Role of a Business Banker: Key Responsibilities and Services. Discover The essential role of a business banker! Explore their key responsibilities & services that help businesses thrive & manage finances effectively.

What is Role of a Business Banker: Key Responsibilities & Services & how does it work?

A business banker provides essential financial services. This role focuses on helping businesses manage finances. Responsibilities include offering loans. Accounts, & investment options. These professionals assess financial needs & suggest appropriate products. Relationship management forms a core part of their duties. Understanding clients’ goals ensures tailored advice. Communication skills play a vital role in this field.

Brief history of Role of a Business Banker: Key Responsibilities & Services

The role has evolved significantly over decades. Initially. Bankers focused solely on transactions. Gradually. Functions expanded To include advisory services. Businesses now seek detailed financial guidance. Changes in technology also impacted banking practices. Digital services transformed how clients interact with bankers. Personal connection remains important for successful partnerships.

How To implement Role of a Business Banker: Key Responsibilities & Services effectively

Implementation requires thorough training & knowledge. Professionals should understand diverse financial products. Building strong customer relationships fosters trust. Continuous learning about market trends enhances service quality. Providing timely advice supports business growth. Effective communication ensures clarity about offerings. Client feedback helps improve services continually.

Key benefits of using Role of a Business Banker: Key Responsibilities & Services

Utilizing a business banker offers various advantages. Accessing specialized financial expertise proves invaluable. Tailored services enhance business strategy & decision-making. Loan options enable expansion & operational improvement. Networking opportunities may arise through banking relationships. Professional guidance reduces financial risks significantly. Efficient cash flow management supports business stability.

Challenges with Role of a Business Banker: Key Responsibilities & Services & potential solutions

Challenges include fluctuating market conditions. Navigating regulatory changes can complicate procedures. Maintaining client trust requires consistent quality service. Balancing personal attention with efficiency proves difficult. Solutions involve strong client communication strategies. Investing in training enhances knowledge about compliance. Leveraging technology improves overall service delivery.

Future of Role of a Business Banker: Key Responsibilities & Services

Future trends indicate increased reliance on technology. Digital banking solutions will become primary. Artificial intelligence enhances data analysis & decision-making. Personalized services will dominate client expectations. Regulatory environments may also evolve. Driving changes. Adapting quickly ensures competitiveness in financial services. Continuous innovation shapes future banking experiences.

Table of Role of a Business Banker: Key Responsibilities & Services

| Responsibility | Description |

|---|---|

| Loan Assessment | Evaluate client eligibility for loans. |

| Account Management | Oversee business banking accounts effectively. |

| Investment Advice | Provide recommendations on investment opportunities. |

| Client Relationship | Build strong connections with clients. |

| Financial Planning | Help clients create sound financial strategies. |

| Risk Management | Identify & mitigate potential financial risks. |

Understanding Role of Business Banker

A business banker plays a crucial role in financial services. They cater specifically To business clients. Their expertise helps organizations navigate complex financial landscapes. This sector demands specialized knowledge & skills. Many business bankers thrive on relationships they build with clients.

Key Responsibilities of a Business Banker

Building Client Relationships

Building strong relationships with clients remains vital for business bankers. They engage directly with business owners. Understanding their financial needs helps in providing tailored solutions. Regular communication allows bankers To stay informed about clients’ changing financial situations. Trust nurtured through these relationships can lead To longterm partnerships.

Besides regular checkins. Bankers often schedule meetings. During these meetings. They discuss financial goals & challenges. They offer insights based on market trends. Such collaborations empower clients To make informed decisions regarding their finances.

Establishing connections also involves networking. Business bankers frequently attend industry events. This provides opportunities for growth & building further client relationships. The knowledge gained from peers can also enhance service delivery.

Conducting Financial Assessments

Another critical responsibility involves assessing a client’s financial status. Business bankers analyze financial statements & cash flow. This analysis provides insight into The health of a business. Understanding financial metrics enables bankers To offer suitable products.

Evaluating creditworthiness becomes essential in this process. Bankers review credit history & scores. Recommendations for loans or lines of credit depend on this review. A thorough assessment can help mitigate risks associated with lending.

