How Standard Oil Became a Horizontally Integrated Monopoly. Discover how Standard Oil transformed into a powerful monopoly by using horizontal integration. Learn The strategies that shaped its rise & impact on The oil industry.

How Standard Oil Became a Horizontally Integrated Monopoly

What is How Standard Oil Became a Horizontally Integrated Monopoly & how does it work?

Horizontally integrated monopoly allows one company dominance. Standard Oil exemplified this concept effectively. This approach creates control over an entire market. By acquiring competing firms. Such practices eliminate competition. As a result. Prices become regulated at a company’s discretion.

Brief history of How Standard Oil Became a Horizontally Integrated Monopoly

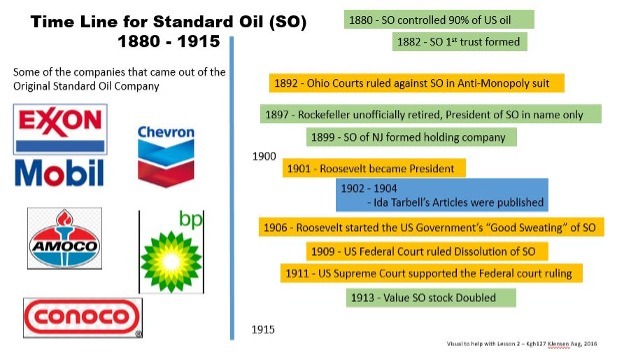

Standard Oil began in 1870. Founded by John D. Rockefeller. Initial focus involved refining crude oil efficiently. Early acquisitions included small refineries. Boosting market dominance quickly. By 1880. Over 90% of U.S. refining capacity belonged To Standard Oil. This strong hold led regulators To examine monopolistic behavior critically.

How To implement How Standard Oil Became a Horizontally Integrated Monopoly effectively

Implementing this model requires strategic acquisitions. Identifying potential competitors helps streamline processes. Maintaining quality during acquisition ensures customer retention. Focusing on innovative technologies often improves efficiency. Constantly analyzing market trends keeps a company ahead.

Key benefits of using How Standard Oil Became a Horizontally Integrated Monopoly

Achieving economies of scale reduces operational costs. Market share expansion increases overall sales revenue. Consistent pricing enhances customer loyalty. Leveraging power makes negotiating with suppliers easier. Innovation leads To product improvements & customer satisfaction.

Challenges with How Standard Oil Became a Horizontally Integrated Monopoly & potential solutions

One significant challenge involves regulatory scrutiny. Governments often enact strict antitrust laws. Addressing public sentiment through ethical practices helps mitigate backlash. Diversifying product offerings creates additional revenue streams. Continuous innovation keeps a company relevant despite challenges.

Future of How Standard Oil Became a Horizontally Integrated Monopoly

Future trends include increased regulatory pressure globally. Sustainability practices will become essential for investment. Technological advancements may redefine industry frameworks. Competition may emerge from non-traditional players. Disrupting markets. Adaptability will determine a company’s success in evolving landscapes.

Table of How Standard Oil Became a Horizontally Integrated Monopoly

| Year | Event |

|---|---|

| 1870 | Formation of Standard Oil |

| 1880 | Controlled 90% of U.S. refining |

| 1906 | Antitrust legislation introduced |

| 1911 | Supreme Court ruling dismantled monopoly |

Understanding Horizontally Integrated Monopoly

Horizontal integration refers To merging organizations within a similar industry. In this structure. Companies aim To consolidate their power. Reducing competition. Standard Oil. Founded by John D. Rockefeller. Serves as a classic example of horizontal integration. Its dominance over oil production allowed it To grow into an enormous monopoly. Control over various sectors allowed for remarkable efficiency & standardization.

Founding of Standard Oil Company

Standard Oil was established in 1870 by John D. Rockefeller. Rockefeller. Along with his associates. Sought To maximize profits within oil markets. They found oil refining To be a lucrative business in Pennsylvania. At that time. Oil as an energy source was gaining popularity quickly. By 1879. Standard Oil controlled about 90% of oil refining capabilities. A staggering achievement.

