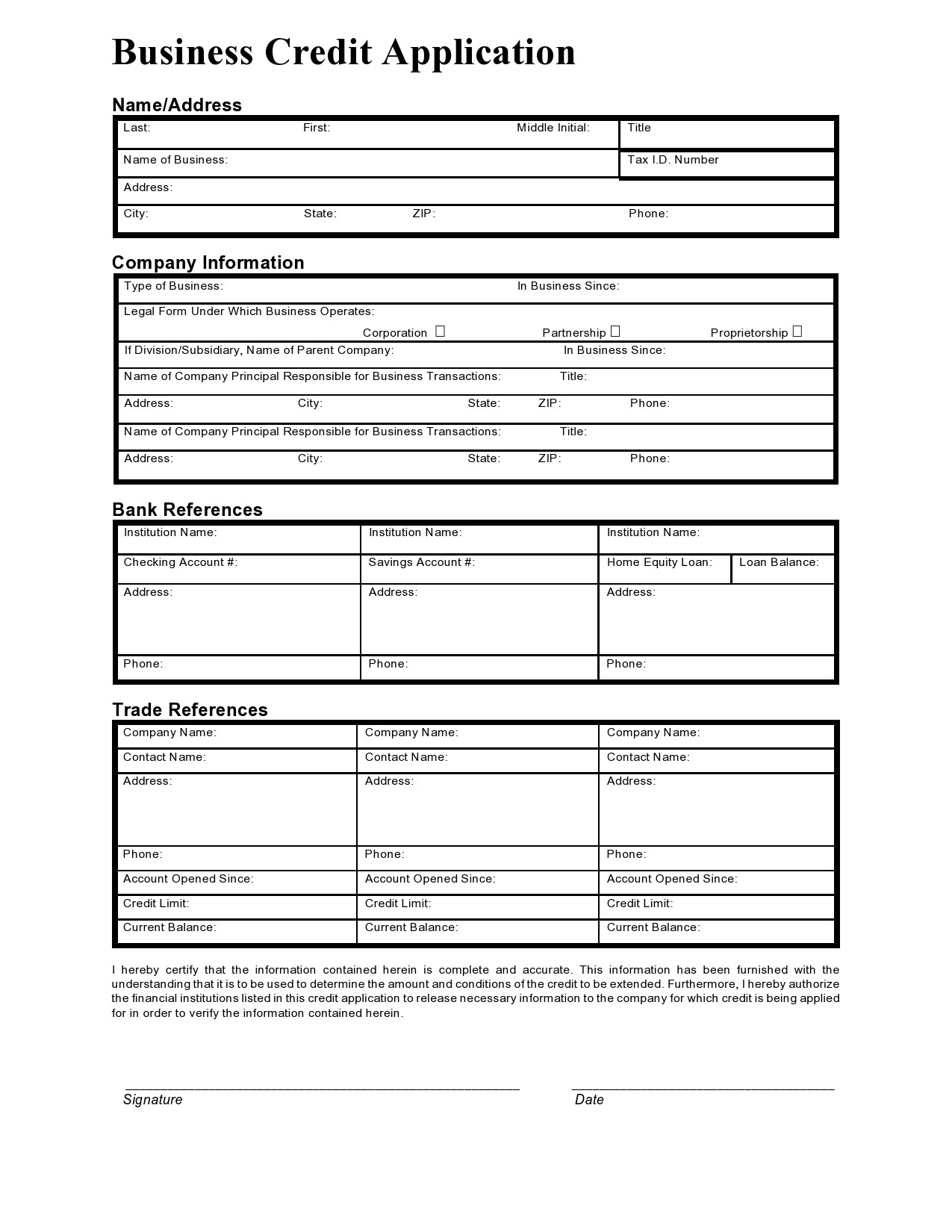

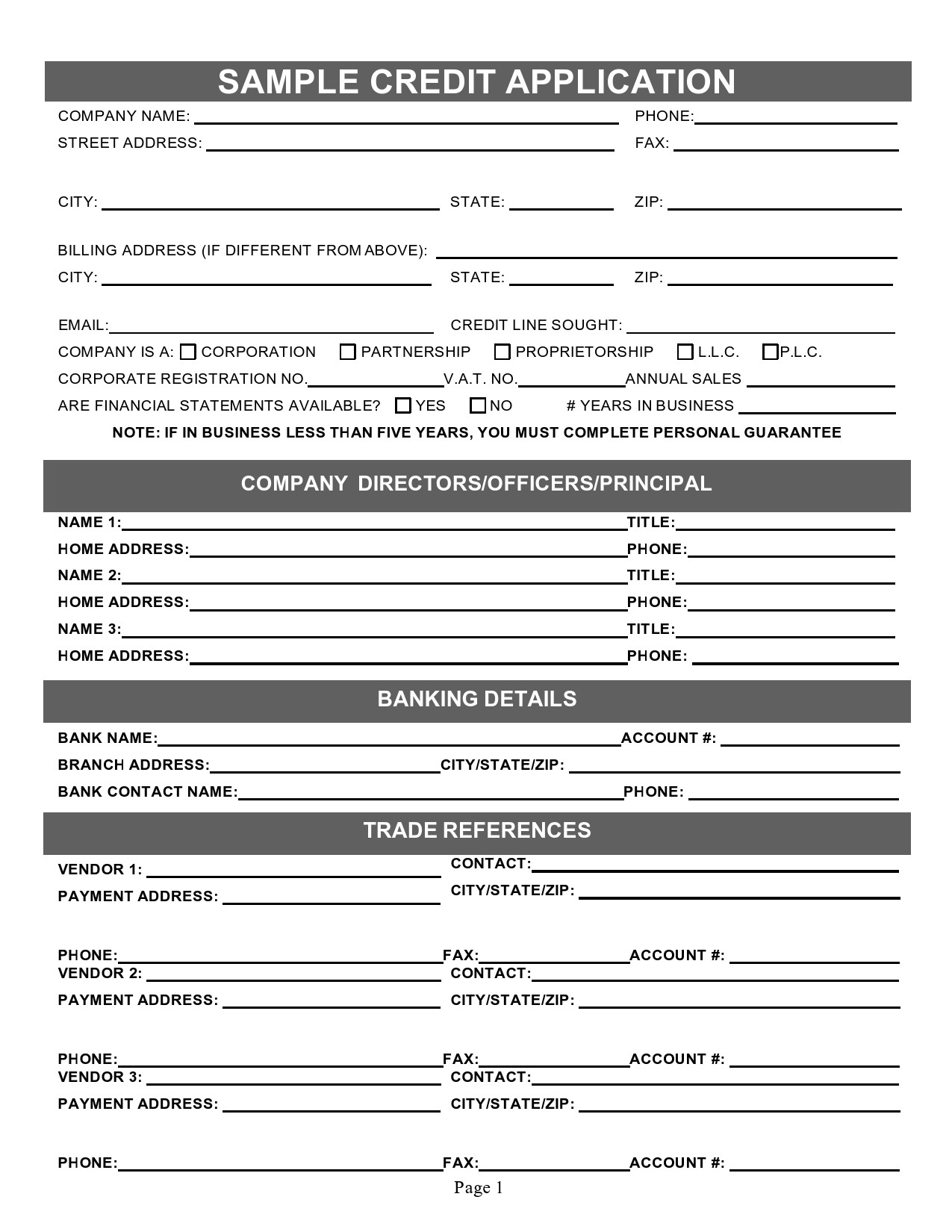

Details Required in Application Form

Your application form will ask for a variety of details. Basic information includes business name. Address, & contact information. Additionally. Lenders request information regarding ownership & management structure.

Financial information follows as next priority. Present details about annual revenue. Business structure, & credit history. Lenders assess this data thoroughly. Clear & transparent information serves your interests well.

Also. Disclose information about any business debts. Lenders want To understand your liabilities. Providing accurate insight enhances your application’s credibility.

Financial Statements & Projections

Presenting accurate financial statements remains vital. Include balance sheets. Income statements, & cash flow statements. These documents must reflect your business’s reaching potential.

Incorporating financial projections lends credibility. Lenders appreciate seeing future growth potential. Comprehensive projections should include realistic forecasts. Tailor these projections according To market trends & business strategies.

Choose a period of at least three years for The projections. This duration allows lenders To gauge longterm stability. Aim for clear. Concise format that highlights your expectations.

Credit History & Scores

Your credit history holds significant importance. Lenders examine this closely when reviewing your application. Be prepared with a credit report showcasing your business’s creditworthiness.

If your business lacks established credit history. Consider using personal credit. Personal scores can play a role in initial applications. Highlighting good financial practices boosts your application’s chances.

Monitoring your credit before applying proves even more beneficial. Ensure all details & scores reflect accurately. Correct any discrepancies that may arise prior To submission.

