How to Get a Business License in Virginia. Looking To start a business in Virginia? Our guide helps you easily navigate The steps To get your business license & launch your dream venture today!

What is How To Get a Business License in Virginia & how does it work?

A business license grants permission for operations. Virginia mandates licensing for various business types. Each municipality may have unique requirements. Owners need local & state licenses. Applications typically include business information. Fees depend on specific industries & locations.

Brief history of How To Get a Business License in Virginia

Virginia’s licensing process evolved through years. Early regulations focused on economic growth. Changes addressed complexity & clarity. Over time. Various industries faced specific licensing demands. Modern versions promote easier access for entrepreneurs.

How To implement How To Get a Business License in Virginia effectively

Start by selecting a suitable business name. Research local requirements for your area. Complete necessary application forms accurately. Provide required documentation & pay fees. Maintain compliance with state regulations for renewals & changes.

Key benefits of using How To Get a Business License in Virginia

Obtaining a business license enhances credibility. It protects consumers & fosters trust. A license opens doors for local business opportunities. Compliance reduces risks of fines & legal issues. Your business gains access To resources & networks.

Challenges with How To Get a Business License in Virginia & potential solutions

Complex regulations may confuse new entrepreneurs. Seeking assistance from local chambers helps navigate hurdles. Keep organized records for smooth application processes. Networking with other business owners can offer valuable insights.

Future of How To Get a Business License in Virginia

Technology will simplify licensing processes. Digital platforms may facilitate easier applications. Future trends suggest a focus on entrepreneurship growth. Policymakers continue refining regulations for clarity. Businesses can expect streamlined procedures ahead.

Table of How To Get a Business License in Virginia

In Virginia. Licensing varies by locality. Below are common requirements:

- License Type

- Required Documents

- Application Fees

- Processing Time

- Renewal Frequency

Understanding Business Licenses in Virginia

Acquiring a business license involves numerous steps. Each state has unique requirements. Virginia mandates several licenses. Permits, & registrations. A business license ensures legal compliance. This process protects business owners. More details available at Virginia’s official state website.

Types of Business Licenses in Virginia

Virginia offers various licenses. Each business type requires specific documentation. Understanding these types helps streamline The application process. Common licenses include:

- General Business License

- Sole Proprietorship License

- Retail License

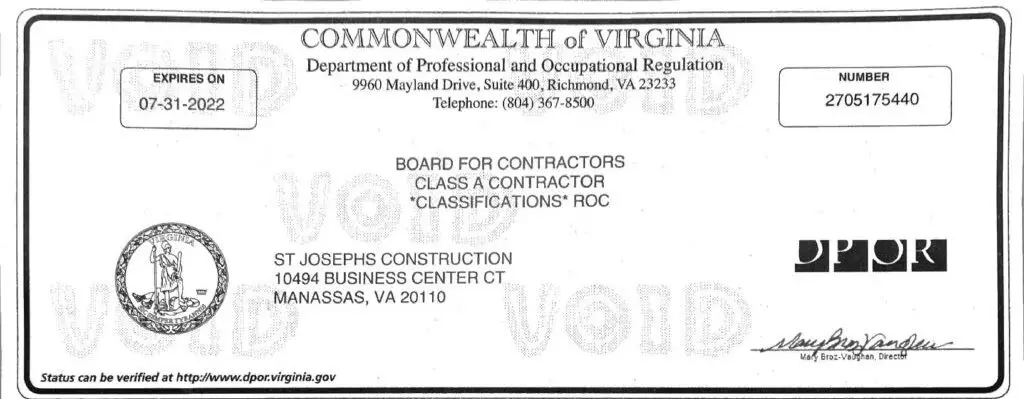

- Contractor License

- Professional License

Some businesses might require special permits. These permits pertain To specific sectors. Examples include health permits & zoning permits. Always check local regulations before proceeding.

Importance of Business Licenses

A business license maintains legality. Operations conducted without proper licensing can lead To penalties. Legal authority lends credibility. Customers trust licensed businesses more readily.

Obtaining a license enhances growth potential. Investors prefer licensed entities. Funding opportunities often arise only for compliant businesses.