Early Business Tactics

John D. Rockefeller employed various business strategies early on. One effective tactic involved drastic costcutting measures. This allowed Standard Oil To undercut competitors significantly. By offering lower prices. Many small refiners could not survive. As competitors exited. Standard Oil’s market share grew exponentially.

Strategic Acquisitions & Mergers

Strategic acquisitions formed core elements of Standard Oil’s growth model. Rather than merely competing. Rockefeller often bought out rivals. These mergers significantly boosted Standard Oil’s strength. For instance. Acquiring small oil refiners allowed control over various aspects of operations. This formed a wellcoordinated network benefiting from economies of scale.

Monopoly Formation through Domination

As competition diminished. Standard Oil became synonymous with oil production. Methods employed led To increased market power. Competition dwindled. Making it easier for Standard Oil To dictate prices. Many critics viewed these actions as unethical monopolistic practices. However. Rockefeller countered these claims with assertions of efficiency & innovation.

Influential Partnerships & Networking

Networking played a huge role in Standard Oil’s dominance. Rockefeller forged connections within industry & finance. He maintained relationships with influential figures. Ensuring access To resources. This web of connections aided Standard Oil during its rise. Collaborations ensured necessary support amid fierce competition.

Regulatory Battles & Legal Challenges

Standard Oil faced opposition from both governments & activists. Authorities began scrutinizing its practices closely. Legal challenges aimed at dismantling Rockefeller’s monopoly became frequent. Gradually. Public sentiment shifted against monopolies overall. Laws like The Sherman Antitrust Act were enacted largely due To Standard Oil’s practices.

Public Perception & Criticism

Standard Oil’s actions drew significant public criticism. Many viewed Rockefeller as a ruthless businessman. His practices often alienated small business owners & consumers alike. Impacted communities voiced concerns over Standard Oil’s dominance. This shifting perception created broader discussions regarding corporate ethics & responsibility.

Technological Innovations & Efficiencies

Innovations within Standard Oil contributed To its success. Rockefeller prioritized advancements in refining processes. Improved techniques led To higher output levels. Maximizing efficiency became a cornerstone of operations. This focus allowed Standard Oil The ability To offer lower prices while still generating profit.

Operational Control over Supply Chains

Standard Oil revolutionized how oil businesses managed supply chains. By acquiring various segments. They created an extensive network. Control over production. Refining, & distribution reduced reliance on outside parties. This operational efficiency enabled them To respond quickly To market changes.

Diversification Strategies

Diversification played a crucial role in reinforcing Standard Oil’s dominance. Initially focusing on refining. They expanded into transportation & marketing. This approach allowed them To offset fluctuations within one segment. Vertical integration later complemented their horizontal strategies. Further cementing market power.

Impact of Identification & Monopolistic Practices

Identification of Standard Oil as a monopoly influenced future regulations. Its practices raised questions regarding corporate governance. Critics argued that monopolies stifle innovation & competitive pricing. This scrutiny became crucial in later antitrust litigation. Legal frameworks began evolving in response To concerns surrounding monopolistic corporations.

Community & Philanthropy Initiatives

In response To criticism. Rockefeller also engaged more in philanthropy. He established foundations that contributed To educational & scientific causes. While many viewed this as genuine philanthropy. Others remained skeptical. Critics often wondered whether these efforts were merely attempts To improve Standard Oil’s tarnished reputation.

Government Interventions & Antitrust Actions

Legal action ultimately led To Standard Oil’s dissolution. In 1911. Supreme Court ruled against it. Citing antitrust violations. This landmark case set significant precedence for future regulation of monopolies. The breakup led To creation of several oil companies. Including Exxon & Chevron.

Lessons Learned from Standard Oil’s Journey

Standard Oil’s case provides crucial insights regarding monopolistic practices. Businesses should prioritize ethical operations while competing. Strategies focused solely on domination often lead To significant regulatory scrutiny. Maintaining positive public relations remains vital for longterm success. The balance of power within industries requires ongoing assessment.

