Using TurboTax Home and Business 2022: Features and Benefits. Discover how TurboTax Home & Business 2022 helps you file taxes easily. Explore its key features & benefits for a stressfree tax season!

What is Using TurboTax Home & Business 2022: Features & Benefits & how does it work?

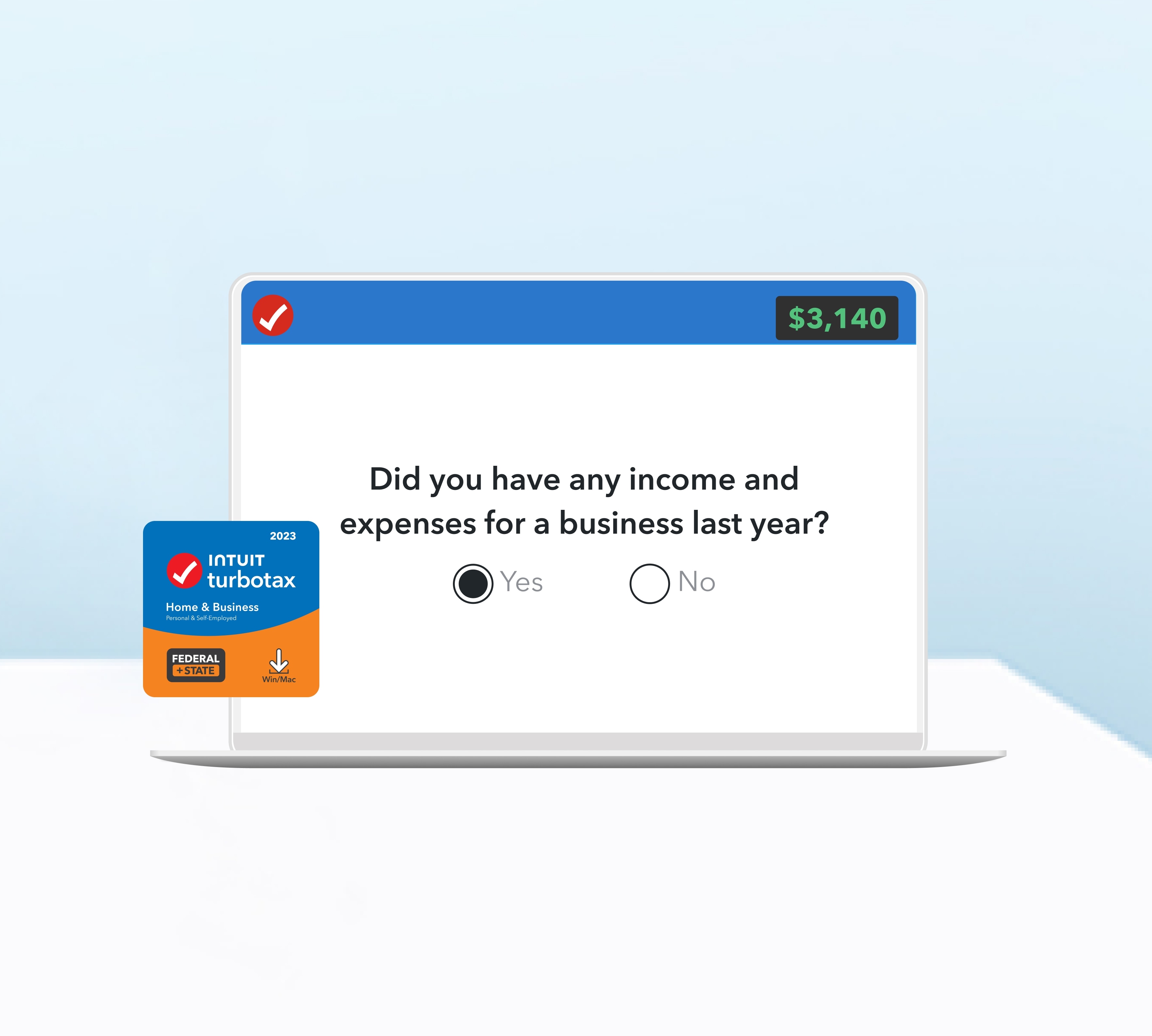

TurboTax Home & Business 2022 assists individuals & small businesses with tax preparation. This software automates processes. Simplifying user experience. Users can easily input financial data for maximum deductions. Its robust guidance walks users through various tax forms.