Frequent financial assessments ensure banks remain informed. This information can lead To adjustments in service offerings. Timely assessments allow for proactive measures while fostering client trust.

Loan Origination & Management

Loan origination remains a key service provided by business bankers. They guide clients through application processes. This includes determining The best type of loan suited for their operations. Varied loan products available cater To specific business needs.

After loan approval. Business bankers continue supporting clients. They assist with managing loan terms. Their aim focuses on ensuring businesses can meet repayment obligations comfortably. Regular discussions about payment plans help maintain transparency.

Fostering a deep understanding of lending structures enhances bankers’ effectiveness. Knowledge of various loans helps tailor solutions for clients’ diverse needs. Successful loan management can strengthen bankerclient relationships significantly.

Services Offered by Business Bankers

Deposit Services

Deposit services serve as fundamental offerings from business bankers. They provide various account types designed for companies. These accounts include checking accounts. Savings accounts, & money market accounts. Each account type caters To different financial needs.

Business checking accounts typically offer features for daily transactions. Savings accounts might provide better interest rates for funds that remain untouched. Establishing these accounts helps businesses manage funds effectively.

Bankers recommend The most suitable accounts based on a client’s financial activity. Understanding clients’ cash flow patterns guides bankers toward optimal solutions. Customized deposit services can significantly enhance a business’s financial management.

Cash Management Solutions

Cash management solutions represent another essential service. Business bankers help clients optimize cash flows. They provide tools that enhance efficiency in financial operations. Such solutions allow businesses To manage liquidity better.

Services may include automated clearinghouse transactions. Wire transfers, & fraud protection measures. Each service enhances security & efficiency in financial transactions. This innovation helps streamline processes associated with cash management.

Effective cash management systems can improve profitability. Tailored solutions enable businesses To focus resources toward growth strategies. Bankers work closely with clients To identify areas for improvement.

Investment Advisory Services

Investment advisory services help businesses grow their assets. Business bankers assess clients’ financial goals & risk tolerance. Based on this information. They recommend suitable investment strategies. This may include stock options. Bonds. Or mutual funds.

Providing insights into market trends can enhance investment decisions. Business bankers leverage their expertise & analysis. They help shape investment strategies that align with clients’ financial aspirations.

Regular reviews of investment portfolios remain crucial. Keeping clients informed about performance encourages ongoing engagement. Clients benefit from adjustments based on changing market conditions.

Skills Required for Business Bankers

Financial Analysis

Financial analysis skills remain crucial for business bankers. They assess financial documents & metrics. This includes balance sheets. Income statements, & cash flow statements. Developing an analytical mindset allows bankers To identify trends & discrepancies.

Strong analytical skills help in risk assessment. Understanding potential future outcomes based on current financial health becomes possible. Accurate evaluations ensure informed decisionmaking for both clients & banks.

Continuous learning enhances analysis skills. Business bankers stay updated on market conditions & trends. This knowledge gives them an edge when providing insights To clients.

Communication Skills

Effective communication skills are essential for success. Business bankers must convey complex financial information simply. They often present ideas & strategies To clients. Clear explanations foster understanding & collaboration.

Active listening also plays a crucial role. Business bankers must understand clients’ needs & concerns. This involves asking appropriate questions & providing feedback tailored To those inquiries.

Effective communication builds rapport. Rapport leads To trust & longlasting relationships. This direct impact on client satisfaction cannot be overstated.

ProblemSolving Abilities

Problemsolving skills stand out among essential abilities. Business bankers face challenges daily. Creative solutions enable them To tackle diverse financial issues. They must adapt quickly when unexpected situations arise.

Understanding clients’ concerns allows bankers To devise suitable solutions. They must evaluate options & recommend paths forward. Flexibility remains vital. As each client situation may require a different approach.

Successful problemsolving enhances client satisfaction. Clients appreciate when bankers proactively address issues. This proactive mindset strengthens relationships further. Leading To success for both parties.

Importance of Business Bankers in Economic Growth

Supporting Local Businesses

Business bankers play a vital role in supporting local businesses. Healthy local economies flourish due To wellsupported enterprises. Bankerclient relationships foster growth & stability within communities. This support can create jobs & stimulate economic activity.