Preparing Personal Guarantees

Many lenders require personal guarantees. This acts as a promise from business owners To repay obligations. In such cases. Both personal & business credit come under scrutiny.

Understanding implications of this guarantee is crucial. Defaulting on payments could impact personal credit. Complicating financial standing. Business owners should weigh risks thoroughly.

When preparing. Disclose all personal assets in relation To The guarantee. Transparency builds trust. Clarity on responsibilities provides peace of mind To both parties involved.

Reviewing Terms & Conditions

Before signing any application. Carefully review terms & conditions. Understanding key provisions protects your interests. Take time To read through each section thoroughly.

Look for any hidden fees or complex stipulations. Identifying these elements can save unnecessary costs in future transactions. Businesses should clarify any confusing items with lenders.

Expect negotiation opportunities on some terms. Lenders may allow flexibility provided they understand your position. Be prepared To discuss any terms that require adjustments.

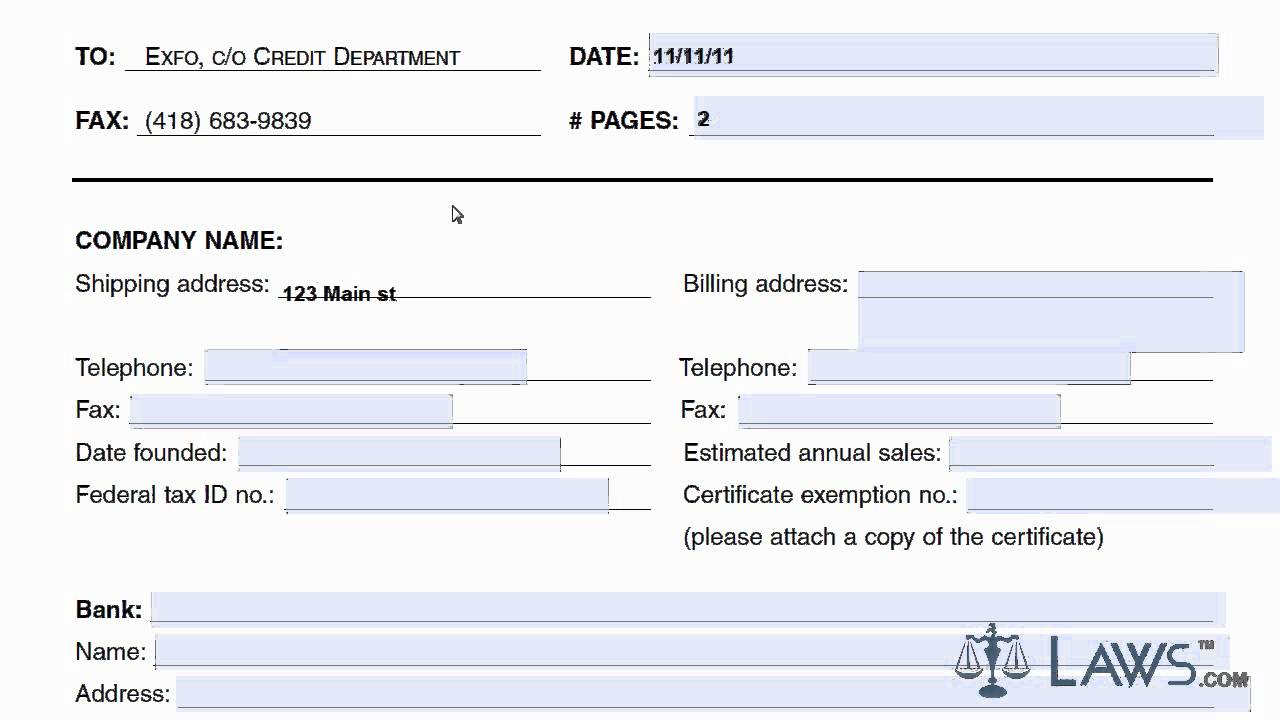

Submitting Your Application

Gather all completed documents before submission. Accuracy remains paramount throughout this process. Ensure each piece of information aligns correctly To avoid delays.

Choose a method of submission that best fits your business. Options typically include online applications. Fax. Or mail. Select one that aligns with your operational capabilities.

After submission. Follow up within a few days. Reach out To your lender To confirm receipt. This proactive step reaffirms your commitment & enthusiasm.

Managing Communication with Lenders

Communication with lenders plays a crucial role in filling out an application. Building rapport establishes a good working relationship. Open channels allow for better understanding & collaboration.