Finally. A business license ensures adherence To local. State, & federal laws. Each jurisdiction has codes governing business practices. Remaining informed & compliant proves beneficial.

Steps To Acquire a Business License

Identify Your Business Structure

Choosing a business structure is essential. Options include sole proprietorship. LLC. Corporation, & partnership. Each structure has different implications for liability & taxes. Understanding these factors shapes future decisions.

Consulting a business advisor can clarify options. These professionals provide tailored guidance. They can aid in making informed choices based on specific needs.

Once clarity on structure arises. Subsequent steps become more manageable. This decision influences licensing. Tax obligations, & regulatory compliance.

Gather Required Documents

Collecting necessary documentation is crucial. Each business type has unique requirements. Common documents include:

- Identification proof

- Business plan

- Financial statements

- Tax identification number

- Proof of address

Gathering paperwork ahead saves time during application processes. Review each document’s validity & relevance. Referencing state or local guidelines can help ensure completeness.

Inadequate documentation leads To delays. Confirm all necessary papers are current & accurate. This proactive approach enhances efficiency.

Where To Apply for a Business License

Local Requirements

Most licenses are obtained at local offices. Each city or county in Virginia mandates its own requirements. Contact local business offices for guidance. These offices provide accurate information on jurisdictionspecific regulations.

During application. Make sure you include required fees. Fees vary by locality. A thorough understanding of local needs accelerates processing time.

Some counties use online systems for applications. Investigating online options can enhance convenience. Check local government websites for relevant portals.

StateLevel Licenses

Certain businesses require statelevel licenses. Industries such as healthcare. Construction, & finance have regulatory bodies. Visit state websites for specific licensing boards. These resources offer guidelines & applications.

State licenses involve more scrutiny. Regulatory bodies evaluate compliance with standards. Meeting these criteria enables operations in regulated sectors.

State licenses often require additional documentation. Maintain organization To expedite processing. Ensure all requisite documents accompany applications.

Understanding Business Taxes

Sales Tax Registration

If selling products. Register for a sales tax permit. Virginia mandates sales tax collection for most retail transactions. Completing The Virginia Department of Taxation’s form begins this process.

Be aware of tax obligations. Accurately collecting & remitting sales tax prevents penalties. Regularly review regulations as they may change.

Implementing a bookkeeping system can aid in tracking sales tax. Accurate records facilitate tax filings. Saving effort & stress.

Employer Identification Number (EIN)

Obtaining an Employer Identification Number (EIN) proves crucial. An EIN acts as a business’s Social Security number. This number allows businesses To hire employees & file taxes.

Applying for an EIN is straightforward. The IRS offers an online application process. Submitting accurate information ensures timely processing.

Understand that an EIN often requires renewal. Stay informed on renewal procedures. This proactive management helps develop sustainable operations.

Special Licenses & Permits

Health & Safety Health Permits

Certain industries require health permits. These permits are crucial for businesses involved in foodservice. Healthcare, & related sectors. Application procedures vary by jurisdiction.

Health inspections often accompany these permits. Employing best practices lowers risks. Ensure compliance with health regulations throughout operations.

Regular updates on health standards help maintain compliance. Follow changes dictated by local health departments diligently. Staying informed enhances reputation & operational longevity.

Zoning Permits

Zoning permits determine where businesses can operate. Each locality has designated zones based on land use. Confirm zoning regulations before applying for a business license.

Understanding zoning regulations aids in selecting suitable locations. Consulting local planning departments can prevent future issues. They help identify whether a location aligns with business needs.

Securing zoning permits may involve submitting plans for review. Presenting clear. Compliant plans increases approval chances. Always doublecheck criteria To avoid surprises during The application process.

Fees & Costs Associated with Licensing

Understanding Fees

Application fees vary significantly. Local government offices typically determine these fees. Research applicable fees before starting The application process.

Budgeting for these costs ensures proper financial planning. Additional costs may arise. Such as renewal fees or inspection costs. Understanding total expenses aids in avoiding financial strain.

Some businesses may qualify for fee waivers. Investigate whether available relief programs suit your situation. Participating in these programs can minimize initial burdens.