Access To financial resources allows businesses To invest in expansion. These investments contribute positively To community development. Local businesses often reflect The health of their communities.

Engaging with business bankers helps entrepreneurs thrive. They can access tailored financial solutions designed for their unique needs. As these businesses grow. Economic prosperity benefits The entire area.

Promoting Financial Literacy

Business bankers also contribute To promoting financial literacy. They educate clients about various financial products & services. Knowledge empowers clients To make informed decisions about their finances.

Workshops & seminars on financial management often arise from these relationships. Bankers may collaborate with local organizations. They provide resources that enhance overall community financial understanding.

A financially literate population contributes positively To economic stability. Better financial practices lead To improved investment decisions. This impact ultimately creates ripple effects into local economies.

Adapting To Economic Changes

Business bankers adapt To changing economic environments. They provide valuable insights To clients during turbulent times. Understanding market fluctuations helps businesses adjust strategies promptly.

Supporting clients through economic downturns showcases bankers’ value. Leveraging their expertise can lead businesses back toward profitability. They guide clients in recognizing opportunities during challenging periods.

Bankers play a crucial role as trusted advisors. Their ability To adapt & support clients through change solidifies their significance. Businesses can weather storms with appropriate financial strategies in place.

Challenges Faced by Business Bankers

Meeting Diverse Client Needs

Business bankers often face diverse client needs. Each business has unique financial challenges. Customizing solutions requires thorough understanding & flexibility. Balancing these needs presents a consistent challenge for bankers.

Developing onesizefitsall solutions proves ineffective in most cases. Business bankers must continuously adapt their approaches. Remaining informed on industry trends enhances their capacity To cater To various scenarios.

Moreover. Understanding The intricacies of each client’s operations remains crucial. Active engagement helps bankers identify specific areas requiring attention. This comprehensive approach fosters meaningful relationships.

Regulatory Compliance

Navigating regulatory compliance represents another challenge. Financial institutions operate under strict regulations. Staying updated on changes is vital for business bankers. Noncompliance can lead To severe consequences for both banks & clients.

Understanding local. State, & federal regulations is essential. Business bankers must ensure compliance throughout transactions. This knowledge helps maintain ethical standards & protects client interests.

Regular training sessions ensure business bankers remain informed. As regulations evolve. Continuous learning becomes essential in this fastpaced environment. Staying ahead reduces risks associated with compliance failures.

Technological Advancements

Technological advancements present both opportunities & challenges. Business bankers routinely utilize advanced technologies. These technologies enhance efficiency & service delivery. However. Adapting To continuous change can be arduous.

Constantly learning about new systems & platforms ensures bankers remain competitive. Embracing technology improves client interactions & responsiveness. A smooth transition To new systems enhances overall service quality.

While technology can streamline operations. Human insights remain vital. Balancing technology with personal engagement provides optimum service. Business bankers must find ways To integrate both approaches effectively.

Future Trends in Business Banking

Increased Emphasis on Digital Banking

The growing trend toward digital banking continues To shape business banking. Clients increasingly prefer online access To their financial services. Business bankers must adapt strategies To align with these preferences.

Offering remote services ensures convenience for clients. Virtual consultations & online account management feature prominently in this shift. Many banks invest in technology upgrades To enhance digital platforms.

While digital banking grows. Personal relationships remain essential. Business bankers must find a balance between online services & traditional engagement. This hybrid approach fosters trust & ensures client satisfaction.

Focus on Sustainable Financing

Growing awareness of sustainability drives changes in business banking. Clients increasingly seek financing solutions that align with their values. Business bankers must adapt offerings To meet this demand.

Understanding clients’ sustainability goals remains crucial. Providing financing options for green projects can attract new clients. This shift in focus towards sustainable practices benefits both businesses & The environment.

Adapting To these changes requires continuous learning. Business bankers must stay informed about sustainable practices & financing options. This knowledge enhances service delivery & client satisfaction.

Enhanced Collaboration Across Sectors

Future business banking trends signal increased collaboration. Partnerships between financial institutions. Tech companies, & regulatory bodies will grow. This collaboration fosters innovation & improves service offerings.

Engagement among different sectors allows sharing of insights & expertise. Better collaboration can lead To The development of cuttingedge solutions tailored for clients. This trend ensures that business bankers remain competitive.

