Creating a Small Business Spreadsheet for Income and Expenses. Learn how To create a simple income & expense spreadsheet for your small business. Stay organized. Track finances, & boost your success easily!

What is Creating a Small Business Spreadsheet for Income & Expenses & how does it work?

A small business spreadsheet helps track income & expenses. This tool aids in understanding financial health. Rows represent different transactions. While columns capture relevant details. Regular updates allow for accurate financial snapshots.

Brief history of Creating a Small Business Spreadsheet for Income & Expenses

Early spreadsheet applications emerged in 1970s. Programs like VisiCalc changed financial tracking forever. As technology advanced. Microsoft Excel became a powerful tool. Today. Many resources exist for managing finances efficiently.

How To implement Creating a Small Business Spreadsheet for Income & Expenses effectively

Start by selecting a suitable software. Create distinct sections for income & expenses. Use clear categories for better organization. Regularly input transactions. Review monthly To ensure accuracy. Adjust categories based on trends.

Key benefits of using Creating a Small Business Spreadsheet for Income & Expenses

This spreadsheet improves financial visibility. Business owners can monitor cash flow easily. Decision-making becomes better informed with accurate data. Tracking expenses helps identify unnecessary costs. Preparing for tax season simplifies with accessible records.

Challenges with Creating a Small Business Spreadsheet for Income & Expenses & potential solutions

Common challenges include data entry errors & complexity. Automate calculations To reduce mistakes. Keep categories consistent for clarity. Schedule regular reviews of your spreadsheet. Seek assistance from financial advisors when needed.

Future of Creating a Small Business Spreadsheet for Income & Expenses

Integration of artificial intelligence may streamline processes. Real-time data syncing ensures accuracy. Cloud technology offers access from various devices. Mobile apps may enhance usability for users on-The-go.

Table of Creating a Small Business Spreadsheet for Income & Expenses

| Date | Description | Income ($) | Expense ($) | Category |

|---|---|---|---|---|

| 01/01/2023 | Website hosting | 0 | 200 | Hosting |

| 01/02/2023 | Monthly subscription | 50 | 0 | Subscriptions |

| 01/03/2023 | Freelance project | 500 | 0 | Income |

Understanding Income & Expenses in Small Businesses

Every small business must effectively track income & expenses. A clear overview helps owners understand where money comes from & where it goes. This insight supports better decisionmaking for business growth & sustainability. Many entrepreneurs struggle with this task & overlook essential aspects. A welldesigned spreadsheet can simplify this process significantly. It provides a realtime snapshot of your financial health.

Utilizing spreadsheets allows entrepreneurs immediate access To crucial data. For templates. You can find several resources online. One such resource includes a customizable template. Available here. Start with a basic format & later refine as business needs evolve. Tailoring spreadsheets enhances accuracy & comprehension.

Counting every transaction meticulously helps build a clear picture. It assists every small business owner in managing financial resources. Regularly updating records promotes accountability & transparency. Proper documentation lays grounds for financial assessments. Enabling strategic growth.

Choosing Software for Your Spreadsheet

Selecting appropriate software for your spreadsheet is vital. Numerous options exist. Including Microsoft Excel & Google Sheets. Excel provides a myriad of features. While Google Sheets offers realtime collaboration. Your choice hinges on personal preference & specific business needs.

Google Sheets appeals favorably due To accessibility & collaboration capabilities. Multiple users can edit simultaneously. Enhancing teamwork. Research different tools & find most suitable for your situation. Simple setups often suffice. Especially for beginners in spreadsheet management.

Consider evaluating software based on key features. Look for userfriendly interfaces. Essential formulas, & templates. Additionally. Ensure software supports importing/exporting data from other applications. This capability allows a seamless transition between multiple systems.

