Business License vs. LLC: Understanding the Differences. Confused about business licenses & LLCs? Discover The key differences in simple terms To make The right choice for your venture. Let’s break it down!

What is Business License vs. LLC: Understanding The Differences & how does it work?

A business license grants permission for commercial activities. Many local governments require registration. An LLC. Or Limited Liability Company. Protects personal assets. This structure combines benefits of corporations & partnerships. Both serve specific purposes within business operations.

Brief history of Business License vs. LLC: Understanding The Differences

Business licenses have existed for centuries. Laws originated from medieval guilds. They ensured quality & safety standards. LLCs emerged in The late 20th century. This structure gained popularity due To its flexible nature.

How To implement Business License vs. LLC: Understanding The Differences effectively

First. Determine local licensing requirements. Visit your local government website. Next. Consider filing for an LLC formation. This process includes drafting Articles of Organization. Register with state authorities for compliance.

Key benefits of using Business License vs. LLC: Understanding The Differences

A business license grants legal permission. This assures customers of legitimacy. An LLC provides personal liability protection. Owners enjoy tax flexibility with an LLC structure. Both options can enhance credibility in markets.

Challenges with Business License vs. LLC: Understanding The Differences & potential solutions

Licenses may require renewal annually. Strict regulations can hinder business growth. LLCs have maintenance fees & annual reports. Seeking professional advice may alleviate complexities. Understanding local laws ensures smoother operations.

Future of Business License vs. LLC: Understanding The Differences

Technological advancements will streamline licensing processes. Online platforms can simplify applications. Trends show that more entrepreneurs prefer LLC structures. Flexibility will attract businesses seeking protection.

Table of Business License vs. LLC: Understanding The Differences

| Aspect | Business License | LLC |

|---|---|---|

| Purpose | Legal permission for operations | Protects personal assets from liabilities |

| Duration | Defined by local regulations | Perpetual existence unless dissolved |

| Fees | Varies by locality | State-specific formation fees |

| Renewability | Often annual renewal required | No annual renewal. But reports may apply |

Business License Overview

A business license functions as a permit. Allowing a company To conduct operations within a specific jurisdiction. It serves as a confirmation that a business complies with local regulations & laws. Often. Cities or counties require this license for various professions. Moreover. Licenses help establish legitimacy & trust between businesses & clients. They can vary significantly based on location & type of business.

Starting a venture without acquiring appropriate licenses can lead To severe penalties. Understanding local requirements assists entrepreneurs in navigating these potential pitfalls. For detailed insights. Here’s an informative resource: Business License vs. LLC.

This process may also ensure avoidance of any unexpected legal issues down The road. Entrepreneurs should invest time researching local licensing requirements. Licensing can grant access To specific markets while protecting your business from unnecessary risks.

LLC Explained

A Limited Liability Company (LLC) provides personal liability protection for business owners. Unlike traditional corporations. LLCs possess flexible management structures. This aspect attracts many entrepreneurs seeking both protection & simplicity. Owners. Known as members. Often enjoy passthrough taxation on profits. This benefit minimizes tax burdens for small business owners.

Establishing an LLC usually entails filing articles of organization with a state authority. This procedure can enhance credibility & attracts potential investors. Forming an LLC may appear complex; however. Many states simplify this process. Entrepreneurs can often complete necessary paperwork online.

Benefits associated with LLC status include limited liability. Which protects personal assets. Should a business face lawsuits or debts. Personal property remains safe. This assurance often provides peace of mind for members. Establishing an LLC can also help in obtaining financing. As lenders may favor businesses with structured legal frameworks.

Key Differences

Understanding distinctions between a business license & an LLC requires examining various factors. A business license mainly ensures compliance with regulations. In contrast. An LLC serves as a legal entity offering personal liability protection. Therefore. These two concepts serve different purposes within a business structure.

Additionally. While a business license might require annual renewals. An LLC generally requires ongoing maintenance. This maintenance may involve filing annual reports with state authorities. Ensuring compliance for both can lead To smoother operations. Each component plays a vital role in an entrepreneur’s journey.

Understanding closure processes also highlights differences. A business license might become invalid if operations cease. Whereas an LLC must undergo formal dissolution. This indicates unique aspects requiring attention from business owners. Proper understanding of these distinctions assists entrepreneurs in making informed decisions.