Features of Standard Oil’s Monopoly Experience

- Strategic acquisitions & mergers 🤝

- Influential partnerships & networking 🏗️

- Technological innovations in refining ⚙️

- Regulatory battles & legal changes ⚖️

- Operational control over supply chains 📦

- Diversification strategies across sectors 🌍

- Community engagement & philanthropy 💖

Personal Reflection on Standard Oil

While studying Standard Oil’s history. I realized its profound impact on modern business practices. I was amazed by how one company’s strategies shaped entire industries. Learning about Rockefeller’s ingenious & sometimes ruthless tactics inspired me To think critically about competition.

Understanding Horizontal Integration

Horizontal integration refers specifically To a strategy where a company expands its operations at similar levels within an industry. This approach increases market share & minimizes competition. Companies often pursue this strategy through mergers or acquisitions. By consolidating power. A firm can dominate its sector effectively. Many examples exist throughout history that demonstrate this concept in action.

Standard Oil. Founded by John D. Rockefeller. Represents a significant case of horizontal integration. Operating in petroleum. This company became immensely successful by acquiring competitors. It streamlined oil production. Refined oil, & distribution. These strategic decisions allowed Standard Oil To control prices while increasing profit margins.

Building an empire requires aggressive tactics. Rockefeller embodied this through various means. His methods included underpricing competitors. Creating market monopolies, & consolidating businesses. Observing such strategies offers insights into how other companies might succeed.

Creation of Standard Oil

Standard Oil emerged from a dynamic business environment in The 19th century. As oil production accelerated. Opportunities for profits surged. Entrepreneurs sought ways To capitalize on this emerging market. Rockefeller. Alongside partners. Recognized this gap & seized opportunities within oil refining.

In Cleveland. Ohio. Operations began. Focusing initially on refining. To ensure quality control. Rockefeller implemented strict protocols. Competitors soon found difficulty keeping pace. Within a few years. Standard Oil expanded across states & attracted significant market attention. For more insight into Standard Oil’s rise. Visit Quora or Wikipedia.

Rockefeller’s vision emphasized growth & consolidation. Using intelligence & strategy. He acquired struggling firms. His approach involved careful management of resources. This focus enabled rapid expansion & dominance over competitors. By effectively analyzing market trends. Standard Oil flourished amid evolving demands.

Tactics of Acquisition

Rockefeller employed various tactics for acquiring rival companies. He often offered attractive buyout deals. Persuading owners. While some accepted immediately. Others resisted. These situations varied widely depending on competitors’ financial conditions. Eventually. Many competitors succumbed under Standard Oil’s weight.

Underpricing competitors became another common strategy. By slashing prices. Standard Oil could attract more customers. This tactic often forced competitors out of business. Those unable To sustain losses had no choice but To sell. With fewer firms left standing. This left Standard Oil in an enviable position.

The psychological aspects of business also played key roles. Rockefeller fostered relationships with industry experts & influencers. This networking formed strategic alliances To support growth. People respected his ability while fearing his power in The marketplace. Such maneuvers empowered Standard Oil. Creating additional opportunities.

Market Control Through Refineries

Standard Oil understood The importance of controlling production facilities. Refineries represented critical assets in oil processing. By owning a vast number of refineries. Standard Oil optimized operations extensively. This allowed them To cut costs significantly. Boosting profit margins.

Focus on innovation characterized Standard Oil’s refining processes. Implementing advanced techniques improved oil quality. Creating demand. Also. Maintaining optimal efficiency became key for increasing output. As competitors grappled with their processes. Standard Oil continued evolving.

By reinvesting profits into infrastructure. Rockefeller ensured continued growth. New refineries emerged. Expanding production capacity. The company eventually controlled a significant percentage of American oil refining. This dominance laid groundwork for further expansions. Establishing a nearmonopoly in The sector.

Strategic Pricing Models

Pricing strategies form another aspect of Standard Oil’s dominance. The company pioneered innovative pricing models that maximized revenue. By dictating prices. They secured market control. Competitors had little choice but To follow suit or risk bankruptcy.