Structuring Your Spreadsheet

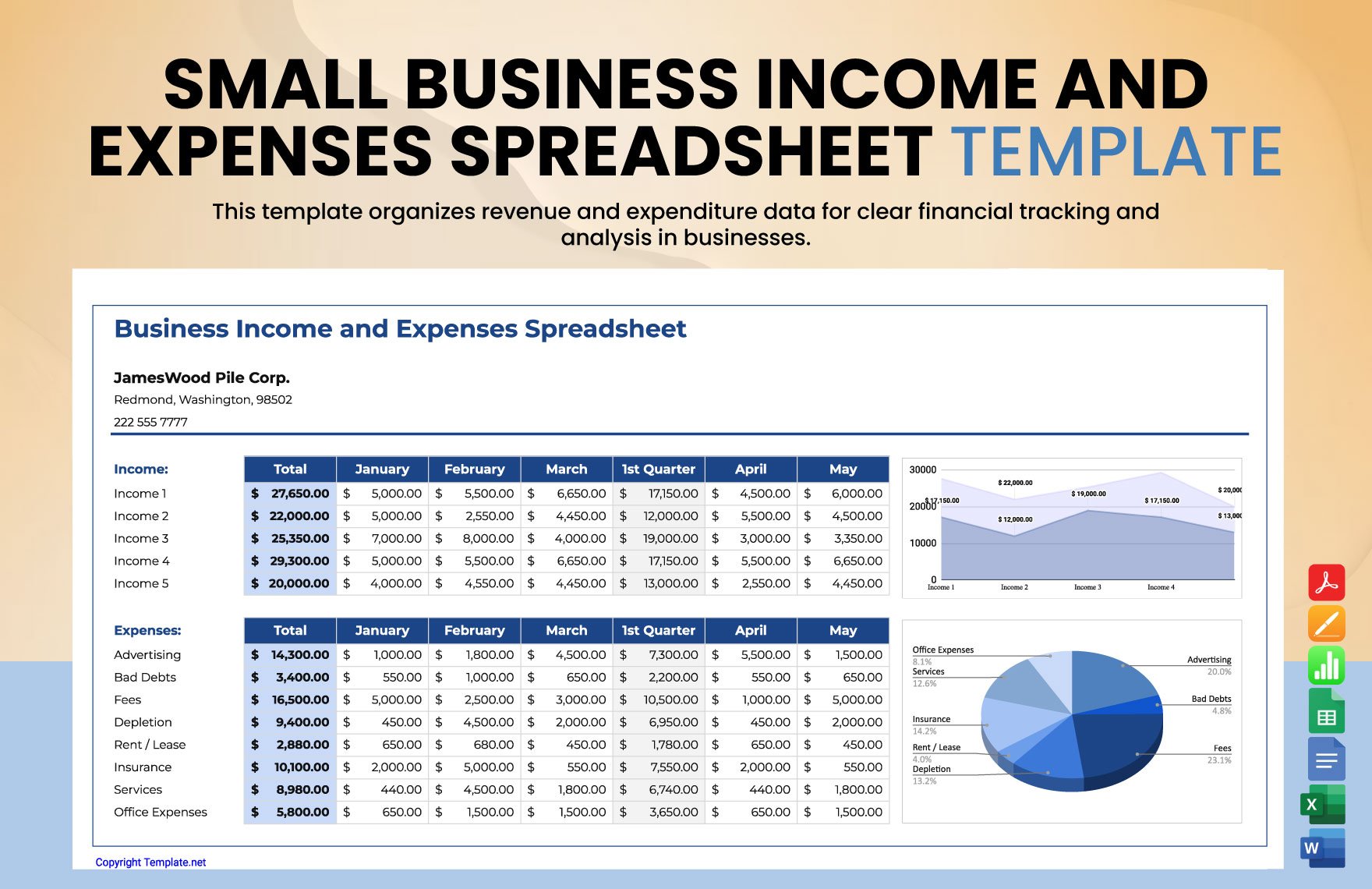

Properly structuring your spreadsheet enhances usability & understanding. Designate clear columns for income sources & another for expenses. Use headers such as “Date,” “Description,” “Category,” & “Amount.” These labels help categorize transactions effectively.

Create specific categories for explicit income & expense streams. Categories can include sales. Services. Supplies, & marketing expenses. By segmenting transactions. You can identify trends effectively. This segmentation promotes clarity regarding where profits arise or costs accumulate.