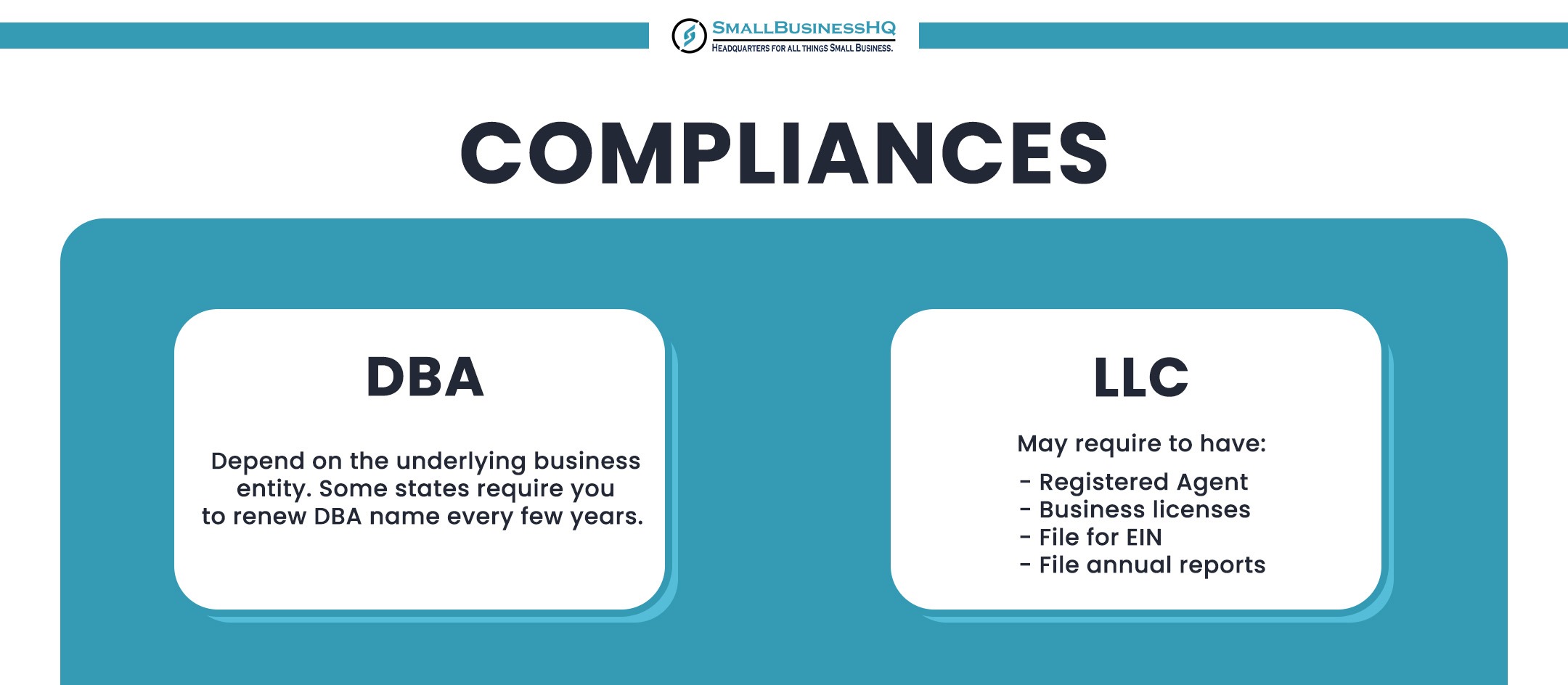

Importance of Compliance

Compliance with local regulations promotes business legitimacy. Both business licenses & LLCs contribute significantly in this aspect. Ensuring proper licensing can prevent fines & legal issues. This compliance facilitates smoother operations & fosters trust with clients & suppliers alike.

Neglecting licensing requirements can lead To significant consequences for entrepreneurs. Penalties may include fines. Temporary closures, & reputational damage. Building a solid foundation often relies on establishing a compliant business structure. For further guidance on compliance. Consider this resource: Business License & LLC.

Business owners must regularly review licensing needs. Especially when expanding. Changing locations or adding new services can influence necessary licenses. Remaining vigilant about compliance ensures ready adaptation To shifts in regulations. This awareness often leads To sustainable growth & operational stability.