Brief history of Using TurboTax Home & Business 2022: Features & Benefits

TurboTax originated in 1984. Offering comprehensive tax solutions. Over decades. Software evolved significantly. Enhancing features & user interface. With advancements in technology. TurboTax improved its capabilities yearly. In 2022. Enhancements focused on self-employed individuals & small business needs.

How To implement Using TurboTax Home & Business 2022: Features & Benefits effectively

Begin by purchasing & downloading TurboTax software. Create an account & choose relevant tax year. Follow prompts. Ensuring accurate data entry throughout process. Save progress regularly. Reviewing previously entered information for accuracy. When finished. File electronically or print forms for mailing.

Key benefits of using Using TurboTax Home & Business 2022: Features & Benefits

- user-friendly interface ensures ease of use

- Step-by-step guidance helps maximize deductions

- Ability To import financial data from various sources

- Comprehensive support for self-employed & small business taxes

- Fast electronic filing options reduce waiting time

- Access To updated tax laws & regulations

Challenges with Using TurboTax Home & Business 2022: Features & Benefits & potential solutions

Some users may encounter technical glitches during use. Regular updates from developers address most issues. Additionally. Complexity in tax laws may overwhelm inexperienced users. Utilizing built-in resources & customer support can alleviate frustration. Consulting with a tax professional might resolve specific concerns.

Future of Using TurboTax Home & Business 2022: Features & Benefits

Trends indicate TurboTax will continue embracing artificial intelligence. Enhanced tools might provide improved data analysis. Integration with other financial software could present greater convenience. Additionally. Customer feedback likely shapes future updates. Ensuring ongoing relevance.

Table of Using TurboTax Home & Business 2022: Features & Benefits

| Feature | Benefit |

|---|---|

| User-friendly design | Simplifies tax filing |

| Max deduction finder | Ensures maximum refund |

| Data import capability | Saves time during data entry |

| Tax law updates | Supports compliance |

| Support for various forms | Covers diverse tax situations |

Understanding TurboTax Home & Business 2022

TurboTax Home & Business 2022 serves as an allinone solution for tax preparation. This software caters well To both individuals & small business owners. It streamlines tax filing. Ensuring compliance with IRS regulations.

Users benefit from a plethora of features designed for ease of use. For more detailed information on The product. Visit TurboTax Home & Business 2022. This link outlines essential details that help better understand what this tax software provides.

Key Features of TurboTax Home & Business 2022

- 📊 Userfriendly interface

- 💼 Business expense tracking

- 🧾 Deduction finder

- 🔍 Personalized guidance

- 📥 Efiling options

- 👨👩👦 Family tax benefits

- 💰 Maximized deductions

Intuitive User Experience

TurboTax focuses heavily on user experience. With an intuitive design. Users navigate through each step seamlessly. Clear prompts guide individuals from start To finish. Reducing frustrations often associated with filing taxes.

Accessibility remains a priority. Ensuring persons of all skill levels can utilize software. Ideal for everyone. Whether experienced or novice. TurboTax Home & Business provides numerous resources. Online assistance offers additional support whenever needed.

Many users appreciate simplified tax filing. I experienced this firsthand when I prepared my family taxes this year. Usability greatly reduced hassle & confusion. Everything felt organized. Allowing for accurate & timely submissions.

Business Expense Tracking

Tracking business expenses efficiently contributes significantly towards accurate tax filing. TurboTax Home & Business allows individuals To categorize expenses effortlessly. This feature ensures that no deductions are overlooked during filing.

Users can easily import financial data from various sources. Bank statements. Spreadsheets, & other documents integrate smoothly. This functionality saves time & increases accuracy when completing tax returns.