Additionally. Consider implementing color coding To distinguish between income & expenses visually. Using colors aids quick identification of categories. Even simple formatting choices can significantly enhance readability. Leading To better tracking.

Setting Up Income Tracking

Tracking income requires capturing various revenue streams distinctly. Identify all income sources. Such as product sales. Subscriptions. Or freelancing services. List each source as a separate line item To monitor performance accurately.

Maintain a dedicated income track section. This section should encompass every sale. Providing details like dates & amounts. Such documentation fosters deeper insights into profit margins & sales cycles.

Consider implementing formulas that total income automatically. Simple functions like SUM in spreadsheets can provide totals with ease. Tracking income accurately empowers businesses. Guiding future revenuerelated decisions.

Establishing Expense Tracking

Expense tracking captures vital information about spending habits. Start by listing every expense incurred through business operations. Categorizing expenses further aids in understanding financial patterns.

Common expense categories include utilities. Payroll. Rent, & marketing costs. Specify subcategories for detailed tracking. Such as utility bills categorized by types like electricity & water. This approach aids in identifying which areas consume most resources.

Utilize similar formulas for expenses as you do for income. Maintaining accurate expense records ensures responsible financial management. Understanding spending will ultimately help businesses make informed budgets.

Utilizing Formulas in Your Spreadsheet

Formulas enhance spreadsheet functionality significantly. Basic arithmetic operations like addition. Subtraction. Multiplication, & division provide essential insights. Familiarity with these functions allows greater financial analysis.

Consider using conditional formatting To flag unusual transactions. For instance. Setting rules for expenses exceeding a specific threshold can offer warnings. Such tools aid expenditure awareness. Promoting better financial control.

Further. Explore advanced formulas for forecasting. Tools like PMT & FV may assist in projecting future financial performance. Efficient forecasting aids in planning & strategizing for upcoming business phases.

Implementing Regular Updates

Regular updates of your spreadsheet ensure accuracy & relevance. Set aside time weekly or monthly for diligently inputting data. Consistency in tracking contributes significantly towards accurate financial records.

Avoid overwhelming yourself by making updates manageable. Breaking down tasks into smaller sections may provide clarity. Reducing frustration. Consistent updates will enhance comprehension & provide actionable insights.

In my experience. Maintaining a disciplined routine for updates has shown tangible benefits. Daily tracking transformed my financial management. Making my business operations smoother. Regular updates ultimately prepare small businesses for unexpected situations or opportunities.

Reviewing Financial Data Periodically

Periodic reviews of your financial data reveal trends & patterns. Monthly evaluations allow quick identification of growing issues or expanding revenue streams. Consider using charts for visual representation.

Visual aids clarify complex data. They help in breaking down statistics into easily digestible formats. Using graphs or pie charts can highlight critical areas needing attention effectively.

Documentation of budget variances should also play a role in these reviews. Noting differences between forecasted budgets & actual outcomes provides insight into financial performance. This understanding informs future planning & accountability.

Incorporating Budgeting Practices

Incorporating budgeting into your spreadsheet offers structure. Setting clear financial goals for each month can help control expenses & drive income. Budgets serve as benchmarks for assessing business performance.

Create a dedicated budgeting section within your spreadsheet. This section can house expected income & estimated expenses. Comparing planned vs. actual figures can offer crucial insights into financial health.

Regularly adjust budgets based on previous evaluations. Reassessing can refine your financial strategies. Understanding your business’s financial landscape can lead To more accurate budgeting practices.

Tax Considerations for Small Businesses

Tax obligations play a pivotal role in small business finance. Accurate tracking of income & expenses simplifies tax preparation. Ensure records are ready for analysis. Especially during tax season.

Create sections in your spreadsheet dedicated solely for tax categories. Tracking deductible expenses can lower tax liabilities significantly. Maintaining organized documentation ensures compliance & reduces stress during tax time.

Consider consulting a tax professional for additional clarity. They can provide insights specific To your location & type of business. Their expertise can help navigate oftencomplex tax regulations effectively.