Cost Management Tips

Staying within budget requires discipline. Regularly review financial statements To monitor spending. Identifying unnecessary costs reduces financial strain.

Involve financial professionals for budgeting help. Accountants provide valuable insights into allocating funds effectively. Consistent tracking aids in achieving financial health.

Potential businesses might consider starting small. Gradually expanding operations after your business license approval minimizes overhead. This approach fosters sustainability.

Maintaining Your Business License

Renewal Process

Every business license requires renewal. Renewal often occurs annually. Although. In some cases. Longer periods are possible. Remaining aware of renewal deadlines prevents lapses in licensing.

Gather necessary documentation ahead of time. Completion of renewals usually mirrors initial applications. Proper organization aids in ensuring timely renewal.

Utilizing calendar reminders can prove beneficial. Add renewal dates well in advance. This preemptive measure facilitates uninterrupted operations.

Compliance with Regulations

Continual compliance helps maintain business licenses. Tracking industry regulations aligns with licenses. Understanding obligations avoids potential penalties or revocations.

Regularly review updates from local offices. Staying current prevents misinformation & ensures proactive management. Reach out if uncertainties arise regarding regulations.

Establishing a compliance checklist fosters accountability. Following set procedures remains vital for upholding business integrity. Consistent reviews can mitigate issues before they escalate.

Seeking Professional Help

Consulting Business Advisors

Hiring advisors streamlines obtaining a business license. Experienced professionals provide tailored assistance. They understand nuances of licensing processes & pitfalls.

Advisors can guide through application complexities. Their expertise often proves invaluable during evaluations. Efficient management saves time & reduces stress.

Consider conducting thorough research before hiring. Identifying reputable advisors fosters trust. Online reviews & referrals enhance confidence in decisionmaking.

Legal Assistance

Some businesses benefit from legal counsel. Attorneys specializing in business law handle complex issues. Their insights safeguard against costly mistakes.

Legal professionals can assist in contract creation. Ensure compliance with local laws through their support. Regular consultations can mitigate risks.

Establishing a working relationship with a lawyer promotes peace of mind. Proactive legal support can prevent many issues. Always have expert resources available when needed.

Staying Informed on Changes

Regularly Check for Updates

Business regulations frequently change. Staying informed ensures compliance with new guidelines. Subscribe To relevant newsletters or notifications from local agencies.

Engage with local business chambers for updates. These organizations often share timely information or hold workshops. Networking enhances awareness of regional changes.

Participating in local business events fosters knowledge. Attend seminars or workshops aimed at business development. Continuous education strengthens operational skills.

Joining Professional Organizations

Many industries offer professional organizations. Joining can provide insights into licensing updates. These associations often host training sessions on best practices.

Networking through these organizations opens doors for collaboration. Establish relationships with peers who understand similar challenges. Sharing experiences fosters solutions To common issues.

Being part of a professional community promotes growth. Frequent engagement strengthens understanding of industry standards. These networks can provide vital resources during licensing processes.

Personal Experience in Licensing

My journey acquiring a business license taught me valuable lessons. Initially. I underestimated The importance of thorough research. Gathering required documents proved more complicated than expected. Missing one document delayed my application. Through persistence. I learned effective communication with local offices speeds processing. Engaging with advisors made The process smoother.

Final Thoughts on Business Licensing

Acquiring a business license in Virginia requires careful planning. Follow guidelines provided by local & state offices. Organizing documentation & staying compliant enhances The process.

Key Features of Business Licensing in Virginia

- Various types of licenses available 🏢

- Local & statelevel applications needed 📄

- Multiple permits may be required 📋

- Fees vary by jurisdiction 💸

- Continuous updates necessary for compliance 🔄

Remain proactive throughout this entire journey. With preparation. Achieving compliance becomes feasible. Use available resources effectively To navigate The licensing landscape.

Understanding Business Licenses in Virginia

Starting a business requires compliance with several regulations. Obtaining a business license represents one critical step. Virginia mandates this license for various trades & professions. Each locality maintains specific requirements for applicants. Understanding regulations helps streamline The process.