Furthermore. The software provides checklists. These lists help users identify eligible expenses related To their business. Anything. From travel expenses To office supplies. Can be categorized easily. Maximizing deductions.

Maximizing Deductions & Credits

TurboTax Home & Business enables individuals To secure maximum deductions. Its robust deduction finder identifies potential tax breaks based on user inputs. This feature analyzes previous returns & current financial situations.

Users receive personalized recommendations tailored specifically for them. This customization enhances deduction opportunities not commonly known. For more invoiced questions. Refer also To this helpful link: TurboTax Home & Business vs Premier.

Additionally. TurboTax provides guidance on available tax credits. Various credits can lead To substantial savings. This feature serves individuals who may otherwise miss out on vital information.

Comprehensive Guidance

TurboTax Home & Business offers thorough guidance throughout tax preparation. Starting from initial questions. Users receive insights tailored for their circumstances. Everything feels highly customized. Ensuring everyone receives accurate information.

Individuals can access numerous tips & explanations while completing their returns. Each question includes detailed explanations. Facilitating clarity. This support system enables users To understand each step of The tax process.

A stepbystep walkthrough empowers users educated about their tax situations. This approach alleviates stress associated with confusion or mistakes. Ensuring peace of mind during tax season.

Efficient EFiling Options

Efiling presents modern conveniences for taxpayers. TurboTax Home & Business simplifies this process significantly. Once completed. Filing returns electronically saves time & paper.

Users receive direct confirmation once returns have been submitted. This instant feedback offers reassurance & allows users To track their returns easily. Notifications regarding acceptance or additional actions needed further enhance user experience.

Moreover. Efiling allows for quicker refunds. Individuals receive their returns directly into their bank accounts. Significantly reducing wait times. Many users prefer this aspect for expediency.

Family Tax Benefits

TurboTax Home & Business understands different family dynamics. Various family tax benefits directly affect tax liabilities. Including children. Dependents. Or caregivers introduces numerous variables that must be addressed during filing.

Maximizing tax benefits associated with family also leads To significant savings. TurboTax ensures each relevant opportunity is considered. Helping families make educated decisions regarding their finances.

Furthermore. Individuals can easily manage eligibility checks for multiple benefits. Users input required information. Automatically receiving detailed recommendations based on their family structure.

Importing Financial Documents

Another advantageous feature of TurboTax Home & Business permits importing financial documents easily. Meals. Lodging. Client expenses, & many more resources import directly from common accounting software.

This convenience enhances overall user experience. People can streamline their entire tax preparation process. Ensuring all documentation remains accurate. Not having To enter information manually saves time significantly.

Categorizing & managing finances turns into simple tasks. Users customarily have their financial information onhand. Ensuring a thorough look at their history & appropriate deductions.

Security & Privacy Features

TurboTax takes security seriously. Strong measures protect personal data while using The software. Users can confidently share information without fear of compromise.

Encryption protocols ensure data remains secure during transactions. Additionally. Advanced authentication options add an extra layer of protection. Users can rest easy knowing their personal information stays private.

Moreover. TurboTax offers a robust identity theft protection plan. This feature monitors for suspicious activity & alerts users immediately. Taking action quickly ensures any potential issues are expedited.

Understanding Tax Filing for SelfEmployed Individuals

Selfemployed persons face unique tax considerations. TurboTax Home & Business caters specifically To these users. It guides individuals through various forms. Ensuring compliance with necessary regulations.

Clarifications on Schedule C & other relevant forms promote user understanding. This functionality ensures that every requirement is met. Reducing uncertainties surrounding selfemployment taxes.

Moreover. TurboTax assists in figuring out estimated taxes owed throughout The year. This detail promotes financial planning. Giving users a clear picture of future liabilities.

RealTime Progress Tracking

Maintaining awareness of progress during tax preparation proves vital. TurboTax Home & Business provides users with realtime progress tracking. This visualization helps individuals stay informed about their current state of completion.