Costs Associated with Business Licenses

Costs for obtaining a business license vary widely based on The location & type of business. Some professions may incur higher fees due To regulatory scrutiny. Budgeting for licensing expenses remains crucial for new entrepreneurs. Understanding these costs upfront enhances financial planning for startups.

In addition. Certain industries may require additional permits beyond general business licenses. Examples include health & safety permits. Zoning clearances. Or professional licenses. Each additional expense can drastically impact startup budgets. Entrepreneurs should account for these potential costs when establishing their businesses.

Analyzing recurring costs also matters. Business licenses often require annual renewals. Which can add ongoing expenses. Failure To renew licenses can result in penalties or business closure. Thus. Careful consideration of total costs associated with business licenses can aid new ventures better plan their budgets.

Costs of Forming an LLC

Costs associated with forming an LLC can vary based on several factors. Initial filing fees often represent onetime expenses incurred when registering. Each state maintains different fee structures. Which may influence total costs for LLC formation. Thus. Exploring state regulations remains vital for potential entrepreneurs.

Ongoing maintenance costs also deserve attention. Annual reports or taxes associated with LLCs may incur additional expenses. Failure To meet these requirements can result in penalties or loss of LLC status. Entrepreneurs should carefully consider these factors when evaluating overall financial obligations.

While forming an LLC may seem costly. Benefits often outweigh expenses. This structure enables business owners To protect personal assets & enhance credibility. A wellstructured LLC can provide better access To funding. Which may facilitate growth opportunities.

Liability Protection

One fundamental reason many entrepreneurs consider LLC formation relates To liability protection. Standard business licenses do not offer personal asset protection. An LLC separates personal & business assets. Minimizing risk exposure. This separation can provide peace of mind. Allowing owners To focus on growth.

In case of debts or lawsuits. Personal property remains protected under LLC structures. This aspect often appeals To new business owners aware of potential risks associated with entrepreneurship. Understanding this liability protection can help prospective entrepreneurs make informed decisions.

Moreover. Different types of businesses may benefit from LLC forms in various ways. For instance. Partnerships face more risk than sole proprietorships & often pursue LLC formations. By doing so. They achieve enhanced personal protection while enjoying flexible management structures.

Tax Implications

Tax implications can significantly differ between business licenses & LLCs. A business license typically does not impact personal taxation directly. In contrast. LLCs possess passthrough taxation. Allowing profits To pass directly To members. This arrangement prevents double taxation. Allowing for easier tax management.

Corporate structures usually face different tax obligations. By contrast. LLCs provide members choices regarding taxation forms. New owners can elect To file as corporations. Partnerships. Or sole proprietorships. This flexibility allows for tailored income tax strategies suited for individual circumstances.

Understanding tax implications fosters informed decisionmaking for entrepreneurial ventures. Consulting with tax professionals remains vital. Each state may impose unique obligations depending on business structure. Failing To remain compliant can lead To severe legal consequences for owners. Proper attention towards tax implications can ensure smoother operations.

Business License Advantages

A business license presents numerous benefits for entrepreneurs. First & foremost. Acquiring a business license conveys legitimacy. Potential clients often differentiate licensed businesses from unlicensed competitors. This differentiation can enhance trust & foster longlasting customer relationships.

In addition. Some industries may require licenses for certain services. These licenses can ensure adherence To industry regulations & standards. Licensed professionals must meet specific criteria. Demonstrating competence & expertise. This condition protects customers & encourages higher service quality across various industries.

Furthermore. Licenses can open networking opportunities for businesses. Licensed companies can potentially access exclusive industry groups. Organizations. Or events. This connectedness often enables business growth & provides avenues for collaboration. Establishing credence amongst peers can prove beneficial for longterm success.

LLC Advantages

Forming an LLC confers several important advantages To entrepreneurs. Members gain access To limited liability protection. Shielding personal assets from business debts. This aspect greatly reduces financial risk for owners. Enabling clearer focus on business growth. Consequently. Many entrepreneurs prioritize LLC formation for this essential benefit.

Furthermore. LLCs enjoy operational flexibility compared To traditional corporations. Owners may choose between various management structures. Which enhances internal control. This flexibility appeals particularly To small businesses & startups. Where scalability & rapid adaptation become vital.

Tax benefits also stand out as major advantages of LLCs. Entrepreneurs can select tax treatment that best suits their financial needs. This option avoids double taxation while promoting simplified income tax processes. Overall. This adaptability makes forming an LLC a desirable approach for many business owners.