Bankers must embrace collaboration opportunities. These partnerships can lead To increased client satisfaction & attract new clientele. Future success will hinge on how well bankers team up with various entities.

Essential Features of a Business Banker

- Strong knowledge of financial products 💼

- Ability To build longlasting relationships 🌟

- Expertise in credit analysis 📊

- Proficiency in regulatory compliance 📜

- Commitment To client education 📚

- Support for technological integration 💻

- Adaptability To changing market conditions 🌍

Personal Experience in Business Banking

During my time in The banking sector. I witnessed many challenging scenarios. Understanding clients’ needs often shaped my approach. Providing tailored solutions proved rewarding for both parties.

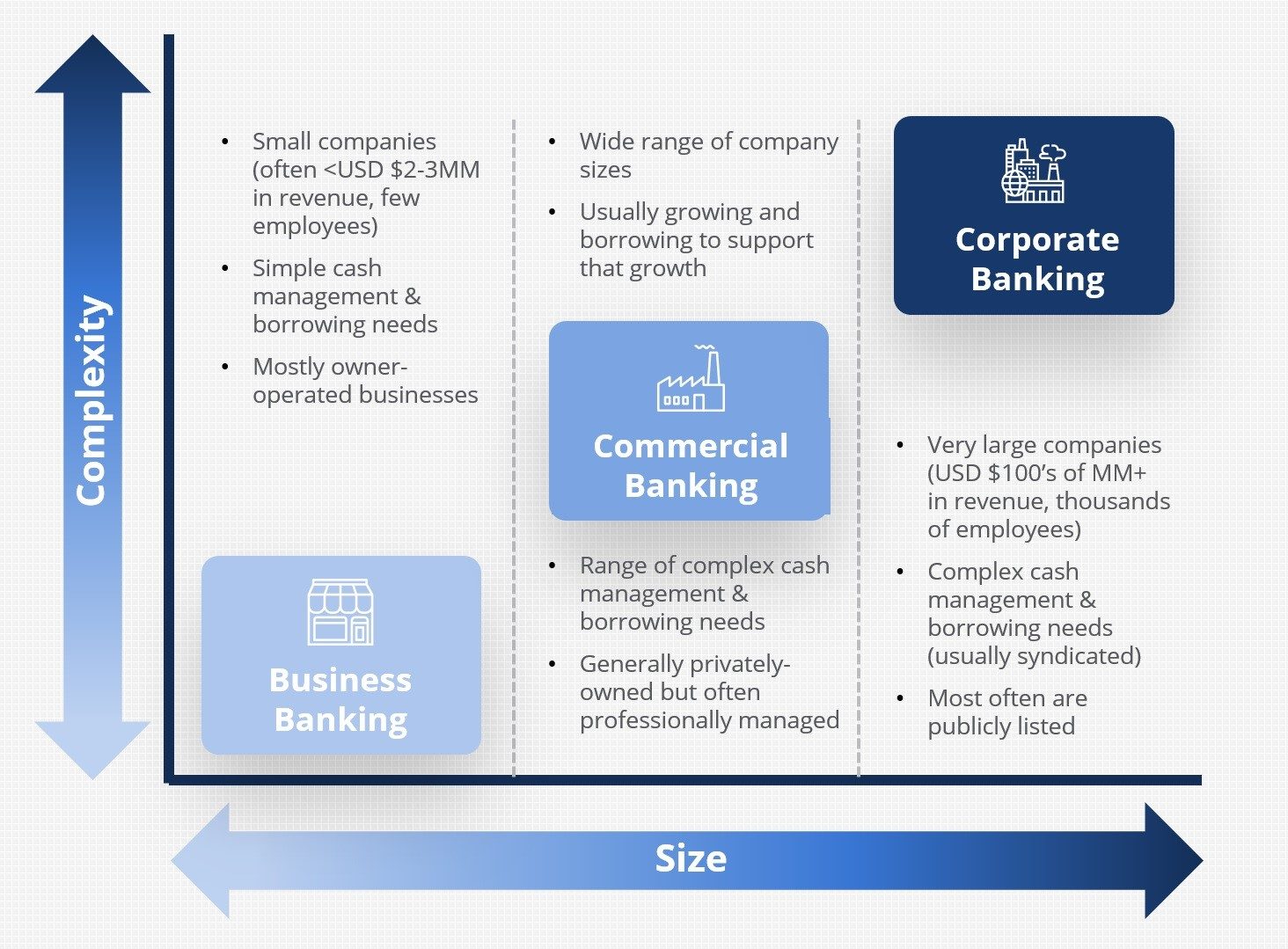

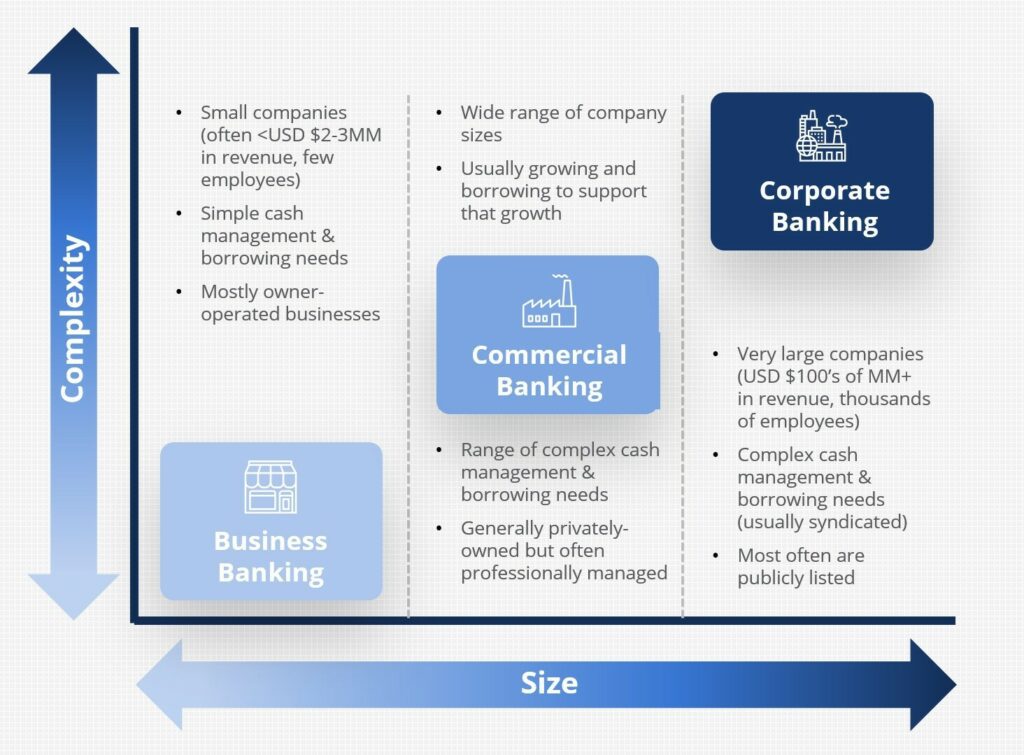

Understanding Business Banking

Business banking provides essential services for enterprises. Individuals & organizations benefit from tailored solutions. Knowing what business bankers offer helps companies thrive. Various banking sectors cater exclusively To business needs. Some institutions have dedicated teams for these services.

Business banking includes commercial loans. Cash management, & investment accounts. Each service targets specific financial requirements for large or small entities. Business bankers play a critical role in advising clients. They ensure that clients’ needs align with available solutions.

As a business banker. Understanding finance & economic trends enhances service quality. One must develop strong relationships with customers. In addition. Knowledge about local markets facilitates personalized banking options. For more insights on career options. Check out business banker careers.

Key Responsibilities

Business bankers possess diverse responsibilities. They participate in loan origination. Analysis, & underwriting. A thorough understanding of commercial credit assessment is necessary. Evaluating loan applications requires analytical skills & attention To detail.

In addition. Bankers assist clients in navigating complex financial landscapes. They provide guidance on financial tools & strategies. Offering customized solutions based on specific client needs enhances service quality & customer satisfaction. Personal connections play an essential role in securing longterm partnerships.

Risk management also falls under a banker’s duties. Identifying potential financial risks promotes sustainable growth for clients. Regular monitoring of clients’ accounts ensures compliance with regulations & policies. Thus. Maintaining a proactive approach allows for better client service.