Ensure responsiveness when lenders request additional information. Quick replies show your seriousness about obtaining credit. Businesses that communicate effectively tend To receive favorable terms.

Establish a single point of contact. If possible. This consistency eliminates communication gaps. Speaking with various representatives can lead To mixed messages.

Understanding Approval Process

The approval process relies on various factors. Lenders evaluate risk closely. Understanding aspects they consider helps businesses align their applications accordingly.

Key factors include credit history. Financial stability, & business structure. Lenders look for patterns or signs of risk. Strengthen your application by highlighting positive aspects of your business.

Anticipate some time for evaluations. Approval can take anywhere from a few days To several weeks. Patience often proves essential during this period.

PostApplication Steps

After receiving approval. Know The next steps. Carefully review loan or credit terms again. Ensure that these align with previous discussions or expectations.

Upon acceptance. Initiate any required actions. This may include signing documents or processing funds. Be diligent in maintaining organized records for future reference.

Consider setting reminders for payment schedules. Timely payments protect your credit score. Keeping a clear payment history fosters a strong relationship with your lender.

Using Credit Responsibly

Responsible use of business credit enhances your financial future. Establish a budget that outlines how credit will be utilized. Disciplined spending ensures sustainable growth.

Keep track of all expenses when using credit. Use accounting software or tools To facilitate this process. Having clear records simplifies managing your finances.

Periodically assess your credit utilization. This helps determine how much credit remains accessible. Organizations should aim To maintain a healthy credit utilization ratio.

Conclusion & Future Considerations

Building business credit requires time & effort. Each set of steps outlined above contributes toward effective applications. Experience taught me value of proper preparation.

Maintaining good financial habits ensures success in obtaining credit. Possessing accurate documentation & proactive communication leads businesses on right path. Building credit ultimately opens doors for future opportunities.

Essential Features for Filling Out Business Credit Application

- Organized Documentation 📁

- Clear Financial Statements 📊

- Comprehensive Credit History 📈

- Transparent Application Submission ✉️

- Prompt Communication with Lenders 📞

- Responsible Credit Use 💳

- Future Financial Projections 📅

Understanding Business Credit Applications

Many entrepreneurs seek business credit. This funding helps companies grow & manage cash flow. Knowing how business credit applications work remains crucial. Each application requires specific information that lenders use for evaluation. An application typically has forms that address business details. Financial history, & owner information. Completing this process requires careful attention To detail. Missing or incorrect information might delay approvals or lead To denials.

Understanding various types of credit helps fill applications accurately. Business credit cards. Lines of credit, & loans serve different purposes. Each type has varying requirements. So careful consideration remains essential. Businesses may benefit from securing funds through multiple avenues. Evaluating options before applying saves time & reduces confusion. Watch this video for more insights: Helpful Video on Business Credit Applications.

Individuals should gather necessary documents before starting applications. Common documents include tax returns. Bank statements, & financial statements. Providing accurate financial records helps lenders assess credibility. Having this information ready can make The process smoother. Make sure everything remains organized & easily accessible. Understanding requirements simplifies filling out these applications.

Preparing Necessary Documentation

Preparation remains key when submitting a business credit application. Each lender may take a unique approach. However. Most require similar pieces of information. Start compiling documentation early. So you do not rush through The process. Solid documentation builds credibility with potential lenders. They appreciate when applicants provide complete information upfront.

Common documents often requested include business formation documents. These may feature articles of incorporation. Operating agreements. Or business licenses. Additionally. Providing personal identification. Including Social Security numbers. Might prove necessary. Keep copies of relevant documents organized. Consider an electronic format for quick access. Proper documentation aids in maintaining professionalism throughout this process.

Financial statements highlight a company’s stability & growth potential. Balance sheets. Income statements, & cash flow statements detail this information. Optimally. These statements should represent at least three years of operation. Some lenders might request current financial projections as well. Establishing a clear financial picture strengthens any application. Ensure these statements remain accurate & reflective of your business’s current situation. A thorough understanding of these documents helps answer questions during application processes.

Filling Out Application Forms

Start filling out application forms by inputting basic information. This step generally includes your business name. Address, & contact details. Clearly entering this data ensures no confusion arises. Next. Applicants must document ownership structure. Whether a sole proprietorship. Partnership. Or corporation. Listing owners accurately helps lenders assess ownership stakes.