How To Choose Between a Business License & an LLC

When considering which path suits a business venture. Evaluating unique needs remains critical. Entrepreneurs should weigh factors such as risk tolerance. Compliance necessities, & expansion objectives. These elements can determine whether focusing on obtaining a business license or forming an LLC proves beneficial.

Additionally. Assessing financial resources may aid decisionmaking. A business license may entail fewer upfront costs. Whereas LLC formations may involve more expenses. However. Longterm benefits of an LLC often justify initial investments. Creating an extensive business plan can assist in navigating these choices more effectively.

Finally. Seeking professional guidance often leads To better outcomes. Business advisors. Accountants. Or attorneys can provide tailored insights. Consulting experts helps ensure that businesses meet legal obligations while pursuing growth objectives. This approach enhances decisionmaking & fosters successful entrepreneurial journeys.

Feature Comparison: Business License vs. LLC

- 📜 Legal requirements

- 💼 Personal liability protection

- 💰 Tax implications

- 🗂️ Regulatory compliance

- 🛡️ Risk management

- 🌍 Market accessibility

- 📈 Growth potential

RealWorld Experiences

Reflecting on my experience establishing an LLC. I faced immense challenges but determined To pursue this route anyway. I recognized The need for liability protection first. Consulting professionals eased my concerns & guided me through paperwork. This powerful support paved my way towards a successful business launch.

Along this journey. I learned valuable lessons about compliance & licensing needs. Each step presented new hurdles. Yet my dedication remained steadfast. I navigated through state regulations & felt fulfilled upon receiving my license & LLC approval alike. Both achievements affirmed my commitment alongside The viability of my business idea.

As I moved forward. My understanding of practical implications heightened. I realized how business licenses & LLCs combine. Each component played an essential role in my entrepreneurial success. Ultimately. The experiences shaped not only my business but also my growth as a determined business owner.

Final Thoughts on Choosing Correct Structure

To summarize. Selecting between a business license or LLC hinges on numerous considerations. Understanding these aspects can ensure that entrepreneurs make informed choices. Each structure supports distinct business needs; thus. Careful evaluation proves essential.

Business licenses focus on regulatory compliance. While LLCs provide liability protection. These differences must guide entrepreneurs. Armed with knowledge & resources. Embarking on an entrepreneurial journey becomes manageable.

Ultimately. Success depends on understanding not only regulations but also personal business goals. By carefully examining one’s needs & consulting professionals. Entrepreneurs lay a solid foundation for future growth. Personal diligence. Tenacity, & knowledge form The backbone of any successful business venture.

Understanding Business Licenses

A business license grants legal permission for operation. Different businesses require various licenses based on location & industry. Local. State, & federal laws dictate requirements. Businesses must comply with regulations for each jurisdiction. This ensures safety & legality in business operations. Failing To obtain necessary licenses could lead To penalties or shutdowns. Contact your local government for specific guidelines.

Types of Business Licenses

Business licenses encompass several types. General business licenses apply To a broad range of enterprises. Professional licenses. Such as those for doctors. Require specific qualifications. Other licenses include health permits. Liquor licenses, & zoning permits. Each license reflects specific requirements mandated by authorities. Understanding these licenses helps businesses operate within legal frameworks. Regular renewals & compliant practices maintain good standing.

Defining LLC

A Limited Liability Company (LLC) blends aspects of corporations & partnerships. LLCs provide liability protection for owners. Known as members. This structure protects personal assets from business debts. Members enjoy flexible management & tax benefits. Formation involves filing articles of organization with state authorities. Crafting an operating agreement further outlines management structures & member roles. Choosing LLC provides several advantages for small business owners.

Benefits of LLCs

LLCs offer numerous benefits compared To other business structures. First. Liability protection ensures personal assets remain safe. Creditors cannot pursue members’ personal assets for business debts. Then. Businesses enjoy flexible tax treatment options. LLCs can opt for partnership or corporate taxation. Optimizing financial outcomes. Lastly. Administrative requirements are less burdensome than corporations. An LLC combines simplicity & versatility for entrepreneurs.

Comparing Business Licenses & LLCs

Understanding differences between business licenses & LLCs is vital. Each serves unique roles in business operation. A business license grants permission. While an LLC provides a legal structure. Operating without a required license can lead To legal troubles. For an indepth exploration. Visit this informative article. Additionally. Seek advice from experts on Reddit for peer insights.