With each completed section. Users can see how much work remains. This detailing motivates individuals. Ensuring prompt submission by tax deadlines. Maintaining control over progress reduces stress significantly during busy times.

Furthermore. Users have access To a “Tax Timeline,” showcasing important milestones. This tool immediately informs individuals about essential dates & deadlines related To their tax preparation journey.

Mobile Accessibility Options

In today’s busy world. Mobility remains crucial. TurboTax Home & Business offers mobilefriendly access through various platforms. Users can operate their accounts from smartphones. Ensuring they remain connected at all times.

Mobile functionality allows for updates onThego. Individuals can easily scan receipts. Upload necessary documents, & maintain progress whenever they find free time. This accessibility enhances overall efficiency in preparing returns.

Additionally. TurboTax’s app includes intuitive features. Users can navigate through returns. Review each section, & make updates remotely. This aspect serves as a valuable improvement in modern tax filing practices.

CostEffective Solutions

Investing in reliable tax software remains a wise decision. TurboTax Home & Business provides competitive pricing for users seeking efficiency. The cost reflects its expansive features. Designed for both individuals & businesses.

Various plans cater To differing needs among users. TurboTax offers flexibility. Providing users options for varying income levels. Individuals can tailor their selections accordingly. Ensuring they receive relevant support suitable for them.

Moreover. Unique promotions & deals are available seasonally. Awareness of potential discounts empowers users. Allowing them an opportunity for savings. Utilizing these offers enhances their overall financial experience.

Dedicated Customer Support

TurboTax Home & Business emphasizes outstanding customer support. Users can access numerous resources whenever they require assistance. Help centers. Live chats, & call options stand available for individuals with questions.

Additionally. An extensive knowledge base provides indepth articles. Users receive answers or guidance through researched articles addressing common inquiries. This resource fosters a sense of support among users.

Community forums also enable interactions among various users. This collaboration promotes sharing insights or troubleshooting common issues. Users can learn from each other. Ensuring a positive experience throughout tax filing.

Final Thoughts on TurboTax Home & Business 2022

TurboTax Home & Business 2022 stands as a robust tool for tax preparation. Whether for personal use or business endeavors. Its features provide comprehensive support. Users seeking a userfriendly & efficient tax solution find TurboTax invaluable.

With a clear focus on maximizing deductions & providing thorough guidance. This software proves essential. From family tax benefits To unique features tailored for selfemployed individuals. TurboTax excels. Overall. TurboTax Home & Business offers everything necessary for smooth tax preparation.

Understanding TurboTax Home & Business 2022

TurboTax Home & Business 2022 serves specific audiences. Individuals. Freelancers, & small business owners benefit from this tool. It simplifies tax preparation with userfriendly features. From its interface. Anyone can prepare taxes effectively.

One main advantage includes an interview process. Users answer simple questions about income & expenses. This makes gathering information simpler & faster. Guarantees accurate calculation of taxes also add confidence.

Expert guidance will help throughout entire process. Users gain access To customized recommendations. These enhance user experience & maximize deductions available. Researching common mistakes might also save you time.

Key Features of TurboTax Home & Business 2022

Deduction Finder

A powerful tool called Deduction Finder scans for credits. This feature helps maximize possible refunds. It identifies relevant deductions specific for fees associated with selfemployment. Users find this incredibly beneficial each year.

Itemized Deductions Support

For those who itemize. TurboTax provides guidance. It assists in tracking all deductible expenses. Additionally. Detailed reporting simplifies reviewing tax obligations. Consequently. Users feel more confident during audits.

Integration with Financial Accounts

Automatic import of financial data proves essential. Users connect bank & investment accounts directly. This results in fewer manual entries & reduced errors in overall calculations. Enhanced accuracy ensures that tax documents reflect reality.

User Experience & Interface

TurboTax offers an intuitive. Streamlined user interface. This design allows easy navigation through various tax forms. Anyone. Regardless of experience. Can finish taxes efficiently. Each page logically flows. Simplifying The entire process.