Rockefeller employed a volumebased pricing strategy. This approach allowed for lower perunit costs. Resulting in higher sales volumes. Increased sales cover losses from lower prices. Thus. Even as prices dropped. Profits continued To rise. Strengthening their financial position.

Implementing discounts for railroads further secured Standard Oil’s power. By partnering with transportation companies. They could ship oil more efficiently. These alliances minimized competition while maximizing Standard Oil’s reach. The pricing model also fostered strong relationships with transportation partners. Further entrenching market dominance.

Building Relationships with Railroads

Partnerships with railroads proved essential for Standard Oil. Transporting products efficiently became a backbone of operations. Initially. Rockefeller negotiated favorable shipping rates. By emphasizing volume. He persuaded rail companies To prioritize Standard Oil shipments.

As competition intensified. Rockefeller’s approach evolved. Standard Oil began demanding rebates from railroads. This further reduced operational costs while squeezing competitors. Many rival firms struggled under these pressures. Leading To further industry consolidation.

Control over transportation routes also allowed Standard Oil preferential access. This access significantly influenced distribution channels. Because of this power. Standard Oil could dictate terms. Driving competitors out more effectively. Such strategies solidified their grip on The market.

The Role of Trusts

Formation of trusts represented a pivotal moment in Standard Oil’s journey. The trust allowed multiple companies To operate under a single entity. This arrangement simplified management & decisionmaking processes. Rockefeller became a trustee of Standard Oil. Directing operations effectively.

Through this structure. Standard Oil could operate at scale. Many small firms relinquished control in exchange for trust shares. Once amassed. This consolidated financial power opened new doors. It became easier To manage resources across various operations. Fostering growth.

Trust structures faced scrutiny as monopolistic practices emerged. Public sentiment shifted against corporate giants like Standard Oil. Reform movements began gaining traction as people feared corporate overreach. Nonetheless. Trusts provided unquestionable benefits during their time. Shaping industries substantially.

Challenges & Antitrust Movements

By early 20th century. Challenges intensified for Standard Oil. Increased scrutiny emerged from government agencies & public interest groups. Antitrust sentiments developed in response To monopolistic practices. Politicians began examining policies that enabled such corporate control.

Opposition mounted against trusts. Labeling them as harmful. Critics argued that monopolies restricted competition & innovation. As reforms gained momentum. Public campaigns targeted Standard Oil. Growing discontent led To calls for breaking up monopolies.

Standard Oil faced numerous lawsuits as a result. Notably. In 1911. A landmark Supreme Court ruling dismantled The company. Standard Oil had no choice but To break into smaller entities. This marked a significant shift in American corporate regulations.

Legacy of Standard Oil

Standard Oil left a profound impact on American industry. Its rise exemplified how horizontal integration reshaped sectors. Techniques pioneered by Standard Oil influenced modern corporate strategies. Many companies today still study Rockefeller’s methods for success.

While Standard Oil’s practices evoked criticism. They also inspired innovation. The company set standards in operational efficiency unmatched for decades. Furthermore. It established frameworks for understanding market dynamics. Leaders continue examining its influence on today’s economies.

Experience learning about Standard Oil provides valuable lessons. I observed marketing strategies & competitive tactics employed back then. Analyzing case studies enriches comprehension of modern businesses. By understanding history. Present & future industries benefit from knowledge captured.

Comparison of Strategies Used by Standard Oil

| Strategy 💡 | Description 📜 | Impact 🌍 |

|---|---|---|

| Horizontal Integration | Acquiring competitors for market control. | Dominated oil industry. Reduced competition. |

| Vertical Integration | Controlling refining & distribution processes. | Enhanced efficiency. Minimized costs. |

| Pricing Strategies | Setting prices To undercut rivals. | Increased market share. Limited competitor operations. |

| Railroad Partnerships | Securing favorable shipping deals. | Improved logistics. Deeper market penetration. |

| Formation of Trusts | Establishing single management over multiple companies. | Streamlined operations. Increased responsiveness. |

Conclusion on Horizontal Integration & Standard Oil

In summary. Understanding Standard Oil’s journey through horizontal integration reveals significant lessons. Competitive tactics emphasized efficiency while redefining market dynamics. Observing such strategies aids individuals in navigating modern industries effectively.