Types of Business Licenses

Virginia offers several types of licenses. Businesses can register for a general business license. Professional license. Or special permits. Each type addresses particular needs within specific industries. For example. Food service businesses must secure health department permits. Similarly. Contractors may require additional certifications based on projects.

Understanding diverse types aids in applying correctly. Entrepreneurs need To research requirements extensively. Local governments often publish guidelines for prospective applicants. Resources may include online portals. Publications. Or direct inquiries with local offices. Each license serves unique purposes tailored To particular sectors.

For detailed information on license categories. Consult official resources. Check out this link for comprehensive guidance. This ensures businesses fulfill necessary obligations before operation.

Determining Your Business Location

Your business address influences licensing requirements. Local jurisdictions impose different rules & fees. Identifying where your business operates initially directs you toward compliance. For example. Fairfax County may have different statutes compared with Richmond.

Local zoning laws also impact operations. Ensure that your business aligns with local zoning classifications. You may need additional permits based on location type. Engage with local zoning offices for needed clarifications. This step ensures that your operations stay within legal parameters.

For further details about zoning regulations. You might find interest in this resource. Knowing local requirements makes securing your business license much simpler.

Gathering Necessary Documents

Successful applications require submitting essential documents. Commonly required items include identification. Business plans, & tax information. Specific industries might need unique permits or certifications. Keep all documentation organized for easy access.

Transitioning from preparation To submission entails careful review. Verify that each document meets jurisdiction specifications. Inaccuracies delay processing time & could incur extra fees. Having a checklists helps streamline application preparation.

Consider leveraging professional assistance if necessary. Accountants or business consultants often provide insights into required documents. Assistance may alleviate stress during The application process.

Filling Out Application Forms

Every locality has its specific application forms. Access required forms through local government websites or offices. Follow all instructions carefully when completing documents. Missing information can lead To rejections or delays.

Online submissions are often available. But paper forms still exist. Ensure that your preferred method aligns with local preferences. Completing forms accurately avoids common pitfalls.

After filling out your application. Maintain copies for personal records. This practice helps in tracking your application’s progress. Familiarize yourself with local followup procedures To confirm receipt.

Preparing for Fees & Costs

Every business license application incurs fees. Costs vary based on local regulations & business types. Understanding expected fees beforehand aids in budgeting effectively.

Check for potential hidden costs. Some jurisdictions impose fees for renewals or late submissions. Plan financially for these expenses To ensure seamless operations. Create a detailed budget that includes all licensing costs.

Assess additional costs related To maintaining compliance. Annual renewals often require further financial investment. Being prepared minimizes financial strain in subsequent years.

Waiting for Approval

Once submitted. Patience becomes essential. Processing times differ by locality & application type. Some licenses receive quick approval. While others may take weeks. Regularly check your application’s status To stay informed.

If additional documentation gets requested. Respond promptly. Delays in providing needed information can extend waiting periods unnecessarily. Engaging with local offices can clarify any uncertainties regarding your application.

During this waiting phase. Consider planning for startup needs. Use this time productively by addressing other business aspects. Focus on elements like marketing. Staffing. Or product development.

Finalizing Business Setup

Approval marks significant progress in your business journey. Once granted. Finalize all aspects of your business structure. Ensure compliance with other legal obligations. Like tax registration & liability insurance.

Engaging with local business networks may lend support. Join local chambers of commerce or business associations. Networking offers valuable insights from fellow entrepreneurs & industry professionals.

Take necessary steps toward launching your business. Promote services or products through marketing strategies. Utilize social media. Local advertising. Or wordofmouth To gain visibility within your community.

Comparison of Business License Steps

| Step | Description | Timeframe | Notes | Emoji |

|---|---|---|---|---|

| Research | Understand requirements | Varies | Critical groundwork | 🔍 |

| Document Gathering | Collect needed paperwork | 12 weeks | Organize effectively | 📂 |

| Application Form | Fill out necessary forms | 1 week | Follow instructions closely | 📝 |

| Fee Payment | Submit payment with application | At application time | Review fee structure | 💳 |

| Approval Wait | Await response from authorities | 26 weeks | Stay proactive | ⏳ |

My Personal Experience with License Application

In 2018. I navigated through Virginia’s licensing process. I learned about local requirements. Gathered documents, & submitted my application. Patience played a vital role as I awaited approval.