Cloud Storage & Data Backup

Implementing cloud storage ensures data safety & accessibility. Losing financial records can cause significant issues. Opt for services that allow realtime syncing & backup; they safeguard against data loss.

Regularly back up data stored on spreadsheets. Frequent backups secure against technical failures or accidental deletions. Keeping multiple versions can help recover previous data when necessary.

Using shared cloud storage also enhances collaboration among team members. Everyone can access upTodate information. Promoting transparency & teamwork. Consider choosing solutions that cater specifically To small businesses.

Integrating with Accounting Software

Integrating spreadsheets with accounting software streamlines financial management. Solutions like QuickBooks or Xero offer seamless data transfers. This integration reduces errors & saves time on manual entries.

Many accounting software platforms provide various features for managing overall finances. They track income. Expenses. Payroll, & tax calculations. Utilizing these tools enhances efficiency significantly.

Choosing software that accommodates your business size & scope matters. Evaluate features carefully before selecting a solution. Ensure you select one that fits your unique operational methods.

Training & Resources for Spreadsheet Management

Investing in training & resources boosts spreadsheet proficiency. Many online courses focus on advanced spreadsheet techniques. These skills will pay dividends as your business scales.

Explore videos. Tutorials, & templates To refine excel expertise. Engaging with online communities can provide vital insights & troubleshooting tips. Participating in forums can bolster your understanding of advanced concepts.

Numerous free resources exist that offer guidelines for effective spreadsheet management. Consider bookmarking useful websites as references. Proactive learning encourages continuous improvement & adaptability.

Staying Compliant with Regulations

Compliance with financial regulations protects your business. Be aware of laws regarding financial documentation in your region. Regularly review these regulations for updates & changes.

Ensure your spreadsheet meets required information retention standards. Staying compliant promotes trust between you & your clients. Keeping transparent records simplifies assessments by regulatory bodies.

Consulting legal professionals can help clarify compliance requirements. Their guidance ensures adherence. Mitigating potential legal risks. Staying informed is crucial for maintaining longterm business viability.

Utilizing Features in Spreadsheets

- Automated calculations 🧮

- Data visualization 📊

- Dynamic filtering 🔍

- Builtin templates 🗂️

- Collaboration tools 🤝

- Cloud accessibility ☁️

- Mobile compatibility 📱

Seeking Community Support

Joining communities focused on financial management can enhance knowledge. Engage in discussions surrounding income & expense tracking. Collaboration with fellow entrepreneurs opens avenues for shared experiences & insights.

Consider platforms like forums or social media groups. Participating in such communities can foster networking & connection. You may find valuable advice from seasoned business owners & experts.

Explore forums with contentrich discussions on effective budgeting practices. A recent thread on Reddit encapsulated diverse tools & strategies here. Shared experiences often cultivate innovation & motivate businesses towards success.

Understanding Income & Expenses

Every small business needs a clear view of its finances. Tracking income & expenses helps manage finances effectively. Knowing where money comes from helps in planning. Understanding expenses allows for better budgeting. A good overview prevents financial surprises. This clarity aids in making informed decisions.

Income represents money generated from sales. Different sources contribute. Such as services or products. Regularly monitoring income aids in understanding trends. Expense management ensures that outflows remain within limits. Important expense categories include rent. Utilities, & supplies.

Managing income & expenses prevents financial chaos. Business owners can plan for slow periods. This planning creates stability for growth opportunities. Identifying areas of overspending allows for effective cutbacks. Properly understanding these factors lays a strong foundation for success.