What is horizontal integration?

Horizontal integration is a strategy where a company increases its market share by acquiring or merging with other companies at The same level of production in The same industry. This approach can help eliminate competition & control prices.

How did Standard Oil practice horizontal integration?

Standard Oil practiced horizontal integration by acquiring numerous oil refineries & related businesses. This allowed The company To dominate The oil industry by consolidating its control over these enterprises. Thereby reducing competition.

Who founded Standard Oil?

Standard Oil was founded by John D. Rockefeller in 1870. He played a pivotal role in establishing The company as a leading force in The oil industry through strategic acquisitions & partnerships.

What strategies did Standard Oil use To eliminate competition?

Standard Oil employed various strategies. Including undercutting competitors’ prices. Forming trusts, & acquiring rival companies. This aggressive approach helped The company secure a significant market share.

When did Standard Oil reach its peak of power?

Standard Oil reached its peak power in The late 19th century. Controlling around 90% of The refined oil production in The United States by The early 1900s. This dominance raised concerns about monopolistic practices.

What was The impact of horizontal integration on oil prices?

Through horizontal integration. Standard Oil was able To control oil prices by manipulating supply & demand. This often led To lower prices for consumers during periods of aggressive competition. But higher prices once competition was reduced.

How did Standard Oil’s practices lead To regulatory scrutiny?

The monopolistic practices of Standard Oil drew widespread public & governmental scrutiny. In 1890. The Sherman Antitrust Act was enacted To combat monopolies. Targeting companies like Standard Oil.

What was The outcome of The antitrust lawsuit against Standard Oil?

In 1911. The U.S. Supreme Court ruled against Standard Oil. Declaring it an illegal monopoly. The court ordered The company To be broken up into smaller companies To restore competitive practices in The industry.

How did The breakup of Standard Oil affect The oil industry?

The breakup of Standard Oil resulted in The creation of several smaller companies. Which increased competition in The oil industry. This diversification ultimately led To innovation & better service for consumers.

What legacy did Standard Oil leave behind?

Standard Oil’s legacy includes The establishment of regulatory frameworks To prevent monopolistic practices. Its influence can still be seen in modern antitrust laws & The ongoing scrutiny of large corporations.

How did Standard Oil’s marketing strategies contribute To its monopoly?

Standard Oil used aggressive marketing tactics. Including branding & advertising. The company created a strong brand that consumers recognized & trusted. Which helped To consolidate its market dominance further.

What role did railroads play in Standard Oil’s success?

Railroads were crucial for Standard Oil’s growth. As they provided an efficient means of transporting oil & its products. Standard Oil negotiated favorable shipping rates. Strategically partnering with railroads To reduce operational costs.

What lessons can be learned from Standard Oil’s rise & fall?

The rise & fall of Standard Oil highlight The importance of regulation in maintaining fair market competition. It illustrates how unchecked power can lead To monopolistic practices detrimental To consumers & The economy.

Did Standard Oil face any significant challenges during its dominance?

Yes. Standard Oil faced significant challenges. Including public backlash against monopolistic practices & increasing regulatory pressure. Grassroots movements & political opposition emerged. Culminating in legal actions against The company.

What industries did Standard Oil expand into beyond oil refining?

Beyond oil refining. Standard Oil expanded into various related industries. Including transportation. Marketing, & distribution of petroleum products. This diversification helped The company enhance its overall market control.

Conclusion

In summary, Standard Oil’s rise To a powerful monopoly shows how a company can grow by buying out its competitors & controlling a whole industry. By focusing on efficiency & lower costs, it dominated The oil market, leaving little room for others. This strategy, known as horizontal integration, helped Standard Oil thrive but also raised concerns about fairness & competition. Ultimately, its story teaches us The balance between business success & ethical practices. Understanding this history helps us see The importance of fair competition in today’s economy, reminding us that monopolies can stifle innovation & choice for consumers.