Networking with other business owners proved beneficial. Sharing experiences provided tremendous insights into overcoming challenges. Engaging local resources streamlined my journey significantly.

Completing this process taught me much about local laws. I gained confidence in understanding requirements & handling applications successfully.

Continuing Education & Compliance

After securing your business license. Remember compliance remains ongoing. Local regulations may evolve. Requiring updates or renewing licenses. Stay informed about changes that might impact operations.

Consider pursuing educational opportunities. Workshops. Webinars. Or local classes can provide essential updates. Knowledge helps ensure adherence To evolving laws & improves business strategies.

Engagement with relevant associations also offers benefits. These groups often share critical updates regarding licensing & regulations. A wellinformed business owner remains ahead of potential challenges.

Resources for Further Information

Resource availability aids in navigating business licensing. Websites. Local offices. Or consultants provide valuable information. Regularly review online resources To remain updated.

Networking groups often share insights among peers. Collaborating with others in your industry can reveal hidden resources. Take advantage of each opportunity for learning & compliance.

Utilize educational platforms or business training tools. Investing time into developing skills enhances overall business acumen. Knowledge leads To better decisions & sustained success.

What is a business license in Virginia?

A business license in Virginia is a permit issued by local or state authorities that allows individuals or businesses To operate legally within a specific jurisdiction.

Who needs a business license in Virginia?

Any individual or entity conducting business activities in Virginia. Including freelancers. Contractors, & corporations. Generally needs To obtain a business license.

How do I apply for a business license in Virginia?

To apply for a business license in Virginia. You must contact The local city or county government where you plan To operate. Applications can usually be submitted online or at local government offices.

What documents are required To obtain a business license in Virginia?

Typically. You will need To provide identification. Proof of business address. A business plan, & possibly other documents such as tax information & zoning permits.

Are there fees associated with obtaining a business license in Virginia?

Yes. There are fees associated with obtaining a business license, & these can vary significantly based on The type of business & its location. Check with your local government for specific fee structures.

How long does it take To get a business license in Virginia?

The time it takes To obtain a business license in Virginia varies by locality. But it typically ranges from a few days To several weeks. Depending on The complexity of The application.

Do I need To renew my business license in Virginia?

Yes. Most business licenses in Virginia must be renewed annually. Be sure To check with your local authorities for specific renewal procedures & timelines.

Can I operate my business without a license in Virginia?

No. Operating a business without a valid license is against The law in Virginia & can lead To fines. Penalties. Or closure of your business.

What if my business is located in multiple jurisdictions in Virginia?

If your business operates in multiple jurisdictions. You will need To obtain a business license from each locality where you conduct business.

Are there specific licenses required for certain types of businesses in Virginia?

Yes. Certain types of businesses. Such as those in The food service. Health care. Or transportation sectors. May require additional licenses or permits beyond a standard business license.

How can I check The status of my business license application in Virginia?

You can check The status of your business license application by contacting The local office where you submitted your application or visiting their official website for status updates.

Do I need To register my business name in addition To obtaining a business license?

Yes. If you are operating under a name that is different from your legal business name. You may need To register a “Doing Business As” (DBA) name with The state or local government.

What happens if I forget To renew my business license in Virginia?

If you fail To renew your business license by The deadline. You may be subject To late fees. Penalties. Or even The revocation of your license.

Can I get a business license online in Virginia?

Many localities in Virginia offer online applications for business licenses. Check your specific city or county’s website for available online services.

What resources are available for small business owners in Virginia?

Virginia offers numerous resources for small business owners. Including local chambers of commerce. Small business development centers, & staterun business assistance programs.

Conclusion

Getting a business license in Virginia doesn’t have To be overwhelming. Just follow The steps we’ve discussed, starting with determining your business type & checking local requirements. Don’t forget To gather The necessary documents & fill out The application accurately. Once you submit, be patient as your application is processed. Remember, each locality may have its unique rules, so always double-check with your local government. With a little effort & attention To detail, you’ll be well on your way To starting your business legally. Good luck on your exciting journey as an entrepreneur!