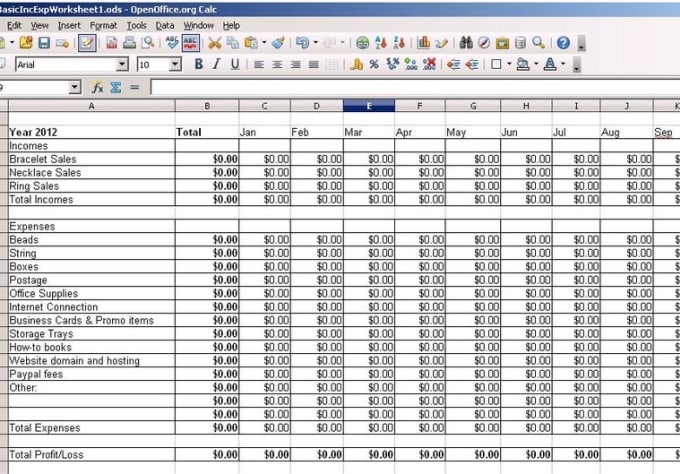

Setting Up Your Spreadsheet

Creating a spreadsheet requires some basic knowledge of software. Choose a program that meets your needs. Options include Excel or Google Sheets. Make sure To name your spreadsheet appropriately. Proper naming conventions simplify searching later.

Use different columns for various categories. Identify headings such as Date. Description. Income, & Expenses. These columns should remain clear & specific. Organizing your spreadsheet visually helps in quickly finding information. Consistency in formatting ensures ease of use.

Several templates are available online. Utilizing a premade template can save time. These templates provide a starting point for customization. You can explore options at SmartSheet. Using templates helps streamline your process.

Essential Components of Your Spreadsheet

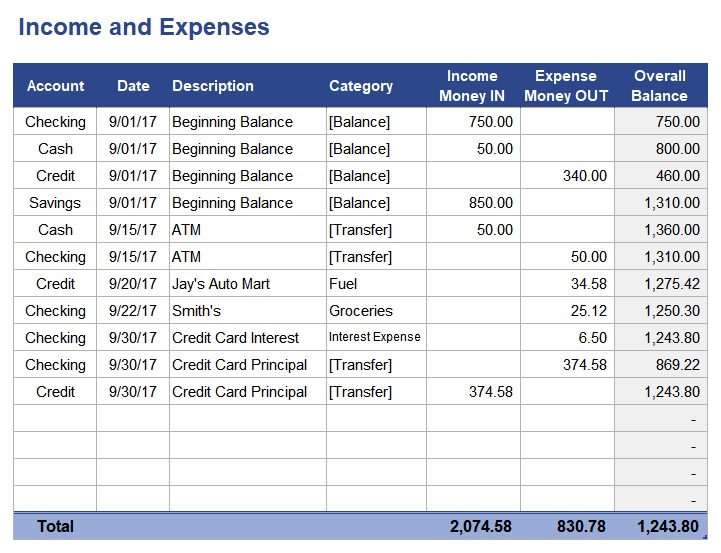

Tracking income includes several critical components. Your spreadsheet must have sections for sales receipts. Services rendered, & refunds. Income entries should reflect accurate totals To ensure clarity. Adding notes within each entry also aids in future reviews.

Expense tracking also requires attention To detail. Create categories like Office Supplies. Salaries, & Utility Bills. Each entry must include amounts spent & dates. Doing this allows you To identify spending patterns quickly. Recognizing trends ensures better budgeting decisions.

Record keeping helps with tax preparation. Proper documentation minimizes issues during audits. Create an additional section for tax deductions. This section highlights potential savings when tax season arrives. You may find further resources at Shoeboxed.

Analyzing Your Data

Once your data enters The spreadsheet. Start analyzing it. Regular reviews provide insights into financial health. Monthend evaluations help spot patterns emerging from data. Comparing various months gives an understanding of growth or decline.

You may also create charts & graphs using your data. Visual representations often clarify trends. Color coding helps emphasize important figures. This system allows you To make decisions based on real data. Datadriven decisions enhance strategic planning.

Utilizing formulas can automate calculations. Common formulas include SUM for totals & AVERAGE for mean figures. Familiarizing yourself with basic formulas will improve efficiency. Automation reduces manual errors & provides accurate results. Look for online resources or tutorials To learn more.

Best Practices for Maintenance

Regular updates keep your spreadsheet relevant. Monthly updates ensure that data remains fresh. Set reminders for updating expenses. Ideally at monthend. Consistency in updating becomes critical for maintaining accuracy.

Backup your spreadsheet frequently. Storing copies online helps prevent loss. Cloud services offer secure storage options for important files. Protecting your data ensures you always have access.