Some sections require input on business operations. Businesses should explain their industry. Products. Or services. Clearly articulating this information helps lenders understand company dynamics. Additionally. Expect questions regarding business history. Including how long operations have run. Providing comprehensive answers showcases transparency & builds trust with lenders. Review all responses carefully as accuracy remains vital.

Financial data requires precision & honesty. Lenders typically require input about annual revenue. Sharing gross sales figures. Expenses, & net income helps create a comprehensive picture. If you have existing debts. Disclose this information as well. Transparency about previous debts can ease lenders’ concerns. Corporate bank account numbers might also be necessary for quick financial assessments. Each detail plays a crucial role in decisionmaking processes.

Understanding Credit Scores & Reports

Business credit scores indicate financial health. Lenders rely on these numbers during evaluations. Maintaining a good credit score proves beneficial for obtaining favorable interest rates. Regularly reviewing credit reports helps identify errors or discrepancies. Always ensure that reported information remains accurate. Corrections. If needed. Should happen promptly. This diligence reflects a proactive approach To managing financial responsibilities.

Understanding different scoring models also proves important. Various companies. Like Dun & Bradstreet or Experian. Provide varying scores. Each score reflects different aspects of creditworthiness. Researching these models helps business owners understand what lenders consider. Achieving a healthy mix of credit types maintains a balanced score. Understand potential impacts of credit inquiries on overall scores.

Building business credit often requires time & consistent efforts. Every payment made on time enhances a credit profile. Establishing relationships with suppliers can aid in accumulating positive credit history. Even applying for a business credit card can offer score development opportunities. Focus on paying off balances in full each month. This habit significantly improves credit scores over time.

Timelines & Expectations

Understanding timelines associated with credit applications proves essential. Each lender may have different processing times. Some lenders respond within a few days. While others may take weeks. Staying informed about expected timelines helps manage expectations. One can often expedite processes by submitting complete applications with necessary documentation.

Once submitted. Expect lenders To conduct thorough evaluations. They will assess both business & personal credit histories. This process can seem lengthy but remains an important aspect of risk assessment. Frequent updates from lenders often provide clarity. Be proactive in communicating with lenders during this period. Asking for updates keeps The process transparent & shows genuine interest.

Ultimately. Patience remains a vital trait during The application process. Understanding that lenders balance multiple applications ensures a degree of acceptance. Remain calm & collected while awaiting responses. If a denial occurs. Do not lose hope. Understand possible reasons for rejection & address them before reapplying. This approach strengthens future applications.

Common Mistakes To Avoid

Many applicants fall victim To common mistakes during submission. Incorrect or missing data remains a frequent cause for delays. Doublecheck all entries before submitting applications. Having another person review information can help catch errors. Small mistakes can result in significant consequences when seeking credit.

Rushing through The process often leads To incomplete applications. Taking time ensures that all necessary documents accompany submissions. Complete applications convey professionalism & seriousness. Lenders notice efforts put forth by applicants. Ensuring everything appears organized can create a favorable impression.

Neglecting To follow up also presents a missed opportunity. Once applications submit. Checking back for updates remains important. Followup reinforces interest in securing business credit. It demonstrates responsibility & professionalism. Traits lenders appreciate. Therefore. Show initiative throughout this process. Consistency in communication can yield positive outcomes during deliberations.

Relationship with Lenders

Developing relationships with lenders can benefit The application process. Building trust leads To favorable terms & stronger connections. Businesses that maintain open lines of communication typically fare better. A solid reputation unfolds over time. Making future interactions smoother. Choose lenders wisely based on their practices & customer support.

Regularly updating lenders about business changes fosters a stronger bond. If revenue grows. Share this information as it builds credibility. Reinforcing positive changes reflects business stability. Lenders appreciate proactive clients who communicate effectively. Show gratitude for their support. Further solidifying relationships. Personalized interactions can propel businesses forward in funding endeavors.

In some cases. Applicants may consider multiple lenders. Shopping around for credit helps businesses compare terms & fees. However. Maintain a careful balance during this process. Too many inquiries in a short time may negatively impact credit scores. Therefore. Final decisions require thorough consideration. Value relationships with lenders that align with business goals.