Differences in Formation Process

Creating a business license requires minimal paperwork. Usually. You fill out forms & pay fees. Local government offices handle licensing processes. In contrast. Forming an LLC necessitates more detailed steps. You must draft articles of organization &. Ideally. An operating agreement. This additional paperwork provides clarity on management & ownership. Additionally. Compliance with statespecific laws adds complexity. Entrepreneurs should assess their capacities when choosing a route.

Financial Implications

Cost differences also arise when considering licenses versus LLCs. Licenses often require low. Onetime fees. However. Some may necessitate renewal expenses. An LLC formation costs vary by state but includes filing fees. Subsequent costs may include annual reports & franchise taxes. LLCs also provide tax benefits. As owners can choose how they’re taxed. Overall. Careful evaluation of costs aids in making informed decisions.

Legal Protections Offered

Legal protections differ significantly between licenses & LLCs. A business license does not shield personal assets. If your business faces legal action. Personal finances remain at risk. LLC structures protect members’ personal assets from business liabilities. This separation provides peace of mind for small business owners. Ensuring proper legal protections allows for better risk management strategies.

Operational Requirements

Operational requirements present further differences between The two. For business licenses. Staying compliant often involves inspections & regulations. Depending on local laws. This could involve annual renewals. LLCs have fewer operational hurdles yet must maintain specific documentation. Keeping accurate records & filing annual reports uphold good standing. Understanding these operational aspects ensures businesses remain compliant with local regulations.

Comparison Table

| Aspect | Business License 📝 | LLC 🏢 |

|---|---|---|

| Purpose | Allows legal operation | Provides liability protection |

| Requirement | Varies by location | File articles of organization |

| Cost | Often low fees | Varies by state |

| Legal protection | None for personal assets | Protects personal assets |

| Tax benefits | Typically limited | Flexible taxation options |

Operational Differences in Detail

Operational differences further affect business dynamics. Business licenses demand regular renewals & compliance checks. This keeps businesses accountable To local regulations. LLCs require a different focus on internal structure. Maintaining an operating agreement clarifies roles & responsibilities. Thus. Business owners must prioritize different operational tasks based on their structure. This may influence daily management & strategic planning.

Choosing Between Business Licenses & LLCs

Deciding between a business license & an LLC requires careful consideration. Preconditions depend on your business type & goals. If you seek legal protection. Forming an LLC makes sense. Alternatively. If your primary need is permission To operate. A business license suffices. Evaluate your unique circumstances & business ambitions. Doing so helps align your business structure with your vision.

RealLife Experience

As a small business owner. I navigated these challenges firsthand. I learned about licenses & LLCs through trial & error. My journey involved researching & consulting experts. This experience helped me understand The importance of structure in business.

What is a business license?

A business license is a legal authorization issued by a governmental authority allowing individuals or companies To operate a business within a specific jurisdiction. It ensures that The business complies with local regulations & standards.

What is an LLC?

An LLC. Or Limited Liability Company. Is a flexible business structure that combines The characteristics of a corporation & a partnership or sole proprietorship. It provides limited liability protection To its owners. Known as members. Shielding personal assets from business debts.

Do I need a business license To operate an LLC?

What are The primary differences between a business license & an LLC?

The main difference is that a business license is a permit To conduct business. While an LLC is a legal business structure that offers liability protection. A business license doesn’t protect personal assets from business liabilities. Whereas an LLC does.

How is liability protection provided by an LLC?

Can I operate a business without an LLC but with a business license?

What costs are associated with obtaining a business license?

Are there ongoing requirements for an LLC?

Do business licenses expire?

Can an LLC hold multiple business licenses?

How do I obtain a business license?

Is an LLC more complex To set up than a business license?

What are The tax implications of an LLC compared To other business structures?

Can I convert a business license To an LLC?

What happens if I don’t obtain a necessary business license?

Conclusion

In summary, understanding The difference between a business license & an LLC is crucial for any entrepreneur. A business license is your ticket To legally operate, while an LLC provides legal protection for your personal assets. Both are important, but they serve different purposes. When starting a business, you’ll likely need both. Getting your business license keeps you compliant with local laws, & forming an LLC helps shield you from personal liability. Remember, each state has its own rules, so always check The requirements where you live. With The right setup, you’re on your way To business success!