In my experience. I found assistance truly helpful. I faced challenges during my own tax return process. Getting instant feedback while making entries greatly reduced stress. This support immeasurably improved my overall experience.

Furthermore. A dedicated support team is always available. If questions arise. Expert assistance helps clarify any confusion. Quick responses ensure that no user gets lost during their tax preparation journey.

Pricing Structure of TurboTax Home & Business 2022

Pricing generally reflects feature sets offered. Users choose based on specific needs & preferences. Compared with other products. Pricing appears reasonable. Users can invest in features that best suit goals.

Basic packages start at a lower price point. However. Users seeking advanced features may pay significantly more. It’s essential To assess necessary functions while evaluating budgets. Overall. A good balance exists between price & functionality.

Taxpayers may want additional features. Keeping up with changes in tax laws requires flexibility with pricing. Exploring potential refunds ensures individuals maximize necessary investments into tax preparation.

Comparative Analysis of TurboTax Packages

| Feature | TurboTax Home & Business | TurboTax Premier | TurboTax Deluxe |

|---|---|---|---|

| Deduction Finder | ✅ | ✅ | ✅ |

| Itemized Deductions | ✅ | ✅ | ❌ |

| Investment Support | ✅ | ✅ | ❌ |

| SelfEmployment Support | ✅ | ❌ | ❌ |

| Audit Support | ✅ | ❌ | ❌ |

Customer Support Options

TurboTax prioritizes user questions through a variety of options. Users can access online resources. Including FAQs & guides. A comprehensive community forum serves as a support network for individuals facing similar challenges.

In addition. Live chat support provides immediate solutions. Customers seeking rapid assistance appreciate this feature. They can resolve queries without waiting for email responses.

Furthermore. Users may contact representatives directly. This option fulfills unique needs many users may have. Overall. Flexibility in customer support ensures that everyone finds assistance readily.

Common Issues & Resolutions

Using any software results in hiccups, & TurboTax Home & Business 2022 is no exception. Users occasionally encounter challenges with inputting data accurately. Inputting industry codes may lead To issues; however. Solutions exist for such common errors.

Another common issue pertains To incompatibility with certain systems. Users occasionally find bugs or glitches in processes. Contacting support promptly often resolves issues quickly.

Finally. Updates may generate temporary issues with The software. TurboTax frequently releases improvements addressing these setbacks. Staying informed ensures users take necessary actions To prevent problems.

Important Additions in TurboTax Home & Business 2022

This year’s version includes notable improvements over past editions. It features enhanced realtime calculations for tax obligations. Each change allows greater precision during tax preparation. Users appreciate streamlined processes this year significantly.

Another addition focuses on business expense tracking. A new interface simplifies capturing screenshots of receipts. Users can now keep all essential documents in one place securely.

Lastly. TurboTax Home & Business 2022 offers tailored recommendations based on user profiles. Each new tool emphasizes personalized guidance. Improving every experience. Comprehensive features allow all users satisfaction during tax season.

Maximizing Refunds with TurboTax Home & Business 2022

One main goal during tax preparation remains maximizing refunds. TurboTax provides users several ways To achieve this target. Utilizing available deductions significantly increases returns on investments. Both personal & professional.

Analyzing your expenses effectively leads To additional savings. This tool identifies credits unique To user income. Ensuring no stone goes unturned. Users can rely on TurboTax’s secure platform for peace of mind.

Additionally. Consulting with tax professionals may offer further guidance. Users exploring options surrounding taxes often find assistance invaluable. Connecting with experienced advisors leads To optimized financial outcomes in many cases.

Conclusion Remarks on TurboTax Home & Business 2022

TurboTax Home & Business 2022 evidently excels in various aspects. Users appreciate seamless navigation & support options. Together. These features empower individuals. Freelancers, & small business owners.

Flexibility within pricing affirms viable options for many. Customized solutions paired with excellent support lead To satisfied customers. Taking advantage of numerous enhancements makes TurboTax an essential tool for tax preparation.

What features does TurboTax Home & Business 2022 offer for selfemployed individuals?