Comparison Table

| Factor | Lender A 🏦 | Lender B 💳 | Lender C 🏢 |

|---|---|---|---|

| Approval Time | 24 hours | 5 days | 1 week |

| Minimum Credit Score | 600 | 650 | 700 |

| Interest Rates | 7% | 9% | 5% |

| Loan Amount | $10. 000 $50. 000 | $5. 000 $20. 000 | $50. 000 $200. 000 |

| Required Documentation | Standard | Extensive | Moderate |

After Application Submission

Following submission. Monitor credit closely. Keeping an eye on scores allows assessment of progress. Implement strategies for improvement when necessary. Every effort made toward enhancing credit stands beneficial for future needs. Additionally. Consider adding new credit lines after successful monitoring periods. Establishing a robust credit profile can positively influence lender relationships.

Continuing To build credit history remains crucial. Taking steps toward improving credit gradually enhances opportunities. As businesses grow. Familiarizing oneself with varying financing options contributes To longterm success. Learning from past experiences equips entrepreneurs for future endeavors. Knowledge translates into stronger applications & better results.

Engaging with resources remains vital throughout this journey. Many websites offer guidance & support for business credit issues. Regularly visiting these platforms can deepen understanding. For additional assistance. Explore this useful link: Business Ideas Study. Utilize every opportunity for growth & learning in this arena.

When I first completed a business credit application. I faced challenges. However. Careful preparation made a substantial difference. I was thorough in collecting necessary documents & details. Leading To success. Each experience offers valuable lessons for future applications.

What information is typically required on a business credit application?

A business credit application usually requires details such as The business name. Address. Type of business. Federal tax ID number, & ownership structure. Additionally. Personal information of The business owners may be needed. Including social security numbers & credit histories.

How can I prepare my business for a credit application?

To prepare your business for a credit application. Gather all necessary documents. Such as financial statements. Tax returns, & any relevant business licenses. Ensure your business is structured properly & that your credit history is in good standing.

What financial documents should I include with my application?

Include recent financial statements. Profit & loss statements. Balance sheets, & tax returns for The past couple of years. Providing accurate & upTodate financial information helps improve The chances of approval.

Do I need To provide personal guarantees for a business credit application?

Many lenders will require personal guarantees. Especially for small businesses or startups. This means that The business owner agrees To be personally liable for The debt if The business cannot repay it.

How important is my business credit score?

Your business credit score is crucial as it impacts your ability To secure financing & favorable interest rates. A higher score indicates financial responsibility. Which can instill confidence in lenders.

What is The difference between business & personal credit?

Business credit is tied To your business entity & evaluates its creditworthiness. While personal credit reflects an individual’s credit history. Strong business credit can protect personal assets in case of business debts.

Can a business credit application be filled out online?

Yes. Many lenders offer online applications that you can fill out at your convenience. Ensure you have all necessary information readily available To expedite The process.

What common mistakes should I avoid when filling out a credit application?

Avoid common mistakes such as providing incomplete or inaccurate information. Overlooking personal credit history. Or neglecting To review The application before submission. Ensure all details are clear & correct.

Is it necessary To provide my business plan?

While not always required. Including a business plan can bolster your application. It demonstrates your business strategy & growth potential. Providing lenders with more context about your operations.

How long does it typically take To get approved for business credit?

The approval process can vary significantly. Ranging from a few hours To several weeks. Depending on The lender & The complexity of your application. Factors influencing this timeline include The completeness of your application & The lender’s policies.

What should I do if my application is denied?

If denied. Request The reason from The lender. Use this feedback To improve your credit profile. Address any issues, & strengthen your application for future attempts.

Can I apply for business credit if my business is new?

Yes. New businesses can apply for credit. But they may face challenges due To limited credit history. Providing personal credit information & a solid business plan can help mitigate this issue.

How can I improve my chances of getting approved?

To improve your chances of approval. Maintain a strong credit score. Provide complete & accurate information, & demonstrate a solid financial history through documentation. Establishing a good relationship with your lender can also be beneficial.

What happens after I submit my business credit application?

After submission. The lender will review your application & The supporting documents. They may conduct a credit check & then inform you of their decision within a specified timeframe. Typically communicated in their initial response.

Are there fees associated with filling out a business credit application?

Some lenders may charge application or processing fees. While others may not. It’s essential To read The terms & conditions carefully To understand potential costs before submitting your application.

Conclusion

Filling out a business credit application doesn’t have To be daunting. By following a few simple steps, you can set yourself up for success. Start by gathering all necessary information about your business, including financial details & credit history. Be honest & thorough in your responses—this builds trust with lenders. Double-check your application for any mistakes before submitting it. Remember, if you’re ever unsure about a question, don’t hesitate To ask for help. With these tips in mind, you’ll be well on your way To securing The credit your business needs To thrive. Good luck!