Lastly. Consider reviewing your spreadsheet annually. This review highlights areas in need of adjustments. It also assists in evaluating overall financial strategies. Adjust your practices based on findings To ensure sustained growth.

Creating a Comparison Table

| Criteria | Manual Tracking 📋 | Spreadsheet Tracking 💻 | Accounting Software 📊 |

|---|---|---|---|

| Ease of Use | Basic functions | Customizable options | Advanced features |

| Cost | Free or minimal | Free/Subscription | Subscriptionbased |

| Automation | None | Limited | High automation |

| Reporting | Basic summaries | Custom reports | Comprehensive reports |

| Cloud Access | No | Yes | Yes |

My Personal Experience

Creating spreadsheets has always fascinated me. Setting up my first small business spreadsheet transformed how I viewed finances. I learned To track income & expenses accurately. This experience profoundly impacted my approach To business management.

What are The essential components of a small business income & expenses spreadsheet?

A small business income & expenses spreadsheet should include categories for income. Fixed expenses. Variable expenses, & total profits or losses. It’s also beneficial To have columns for dates. Descriptions, & payment methods.

How can I track my sales effectively in a spreadsheet?

You can track sales by creating a dedicated column for sales entries. Including rows for each transaction. Use formulas To sum The total sales over specific periods To analyze performance easily.

What types of income should I record in my spreadsheet?

You should record all streams of income. Including sales revenue. Service fees. Grants. Investments, & any other money your business earns. Each type can be listed under a separate category for clarity.

How can I categorize my expenses in a spreadsheet?

Expenses can be categorized into fixed costs. Such as rent & utilities, & variable costs. Like office supplies & marketing expenses. This helps in understanding which areas consume most resources.

What formulas should I use To calculate total income?

You can use The SUM formula To total all income entries. For example. If your income is in column B from rows 2 To 10. The formula would be =SUM(B2:B10).

How often should I update my spreadsheet?

It’s advisable To update your spreadsheet regularly. Ideally on a daily or weekly basis. This ensures you have accurate & upTodate information on your finances.

Should I include tax calculations in my spreadsheet?

Yes. It’s important To include an estimate for taxes in your spreadsheet. You can create a separate section To estimate & calculate taxes based on your income To avoid surprises at tax time.

How can I use my spreadsheet To forecast future income?

You can analyze past income trends & apply them To future projections. Creating graphs or charts can make visualization easier & help in setting realistic revenue goals.

Is it necessary To separate personal & business expenses in my spreadsheet?

Yes. Separating personal & business expenses is crucial for accurate reporting & tax purposes. It helps track business performance & ensures compliance during audits.

What tools can I use To create a spreadsheet?

You can use software like Microsoft Excel. Google Sheets. Or any spreadsheet application that allows for easy data entry & formula calculations.

How do I analyze my expenses using The spreadsheet?

By categorizing & summing The total expenses. You can analyze which areas are consuming The most resources. Consider using pie charts or bar graphs for better visualization of spending patterns.

Can I share my spreadsheet with others?

Yes. Most spreadsheet tools allow for easy sharing. In Google Sheets. For example. You can set permissions To allow others To view or edit as necessary.

What should I do if I make an error in my spreadsheet?

If you find an error. You can simply adjust The incorrect entry. It’s also good practice To regularly back up your spreadsheet so you can restore earlier versions if needed.

How can I secure my spreadsheet data?

You can secure your spreadsheet by passwordprotecting it & restricting access. Regular backups are also recommended To prevent data loss.

What is The benefit of using templates for my spreadsheet?

Using templates can save time & effort. Ensuring that you don’t miss important categories or calculations. Many spreadsheet programs offer premade templates for small business finances that are easy To customize.

Conclusion

In wrapping up, creating a small business spreadsheet for tracking your income & expenses is a smart move. It helps you see where your money is coming from & where it’s going. By keeping everything organized, you can make better decisions for your business. Remember To update your spreadsheet regularly, so you stay on top of your finances. This simple tool can provide big insights & ultimately help your business grow. So, grab that spreadsheet & start planning for a brighter financial future today! Your business will thank you for it.