TurboTax Home & Business 2022 provides features tailored for selfemployed individuals. Including personalized guidance for maximizing deductions. Generating Schedule C forms, & handling business income & expenses. It also includes tools for estimating quarterly taxes & reporting 1099 income.

Can I file both personal & business taxes using TurboTax Home & Business 2022?

Yes. TurboTax Home & Business 2022 allows you To file both personal & business taxes in a single return. The software streamlines The process. Ensuring you don’t miss any valuable deductions from your business while filing your personal taxes.

How does TurboTax Home & Business 2022 help with maximizing deductions?

The software provides detailed guidance & tips tailored To your specific business type. Helping you identify all eligible deductions. It analyzes your income & expenses To suggest potential savings based on The latest tax laws.

Is TurboTax Home & Business 2022 suitable for freelancers?

Yes. TurboTax Home & Business 2022 is ideal for freelancers as it is designed To cater To selfemployed individuals. It simplifies The filing process by helping freelancers report their income & expenses accurately.

Can I access TurboTax Home & Business 2022 from multiple devices?

TurboTax Home & Business 2022 can be accessed from multiple devices as long as you have an internet connection. You can start your tax return on one device & continue on another. Making it convenient To work on your taxes from anywhere.

What kind of support is available with TurboTax Home & Business 2022?

TurboTax Home & Business 2022 offers various support options. Including a vast knowledge base. Live chat, & paid options for oneonone assistance with tax professionals. This ensures you can get help when needed.

Does TurboTax Home & Business 2022 include information on new tax laws?

Yes. TurboTax Home & Business 2022 is updated with The latest tax laws & regulations. The software integrates these changes. Ensuring that your tax return is compliant & upTodate.

Can I import my financial data into TurboTax Home & Business 2022?

Yes. TurboTax Home & Business 2022 allows you To import financial data from various sources. Including previous tax returns. 1099 forms, & accounting software. Which streamlines The data entry process.

Is there a mobile app for TurboTax Home & Business 2022?

Yes. TurboTax Home & Business 2022 has a mobile app available for both iOS & Android devices. The app allows you To manage your taxes. Upload documents, & even file your tax return from your phone or tablet.

Are there any guarantees with TurboTax Home & Business 2022?

TurboTax Home & Business 2022 offers a maximum refund guarantee. Meaning you’ll receive The largest refund you’re entitled To. Additionally. They provide a satisfaction guarantee. Ensuring you’ll be satisfied with The product’s functionality.

Can TurboTax Home & Business 2022 help me with state taxes?

Yes. TurboTax Home & Business 2022 provides options To file both federal & state taxes. The software will walk you through The necessary steps & calculations To ensure you comply with your state’s tax laws.

What if I need To make changes after filing with TurboTax Home & Business 2022?

If you need To make changes after filing. TurboTax Home & Business 2022 allows you To amend your return. You can easily follow The prompts To update any information necessary. Ensuring your tax return is accurate.

Are there any additional costs associated with TurboTax Home & Business 2022?

While TurboTax Home & Business 2022 has a base price. Additional costs may arise for accessing certain features. Such as filing state taxes or opting for live assistance. It is essential To review The pricing details before proceeding.

Is TurboTax Home & Business 2022 userfriendly for those unfamiliar with tax filing?

TurboTax Home & Business 2022 is designed with userfriendliness in mind. Featuring an intuitive interface & stepbystep guidance. Even those unfamiliar with tax filing should find The software accessible & helpful.

Conclusion

In summary, TurboTax Home & Business 2022 makes tax time easier & less stressful. Its user-friendly design helps you navigate through your forms without any hassle. You can maximize your deductions, ensuring you get The best refund possible. With features like live support & a simple step-by-step process, it’s perfect whether you’re a small business owner or filing personal taxes. Plus, The ability To import last year’s data saves you time. Overall, TurboTax Home & Business 2022 is a smart choice for anyone looking To manage their taxes efficiently & effectively. Give it a try for a smoother tax experience!