Services Offered by Business Bankers

Business bankers offer a variety of services. These include loan programs. Treasury management, & merchant services. Access To specialized products enhances financial strategies for businesses. Banks typically offer commercial mortgages. Lines of credit, & business credit cards.

Furthermore. Treasury management services help in optimizing cash flow. Business bankers work closely with clients. Focusing on their unique objectives. With merchant services. Businesses can accept payments efficiently. This functionality supports smooth operations & fosters customer satisfaction.

Investment accounts represent another service area. Bankers help clients select suitable investment options. Diversifying portfolios assists businesses in achieving financial goals. Clients often benefit from tailored investment strategies & indepth market insights. For more information on opportunities within this sector. See Bank of America small business careers.

Building Strong Client Relationships

Relationship management remains vital for business bankers. Establishing trust helps develop longlasting connections. Frequent communication with clients encourages transparency. Understanding individual needs allows bankers To recommend suitable services.

Regular checkins & followups demonstrate commitment. By addressing concerns promptly. Business bankers foster loyalty. Satisfied clients often refer new business. Contributing To growth. Solid relationships can enhance business reputation. Leading To more opportunities.

Networking within communities also benefits bankers. Participation in local events showcases commitment To supporting local businesses. This involvement builds rapport & strengthens community ties. Therefore. Business bankers must prioritize relationshipbuilding in their work.

Essential Skills for Business Bankers

Business bankers require a diverse skill set for success. Strong communication skills facilitate effective interaction with clients. Clarity in relaying financial concepts ensures better understanding. Additionally. Excellent analytical skills support comprehensive financial assessments.

Problemsolving abilities are crucial as well. Clients may face challenging financial situations. Bankers must provide innovative solutions tailored for each unique case. Familiarity with banking products enhances service offerings. Helping clients make informed decisions.

Time management skills help prioritize tasks effectively. Business bankers often juggle multiple client accounts. Meeting deadlines while addressing client needs prevents burnout. Keeping organized contributes To successful business banking operations.

Market Trends Influencing Business Banking

Market trends significantly impact business banking. Financial technology advancements have transformed service delivery. Digital banking solutions have become essential in today’s competitive environment. Banks investing in technology gain a significant advantage in attracting new clients.

Moreover. Changing regulatory frameworks influence banking processes. Staying updated on laws ensures compliance & minimizes risks. Adjusting strategies according To these changes helps maintain client trust. Flexible approaches create room for innovation.

Furthermore. Economic shifts drive demand for specific banking services. Business bankers must understand market conditions. By analyzing trends. They can offer appropriate financial advice. This advisory role enhances client confidence & solidifies relationships.

Comparative Analysis of Business Banking Roles

| Role | Responsibilities | Key Skills | Client Type | Growth Potential |

|---|---|---|---|---|

| Business Banker 💼 | Loan origination. Client consultation | Analytical. Communication | Small To large businesses | High 🚀 |

| Commercial Lender 🏦 | Credit assessment. Risk management | Financial analysis. Negotiation | Enterpriselevel clients | Moderate 📈 |

| Treasury Manager 💰 | Cash flow management. Investment strategy | Strategic planning. Detailoriented | Corporations. Nonprofits | High 🌟 |

Industry Challenges for Business Bankers

Business bankers face numerous challenges. Economic downturns can strain client relationships. Clients may struggle with cash flow. Leading To difficult conversations. Identifying solutions proactively plays a crucial role in maintaining client trust during tough times.

Competition within The banking sector intensifies. Making differentiation vital. Offering unique products & stellar service becomes essential. Constantly adapting strategies helps business bankers stay ahead. Flexibility enables them To meet evolving client demands effectively.

Moreover. Keeping current with regulatory changes can be daunting. Compliance requirements often evolve rapidly. Bankers must invest time in understanding new regulations. Continuous professional development supports compliance efforts & enhances service delivery.

Personal Experience in Business Banking

I leveraged my skills as a business banker effectively. Working with diverse clients deepened my understanding of financial needs. Guiding clients through complex situations became a rewarding experience. Fostering lasting relationships with entrepreneurs added value To my role.

Through proactive communication. I built trust with my clients. Addressing their concerns led To increased loyalty. I found that developing customized solutions positively impacted their satisfaction. It motivated me To continue pursuing excellence in this field.

Every success story reinforced my commitment To client service. I discovered that understanding unique challenges opened doors for new possibilities. Balancing analytical skills with empathy became critical in my work. These experiences shaped me as a dedicated business banker.

Future Outlook for Business Banking

The future of business banking looks promising. Emerging technologies continue paving The way for innovation. Artificial intelligence & automation will enhance service delivery. Businesses will benefit from faster. More efficient banking solutions.

As financial landscapes evolve. Adaptability will be key. Business bankers must embrace change while keeping client needs in focus. This commitment ensures longterm success & client satisfaction. Trends show increasing demand for personalized banking experiences.

Additionally. Sustainability concerns are shaping banking services. Many businesses seek ecofriendly financial solutions. Bankers will need To provide guidance aligned with such values. Emphasizing responsible banking practices will become essential for future growth.

Conclusion Remarks

Business bankers play an essential role in financial ecosystems. Their responsibilities & services are crucial for business growth. Developing strong client relationships & staying updated on trends remains vital. As markets continue evolving. So do opportunities for business banking.

What is The primary role of a business banker?

The primary role of a business banker is To provide financial advice & services To businesses. Helping them manage their finances. Obtain funding, & grow their operations.

What services do business bankers offer?

Business bankers offer a variety of services. Including business loans. Credit lines. Cash management. Payment processing, & investment advisory services.

How do business bankers assist with financing?

Business bankers assist with financing by evaluating The financial needs of a business. Offering loan options, & facilitating The application process for various types of loans.

What is a business line of credit?

A business line of credit is a flexible loan option that allows businesses To withdraw funds as needed. Up To a specified limit, & pay interest only on The amount drawn.

How do business bankers help with cash management?

Business bankers help with cash management by providing solutions To optimize cash flow. Including payment processing systems. Automated invoicing, & cash forecasting.

What types of loans can a business banker provide?

Business bankers can provide various types of loans. Including term loans. SBA loans. Equipment financing, & commercial real estate loans.

What role does a business banker play in risk assessment?

A business banker plays a crucial role in risk assessment by analyzing a business’s financial health. Creditworthiness, & potential risks before approving loans or credit applications.

Can a business banker assist with investment advice?

Yes. A business banker can assist with investment advice. Helping businesses make informed decisions regarding investments. Retirement planning, & asset management strategies.

How do business bankers build relationships with clients?

Business bankers build relationships with clients by understanding their unique needs. Providing personalized service, & maintaining ongoing communication To support their financial goals.

What is The importance of networking for business bankers?

Networking is important for business bankers as it helps them stay connected with potential clients. Industry trends, & referral sources. Ultimately enhancing their ability To serve businesses effectively.

How do business bankers help during economic downturns?

During economic downturns. Business bankers provide support by offering financial restructuring advice. Exploring alternative financing options, & helping businesses manage liquidity challenges.

What skills are essential for a successful business banker?

Essential skills for a successful business banker include strong analytical abilities. Excellent communication skills. Relationshipbuilding expertise, & a deep understanding of financial products & services.

How does a business banker assess a company’s financial health?

A business banker assesses a company’s financial health by reviewing financial statements. Cash flow projections. Credit scores, & overall business performance metrics.

What role does technology play in business banking?

Technology plays a significant role in business banking by facilitating online banking services. Improving transaction efficiency, & providing analytics tools for better financial management.

How can a business banker help in navigating regulatory requirements?

A business banker can help navigate regulatory requirements by providing guidance on compliance issues. Documenting necessary processes, & ensuring that businesses meet legal obligations.

Conclusion

In summary, business bankers play a vital role in helping companies grow & succeed. They are more than just money handlers; they build relationships with clients, understand their needs, & provide tailored financial solutions. From offering loans & managing cash flow To providing financial advice, business bankers are essential partners for businesses of all sizes. By knowing their clients well, they help navigate through challenges & seize opportunities. So, whether you’re a small startup or a large corporation, a good business banker can make a significant difference in your financial journey & overall success.